Trading the Record Surge in Global Defense Spending

Human civilization set a new record for military and defense spending in 2022 at roughly $2.2 trillion, which has in turn boosted the revenues and share prices of companies operating in this sector.

After nearly 15 months of intense fighting, there’s no end in sight to the Russo-Ukrainian war.

The latest report from the battlefield indicates that more than 350,000 soldiers have now died in the war. That’s roughly equivalent to the population of Cleveland, Ohio.

It’s been widely reported that Ukraine is right now planning a massive counteroffensive against Russia, which means the death toll could climb significantly in the coming weeks. One can only hope that a ceasefire will be announced in the very near future, so that any further human loss and suffering can be avoided.

Beyond the battlefield, the war has also displaced millions of people. A recent report by AP News indicated that roughly 13.5 million civilians have been driven from their homes as a result of the war. On top of that, there are an estimated 17.6 million people in Ukraine that now require ongoing humanitarian assistance.

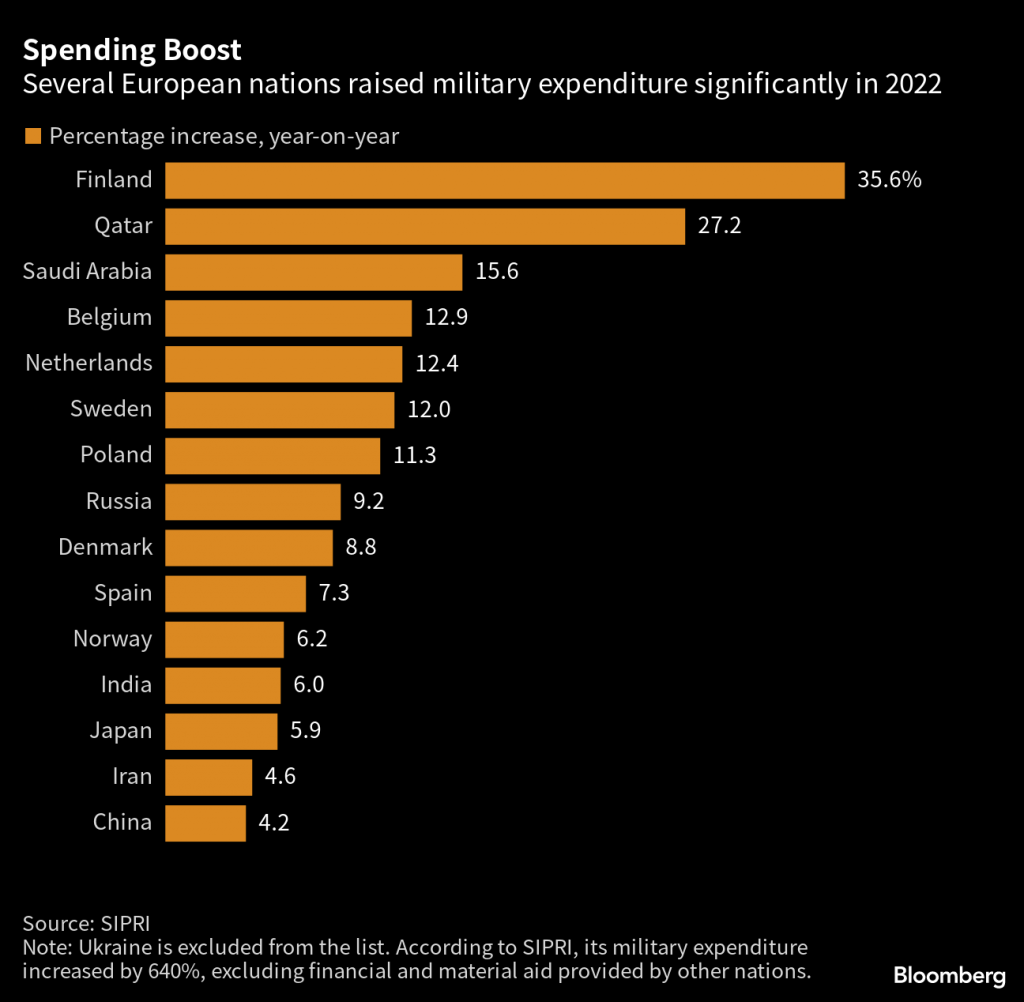

As a result of these harsh realities, the world is awash with fresh anxiety that the conflict could domino, and spread beyond the borders of Ukraine. And many countries—especially those located in close proximity to the conflict—are plowing fresh funds into their sovereign defense budgets.

Along those lines, the Stockholm International Peace Research Institute estimated that a record amount of money was directed toward global military spending in 2022—roughly $2.2 trillion by their account. And that figure is set to grow in 2023.

Considering these astronomical sums, it stands to reason that the global military and defense sector has benefited immensely from the war in Ukraine. That’s because a large chunk of the money spent on defense goes directly into the coffers of military/defense contractors and suppliers.

