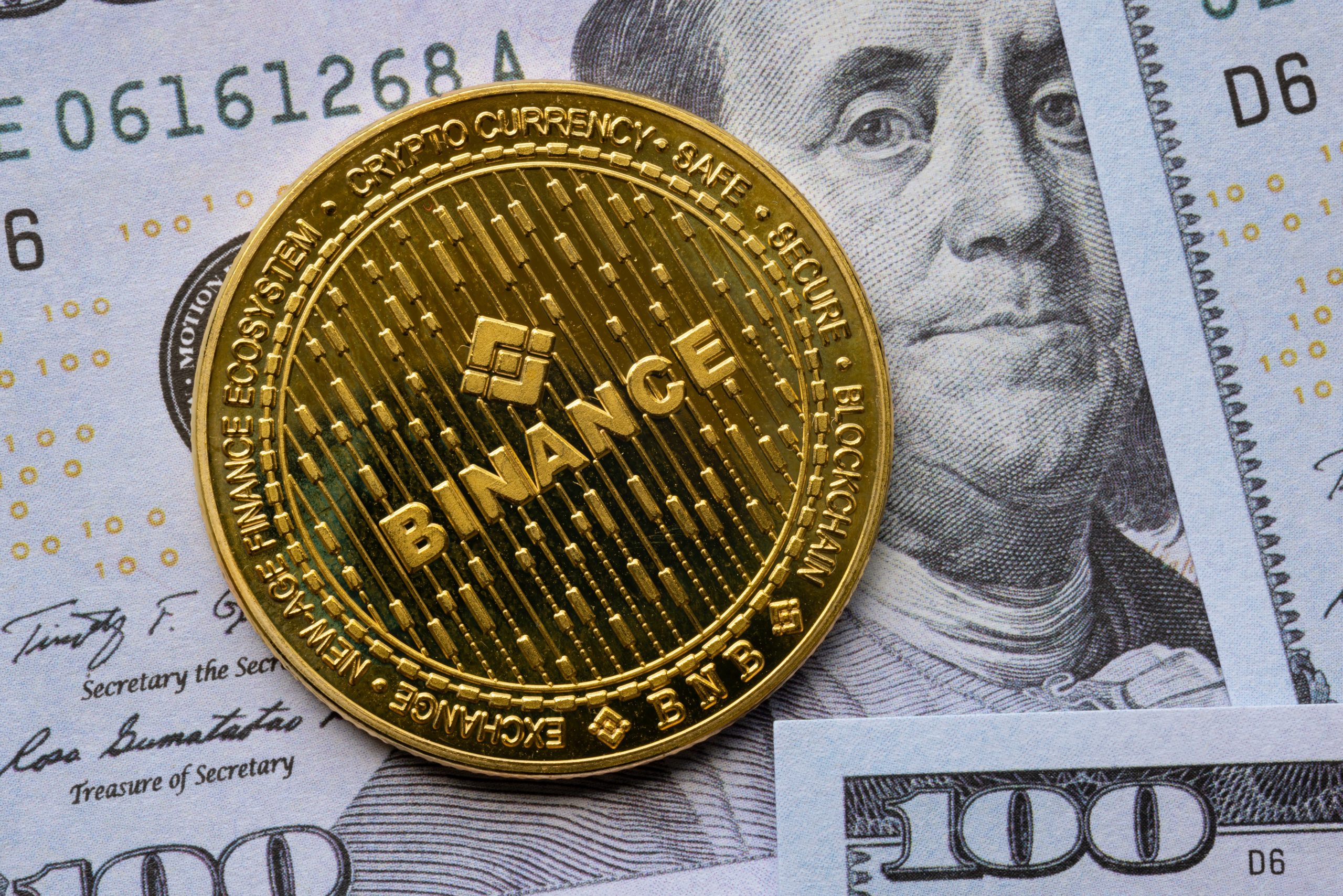

Withdrawals from Binance and Coinbase Surge After SEC Unveils Latest Crypto Lawsuits

The SEC took legal action against two of the world’s largest cryptocurrency exchanges, alleging they violated U.S. securities law by illegally operating as exchanges, brokers and clearing agencies.

Under pressure for many months, the cryptocurrency sector absorbed another body blow this week when the U.S. Securities and Exchange Commission (SEC) took legal action against two of the world’s largest cryptocurrency exchanges—Binance and Coinbase (COIN).

