BIG TECH & THE LAW OF LARGE NUMBERS

HOW EXACTLY DID BIG TECH GET TO BE SO … BIG?

To paraphrase ben franklin, those who would give up essential privacy to purchase temporary convenience deserve neither privacy nor convenience. Throughout history, humankind has used opposable thumbs and excess brain capacity to make daily existence easier. A line of convenience could be drawn from a flint hand ax to the iPhone 13. They’re both tools of immense personal utility.

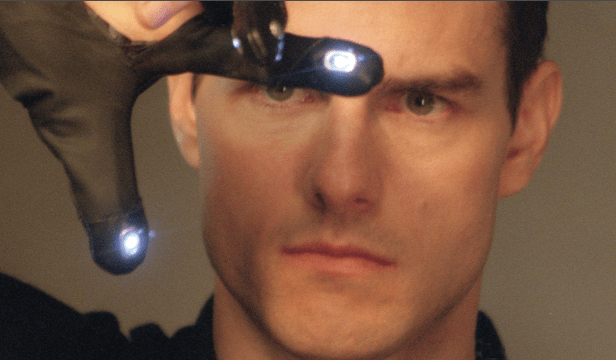

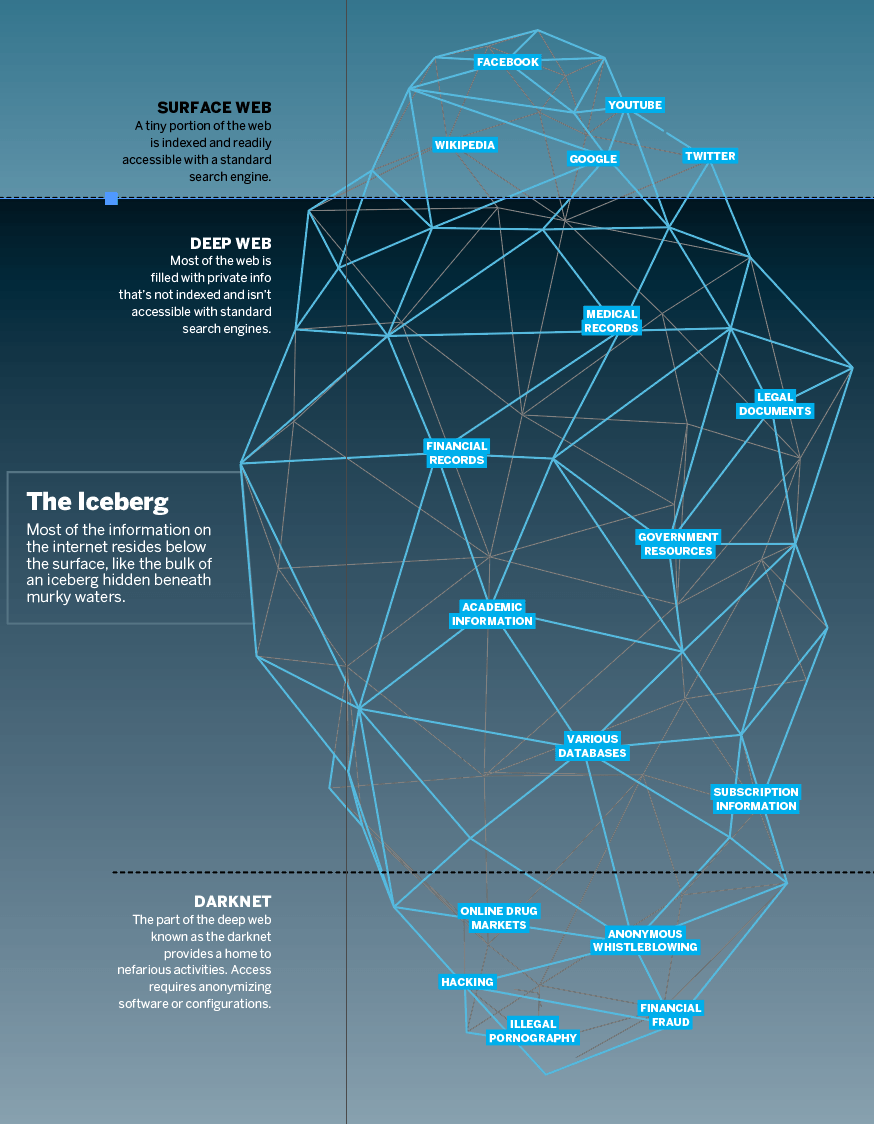

But people can use a sharpened rock without revealing anything about themselves to anyone. The iPhone, on the other hand, is designed to vacuum up the user’s personal activities, habits and desires. Every benefit from using an internet-connected device requires letting some organization—usually private—observe how that device is used, what it’s used for and who’s using it.