For example, Lockheed Martin (LMT)—which is one of the world’s largest weapons manufacturers—stated in its 2021 annual report that “71% of our $67 billion in sales were from the U.S. government.”

Increased military spending, therefore, translates directly to increased revenue for defense companies. And in turn, higher revenues and earnings typically have a positive impact on associated stock prices.

To wit, shares in Rheinmetall and Hensoldt—two well-known German defense companies—rallied by 153% and 130%, respectively, between February 2022 and February 2023. Rheinmetall produces the Leopard tanks that Europe has been sending to help Ukraine.

In the United Kingdom, shares of BAE were up over 50% from February 2022 to February 2023, while shares in Italy’s Leonardo were up 60% over the same period.

In the United States, Ratheon Technologies (RTX)—one of the country’s largest defense contractors—is up roughly 12% since the start of 2022. Another big American defense contractor, Honeywell (HON), has seen its shares rise by 17% since early October of last year.

However, the U.S. stock market has been plagued by the ongoing banking crisis, which may help explain why American defense stocks aren’t up as much as their European counterparts. That said, since bottoming out during the onset of the COVID-19 pandemic, the iShares US Aerospace and Defense ETF (ITA) has rallied by roughly 85%.

And based on recent reports from the Ukraine war, it’s virtually assured the military spending spigot will remain wide open for the foreseeable future.

Labor Shortage Crimps Efforts To Grow Military/Defense Manufacturing Capacity

Considering the shockingly high number of casualties in the Ukraine war, it’s apparent that both sides in the conflict are using extensive stocks of ammunition.

The situation has become so critical that even the countries supplying Ukraine—such as the United States—are now starting to run low on this key military resource. As a result, the global defense industry has shifted into high gear to restock supplies.