While each case is unique, there’s extensive crossover between the two. In both legal complaints, the SEC argued that the companies had violated U.S. securities law by failing to register as exchanges, brokers and clearing agencies, and therefore were operating illegally in those functions.

The complaint against Binance is especially complex because the global crypto exchange isn’t headquartered in the United States. Oddly, it’s not technically headquartered anywhere, and has no physical address. Commenting on that strange reality, the founder of Binance—Changpeng Zhao (aka “CZ”)—said back in 2020, “Wherever I sit, is going to be the Binance office.”

Binance had previously established an affiliated entity known as Binance.US which was intended to house customers from the U.S. However, the SEC complaint alleges that Binance intentionally subverted its own internal controls to allow high-value American customers the ability to transact on the firm’s global Binance.com platform.

Moreover, the SEC further alleged that Binance illegally mixed customer funds with those of the company and its affiliates. The now infamous FTX exchange was also accused of mixing customer funds back in November, when it fell afoul of global authorities.

Additionally, the complaint against Binance states that Changpeng Zhao is personally liable due to his role as a control person at Binance and some of its affiliates. For now, the alleged fraud against Zhao appears to be civil in nature, whereas Sam Bankman-Fried, the FTX founder, currently faces criminal charges.

As if all that wasn’t enough, the SEC also accused Binance of falsely inflating trading volume figures at its U.S.-based affiliate. The U.S. Department of Justice is also reportedly investigating whether Binance should face criminal charges for failing to implement an anti-money-laundering program.

In contrast, the charges against Coinbase pertain to the company—no specific individual has been charged with wrongdoing. However, the SEC did take issue with the company’s staking program, which the regulator said should have been licensed and, therefore, “deprived investors of critical disclosure and other protections.”

Staking programs allow customers to earn interest on their digital coin holdings. Earlier this year, the SEC forced Kraken—another U.S.-based cryptocurrency exchange—to shut down its own staking program.

Considering the fast-moving nature of this developing story, additional details, and potentially further charges/defendants, will undoubtedly be unveiled in the coming days.

Are cryptocurrencies securities?

Looking beyond the alleged fraud at Binance, the SEC complaints against Binance and Coinbase hinge on the SEC’s assertion that some cryptocurrencies qualify as securities, as opposed to a form of digital currency, as their name implies.

Since their inception, cryptocurrencies have been mostly unregulated, which was one of the rallying cries of the industry’s numerous supporters. Due to the slow-moving nature of the government, regulators in the U.S. and abroad failed to establish or enforce a clear and consistent regulatory framework for digital assets.

In their own defense, the crypto sector has argued that the regulatory process is being driven by punitive, selective enforcement of laws that were never intended to govern this emerging niche in the financial system.

Coinbase, for example, claimed that it has previously reached out to the SEC to register as an exchange, but received no guidance on how to do so. The company published a memorandum on March 22 outlining how it had spent considerable capital to develop a variety of potential frameworks for registering its business activities with the SEC, but received no meaningful feedback on those proposals.

Robinhood (HOOD) recently indicated that it too attempted to register as a special-purpose broker for digital assets, and was likewise rebuffed by the SEC.

These examples suggest that some actors in the cryptocurrency sector have actively embraced the prospect of regulation, suggesting that the implementation of a comprehensive regulatory framework for digital assets would benefit from a collaborative effort between the public and private sectors.

On the other hand, the SEC is still picking up the pieces from the FTX debacle, for which it’s been assigned a fair share of responsibility.

Instead of standing on the sidelines and waiting for the next calamity to unfold, U.S. regulators are probably hoping that the lawsuits against Binance and Coinbase will force fresh debate on this issue, and catalyze a genuine effort to create and implement an effective regulatory environment for cryptocurrencies and other digital assets.

Building that framework could take years, but these lawsuits should at least finally establish once and for all whether or not cryptocurrencies are securities. And the resolution of this key question could serve as the foundation from which the new regulatory framework is erected.

Speaking to the regulatory inconsistencies that exist between traditional financial companies and the emerging crypto sector, Gurbir Grewal, the Director of the SEC’s Division of Enforcement, said of the latest lawsuits, “You simply can’t ignore the rules because you don’t like them or because you’d prefer different ones: the consequences for the investing public are far too great.”

In recent months, the SEC has been discreetly inching the crypto sector closer to its sphere of influence.

