UiPath (PATH): Another AI Stock to Consider Ahead of Earnings

Shares of UiPath (PATH) are up sharply in 2023 because the company’s robotic process automation (RPA) services are viewed as fertile ground for recent advancements in artificial intelligence (AI)

- Shares of UiPath (PATH) are up roughly 50% year-to-date.

- The company offers robotic process automation (RPA) services, which is a part of the broader business enterprise automation segment.

- UiPath is viewed as a potential leader in the commercial application of artificial intelligence (AI), because the company has successfully paired its RPA services with advanced AI.

This has been the year of artificial intelligence (AI), and as evidenced by Nvidia’s (NVDA) Q3 earnings report, demand for AI-focused products and services continues to surge.

In Q3, revenues at Nvidia clocked in at about $18 billion, which was a company record, and 12% higher than the company’s internal projections from just a few months ago.

On top of that, the company also set a fresh record for net income, pulling in a jaw-dropping $9.2 billion for the quarter, which was roughly $3 billion higher than the company’s previous record in Q2.

But Nvidia isn’t the only company in the AI universe putting up better-than-expected financials. Symbotic (SYM) recently reported quarterly revenues that were 60% higher than the same quarter last year. Shares of Symbotic spiked 40% in the wake of earnings, and are up more than 300% since the start of the year.

These results certainly bode well for other AI-focused companies, including UiPath (PATH), which is scheduled to release its Q3 earnings report on Nov. 30.

Much like Symbotic, UiPath sits at the crossroads of robotics and artificial intelligence. However, unlike Symbotic, which focuses on real-word robots, UiPath develops digital (e.g. virtual) robots.

These digital robots are essentially software-based “bots” that assist with the automation of business processes. UiPath operates in an emerging business segment known as robotic process automation (RPA), which falls under the broader umbrella of enterprise automation.

At a high level, business enterprise automation focuses on improving the efficiency of business operations by automating routine tasks. The goal of this automation is to improve accuracy and productivity, while also reducing costs.

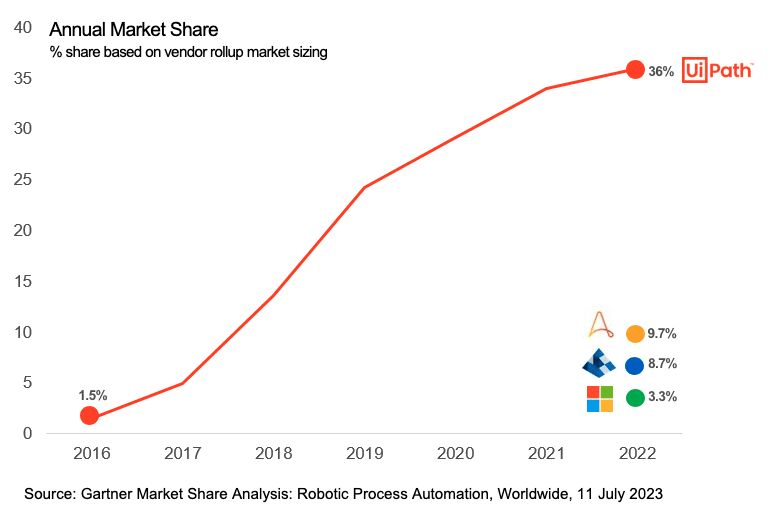

Recent market research indicates that UiPath controls roughly 36% of the robotic process automation market, as illustrated below.

Shares in UiPath are up roughly 50% so far in 2023, suggesting that the market is optimistic that UiPath could be a big beneficiary from advanced AI.

UiPath’s Financials Have Been Steadily Strengthening

In addition to benefiting from positive sentiment in the AI niche, shares in UiPath have also benefited from the company’s strengthening financial position.