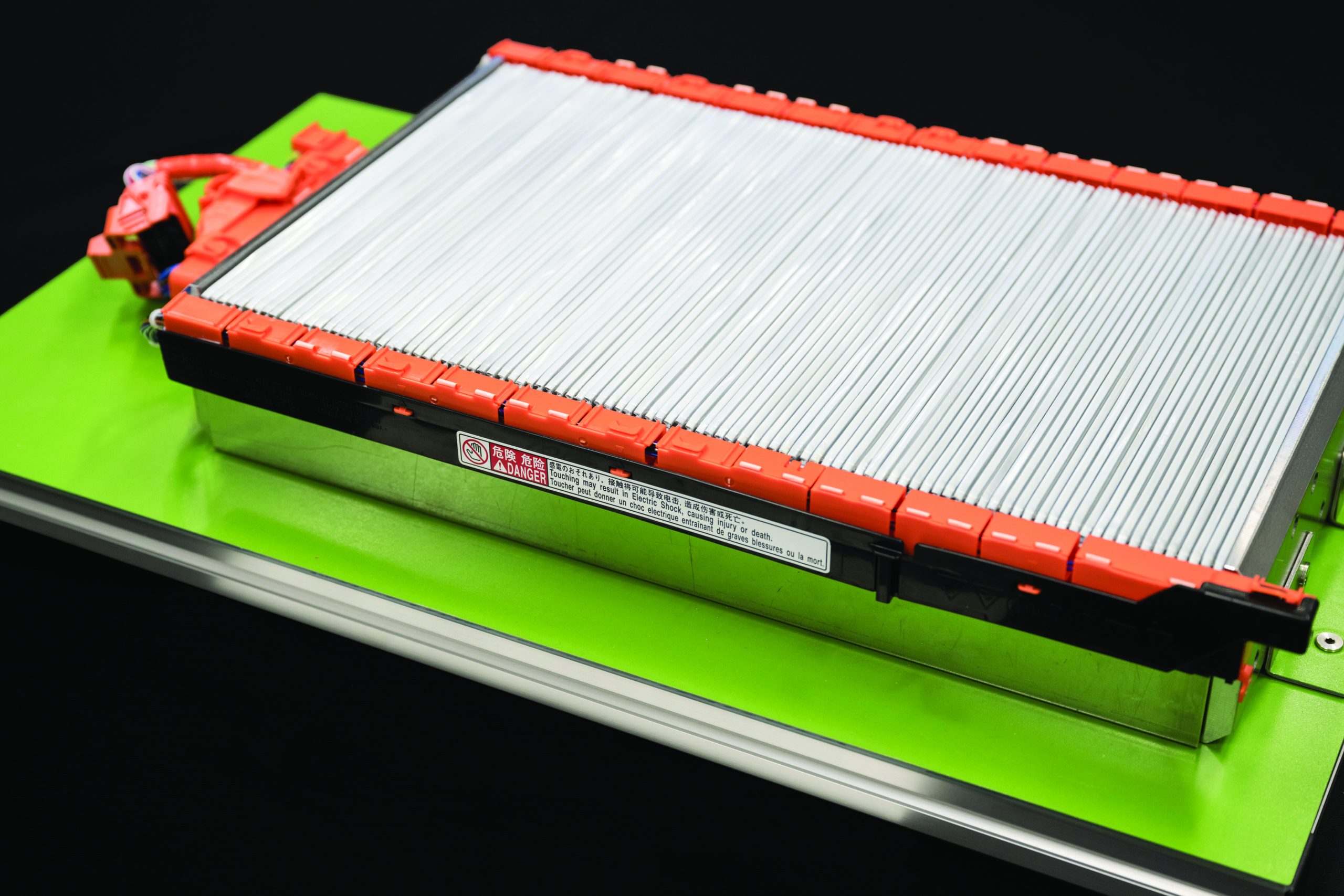

Companies track that data for security and to enhance the user experience. And that personal information has become the most valuable commodity in the world. Don’t think so? The world’s trillion-dollar companies, like Apple (AAPL), Google (GOOGL), Microsoft (MSFT), Amazon (AMZN), and Facebook (FB), are worth what they are because they monetize all the information that the public gives to them—willingly and for free.