For example, back in February, the SEC classified a large chunk of cryptocurrencies as securities when it charged Terraform Labs with fraud. And this week, it added another handful to that list when it charged Binance and Coinbase. According to cointelegraph.com, the SEC has now labeled nearly 70 cryptocurrencies as securities.

Providing further context, Gary Gensler, chair of the SEC, conducted a wide-ranging interview with New York Magazine several months ago and asserted that “everything other than Bitcoin” qualifies as a security, and therefore falls under the purview of the SEC. Notably, Ethereum hasn’t yet officially been classified as a security, either.

Whether or not the U.S. legal system agrees with Gensler will be one of the key dynamics in the forthcoming cases against Binance and Coinbase. Whatever the result, there will be wide-ranging ramifications for the sector.

If cryptocurrencies are indeed ultimately classified as securities, then the firms operating in this space will be forced to adhere to the same complex (and costly) regulatory environment that traditional financial firms are forced to navigate. However, that would also theoretically provide crypto market participants with a much higher degree of protection—for example, if Coinbase were to operate under the same regulatory rules as Nasdaq.

Commenting on the potential outcome of the lawsuits, John Stark, a former SEC enforcement attorney, recently told Vox, “If the latest lawsuits stand in court, the exchanges will have to become compliant under the SEC’s regulatory rules—and if not, they could [be] shut down in the U.S.”

If cryptocurrencies are officially classified as securities, it’s widely projected that a large portion of the U.S. crypto industry would pack up and move offshore.

That’s largely attributable to the high cost associated with compliance, however, it’s certain that stringent regulatory oversight would also serve to force out some of the bad actors operating in the U.S. crypto market.

In that regard, increased regulation of digital assets would in many ways represent a positive development, because it would provide the sector with a newfound level of legitimacy.

Market impact, surging withdrawals from Binance and Coinbase

Thus far, the response in the crypto market has been relatively muted in the wake of the latest lawsuits against Binance and Coinbase. The total global market cap for the crypto sector currently stands at roughly $1.15 trillion, which is down from roughly $1.18 trillion on June 5.

As of June 9, Bitcoin (BTC) is currently trading about $26,600/coin, while Ethereum (ETH) is trading at roughly $1,840/coin.

Bitcoin dropped by about 7% when the case against Binance was first announced on June 5. However, it has mostly recovered since then, and is trading only marginally lower than it was at the start of the month. Ethereum has traded in almost the exact same fashion.

On the other hand, the latest SEC lawsuits did trigger fresh withdrawals from Binance and Coinbase, and weighed on the publicly-traded shares of the latter.

For example, coindesk.com reported that upwards of $500 billion was withdrawn from Binance on June 5, and that the industry as a whole saw roughly $1 billion in withdrawals. Coindesk.com further reported on June 6 that Coinbase saw roughly $600 million in withdrawals after it too was targeted by the SEC.

Publicly traded shares of Coinbase have also fared poorly in recent days. On June 2—prior to the SEC actions against Binance and Coinbase—Coinbase stock closed the day trading $64.55/share. Since then, however, Coinbase stock has dropped by roughly 16%, and currently trades for about $54.00/share.

It should be noted that the credit agency Moody’s downgraded its rating of Coinbase to “negative” from “stable” on June 8.

Binance isn’t publicly traded, but the company previously released two of its own digital coins, including Binance Coin (BNB) and BinanceUSD (BUSD). The latter is a dollar-pegged stablecoin. So far this month, BNB is down roughly 15%, while BUSD has remained relatively stable, and still trades closely in line with its dollar peg, at $0.9999.

Importantly, those two digital tokens were both classified as securities in the SEC’s recent complaint against Binance.

Looking at month-to-date performance in the broader crypto sector, the 10 biggest losers so far in June include the following (with market capitalizations of at least $500 million, as of June 9):

- Conflux Network (CFX), -19%

- Algorand (ALGO), -18%

- Filecoin (FIL), -17%

- Cardano (ADA), -16%

- BNB (BNB), -15%

- The Graph (GRT), -14%

- Flow (FLOW), –14%

- Polygon (MATIC), -14%

- Gala (GALA), -14%

- VeChain (VET), -13%

For more background on the recent SEC legal actions against Binance and Coinbase, readers can check out this episode of Engineering the Trade on the tastylive financial network. To follow everything moving the markets, readers can also tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastylive or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.