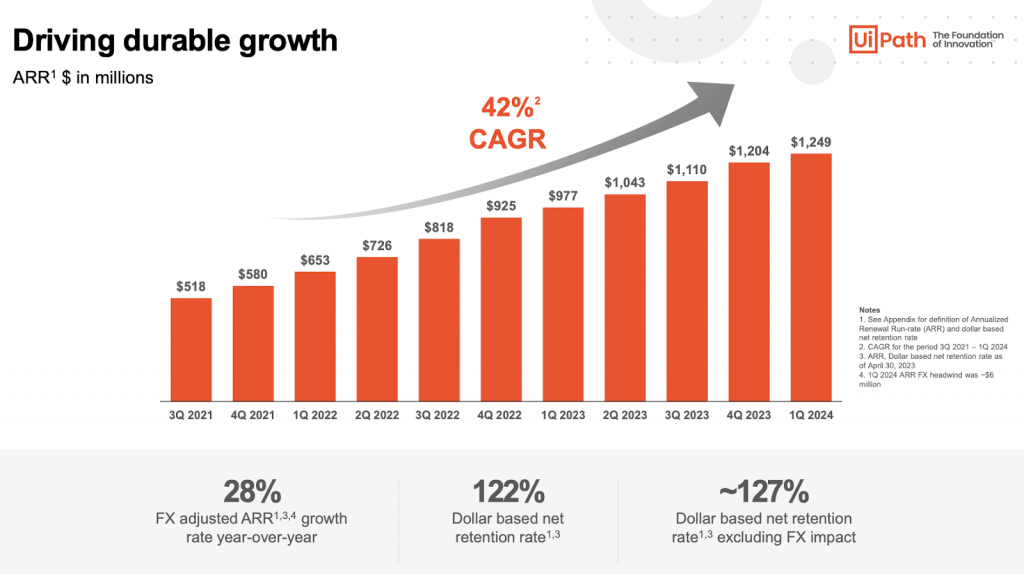

Revenues and profits at UiPath have been steadily improving in 2023, and that trend is expected to persist in the second half of 2023, and into 2024.

During Q2 of this year, revenues at UiPath increased by about 19% as compared to the same period last year. And at present, analysts expect that UiPath’s earnings will grow by about 20% in Q3—roughly in-line with the same robust growth observed last quarter, as illustrated below.

UiPath Corporate Presentation

Overall, UiPath is expected to generate around $1.3 billion in sales for fiscal year 2023. And rising revenues are also helping to boost profitability at UiPath.

During the first half of 2023, UiPath’s operating margin improved from -5% in Q1 to +10% in Q2, indicating that the company’s profitability potential is likewise trending in the right direction.

Along those lines, analysts are currently forecasting that UiPath will report earnings of about $0.07 in its November 30 report. On top of that, Zack’s is projecting that the company will post a $0.40/share profit for fiscal 2023.

In the company’s Q2 earnings report, UiPath revealed that it had around 250 customers contributing at least $1 million in annual revenue, which represented a 30% increase from the same period last year.

These promising revenue and earnings figures help illustrate that strength in UiPath shares during 2023 doesn’t stem from hype alone—the actual financials at UiPath have also been strengthening. And if UiPath’s financials continue to improve, shares could easily move higher.

At present, 15 analysts follow UiPath, and of those 15, none of them have rated shares of UiPath a “sell.” In comparison, 6 analysts currently rate shares of UiPath a “buy,” while 9 rate them a “hold.”

Overall, UiPath is currently rated a “moderate buy” by TipRanks with an average price target of about $20/share. Based on recent earnings performance at UiPath, “moderate buy” appears to be a fair recommendation for the company’s shares at this time.

However, if the company is able to dramatically improve its operating margin, and push that figure closer to its target level of 20%, shares in UiPath could easily be re-rated as a “strong buy.”

If the U.S. economy remains robust—and the UiPath Q3 earnings report plays out as expected on Nov. 30—shares in UiPath could easily trend toward the upper end of the current analyst price range, which is $25/share. Shares of UiPath currently trade for about $18.50/share.

On the other hand, any significant deterioration in the U.S. economy could represent a serious headwind for UiPath. Under that scenario, UiPath’s earnings would likely suffer—potentially pushing the company back into a situation where it is posting quarterly losses. In that case, shares of UiPath could easily pull back to the $15/share level, or lower.

The good news, however, is that the risk of a recession appears to be receding—at least for the time being—which probably helps explain recent strength in the broader stock market.

To follow everything moving the markets, including the options markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.