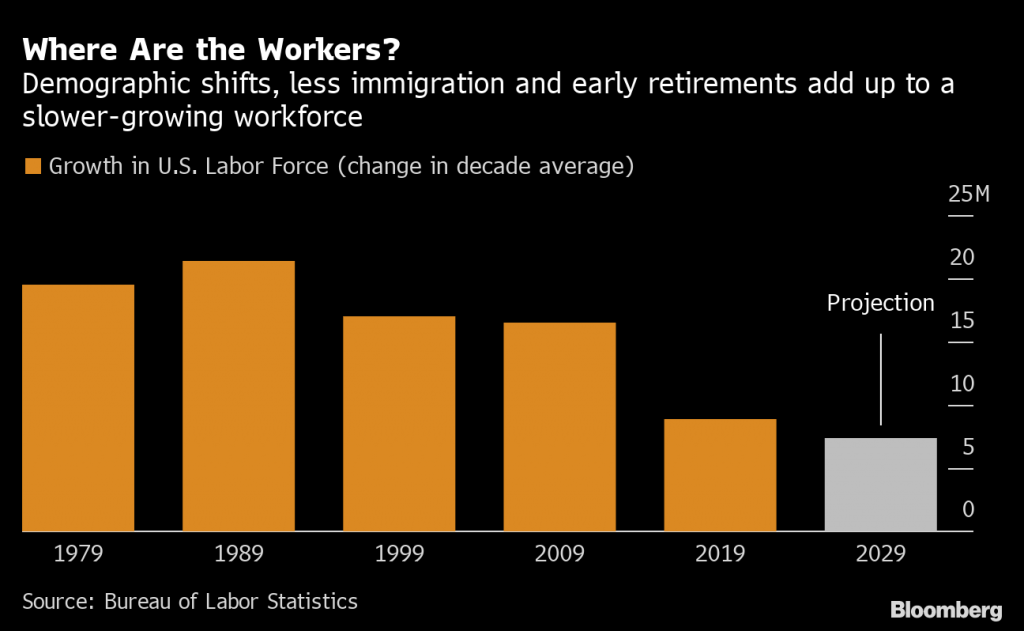

However, in order to significantly grow capacity, defense companies first need to identify and hire additional workers. And, as of late, that’s been a huge problem. And not just because employees in this sector often require security clearances.

The primary issue has been finding suitable candidates in the wake of the pandemic. The industry’s employment ranks were already depleted because many employees chose not to return to work after the pandemic. As a result, the defense industry—like virtually all business sectors—was starved of labor when the economy bounced back from COVID in 2021.

Taken all together, that means most defense companies were already behind the 8-ball in terms of human resources before Russia invaded Ukraine in early 2022. And due to the resulting uptick in demand for defense-related products, those shortages are now even more critical.

Hiring for the defense sector is especially complicated because there can be a negative stigma associated with such jobs. In many cases, a potential candidate elects to take a job with another manufacturer—outside the defense sector—because of the reduced risk of a potential moral dilemma.

The fact that weapons manufacturers are often located in sparsely populated regions, due to potential safety hazards, doesn’t help, either.

One of the munitions that’s in particularly short supply in 2023 are 155mm howitzer shells. These shells have been highly effective in repelling Russian forces, with some reports suggesting that the Ukrainians have been launching upwards of 3,000 per day. The U.S. military deems them critical not only for the European theatre but also in Asia, should a large-scale conflict break out in that region.

As a result, the U.S. defense sector plans to increase the production of 155mm shells by sixfold over the next five years. However, that will hinge on the ability of defense contractors to ramp up available capacity. Two key producers of the shells are General Dynamics (GD) and American Ordnance, the latter of which is a private company.

As a result of declining inventories, the U.S. is also planning to ramp up the production of other key munitions, including the Javelin antitank missile, which has also been widely utilized by the Ukrainian military.

Last year, the Pentagon launched the “Munitions Industrial Base Deep Dive” to analyze current production levels and capacity. Then, in early 2023, the Defense Department established the “Joint Production Accelerator Cell” in order to help optimize defense-related manufacturing.

This year, the U.S. defense budget is expected to grow by some $70 billion as compared to 2022 (totaling upwards of $840 billion). And much of that will undoubtedly end up as revenue for the U.S. defense sector.

To track and trade the U.S. defense sector, readers can add the following symbols to their watchlists:

- AeroVironment (AVAV)

- Elbit Systems (ESLT)

- General Dynamics (GD)

- Honeywell (HON)

- Huntington Ingalls (HII)

- Kratos Defense and Security (KTOS)

- Leonardo DRS (DRS)

- Lockheed Martin (LMT)

- L3Harris Technologies (LHX)

- Mercury Systems (MRCY)

- Northrop Grumman (NOC)

- Raytheon Technologies (RTX)

- Sturm Ruger (RGR)

- VSE Corporation (VSEC)

- V2X Inc. (VVX)

To follow everything moving the markets in 2023, readers can tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastylive or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.