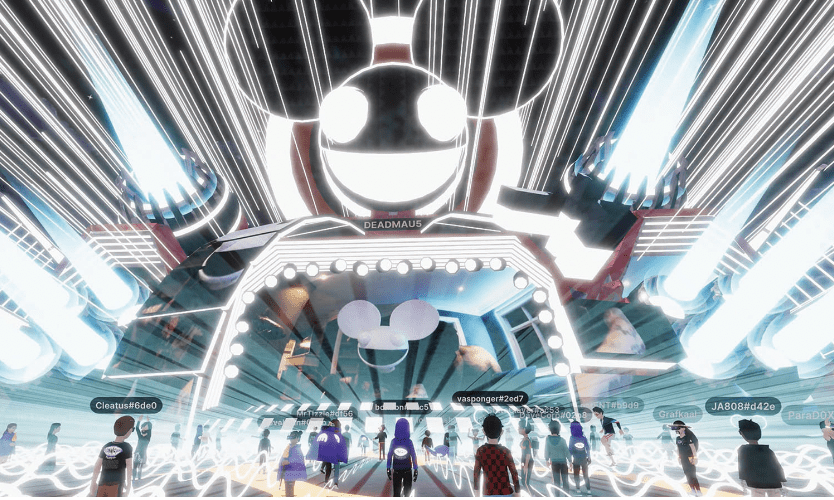

The world has sacrificed privacy for consumerism. People allow tech companies to look at what they’re doing and, in exchange, the world is at their fingertips. Irresistible. That’s become a marketing strategy for just about every product, and it funnels cash to the companies that gather data. On the dark side, those companies can sell the data to governments or political organizations that use the power in the data to manipulate voting patterns, sway public opinion and punish the opposition.

Those entities apply persuasion to the data. The news the public reads, the products they see in ads, and the relationships they’re encouraged to pursue are fed to them by entities looking to benefit from influencing them.

Their persuasion works on only a small percentage of the people exposed to the message. But all that’s needed to tilt financial, behavioral or political results is a shift of a couple of percentage points when a few people change their minds. A small percentage can produce numbers big enough to move the needle.

If tech companies could peer into the digital lives of only a few hundred people, the data would be worth nothing. It’s only when tech has data for hundreds of millions of people that information becomes something other companies and governments would pay to own. That’s because while an individual may make a binary choice—buy or not buy, vote for candidate A or candidate B, click or not click—a lot of individual choices can combine to resemble a normal distribution. That’s due to the law of large numbers.

The law of large numbers is really handy. Some think it’s the idea that anyone who looks at enough data will eventually find something good (or bad). But its real meaning is simpler and more powerful. The law of large numbers holds that regardless of the actual statistical distribution of the data—binomial, Poisson, Student’s T—the averages of samples from that data will be normally distributed.

For example, a coin flip has a binary distribution—heads or tails—and nothing else. By attaching a numerical value to the faces of the coin—1 for heads, 0 for tails—one can calculate an average value of a series of coin flips. Flip the coin 10 times and get five heads and five tails, and the average is 0.50. Flip 10 more times and get seven heads and three tails, and the average is 0.70. Flip 10 more times and get two heads and eight tails, and the average is 0.20.

Perform 1,000 of those 10-flip exercises and calculate the average of each one, and those average numbers would approach a normal distribution. Most of the 10 flip samples would have an average of 0.50. Fewer would have averages of each 0.40 and 0.60. Fewer still would have averages of 0.30 or 0.70. A plot of those averages would look a lot like a normal distribution. The law of large numbers says that even though each coin flip has a binary distribution, the large number of flips gives the averages a normal distribution.

Data that’s normally distributed enables companies to attach probabilities to behavior. That makes people predictable and enables companies to monetize and control them. It’s almost impossible to avoid being part of that trend, unless one chooses to unplug from society.

One wonders what Ben Franklin would say about that.

Tom Preston, Luckbox contributing editor, is the purveyor of all things probability-based and the poster boy for a standard normal deviate. @fittypercent