5 Effective Strategies for Managing Risk in a Bull Market

Even amid all-time highs, a disciplined approach to portfolio risk management is paramount

- The major market indices have rallied significantly over the past 18 months.

- Active investors should consider re-evaluating their exposures, portfolio weighting and risk-management strategies.

- Five tactics/strategies to consider include rebalancing the portfolio, updating stop-loss and take-profit orders, building a larger cash reserve, and deploying covered calls or protective options collars.

In the financial markets, vigilance is a constant companion. Risk management is a daily ritual—a fundamental discipline that underpins every decision. Yet, there are moments when the stakes feel higher, when the usual calculus of risk and reward is overshadowed by the need for a more profound reassessment.

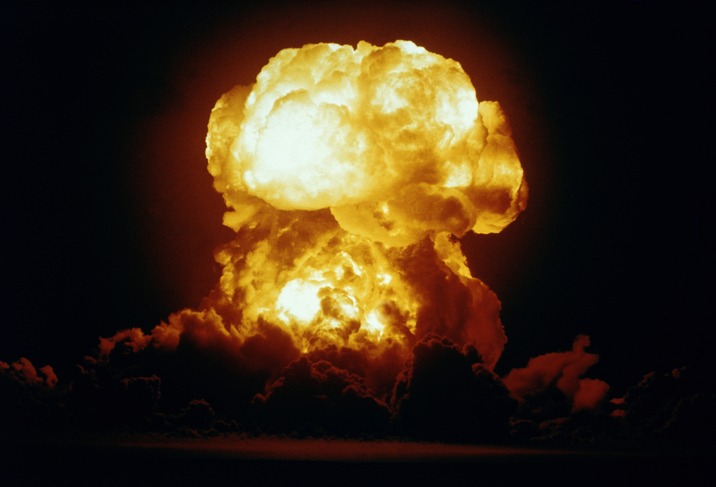

For example, consider the volatility associated with major geopolitical upheavals. A sudden escalation in tensions between powerful countries can unsettle even the most confident market participants, necessitating swift and decisive action to shield one’s capital from turbulence.

However, other catalysts can trigger similar introspection. An unexpected “super spike” in the price of a commodity, a natural disaster with far-reaching impact or the abrupt collapse of a key business enterprise can all prompt active investors to scrutinize their holdings. These events, while disparate, share the potential to disrupt market equilibrium and amplify risk.

But other developments may also prompt a similar review. One example would be a market peak or trough, such as the one observed in 2024. At present, the major stock market indices in the United States are bumping against all-time highs, which has provided a good reason to assess one’s portfolio and risk appetite.

For example, one might elect to pare back individual holdings that have moved substantially in one direction or the other (to reduce the risk of concentration), or build a larger reserve of cash, to use on a pullback. Alternatively, active investors might consider hedging the overall portfolio—or a portion of it—to lock in gains and protect against adverse movement.

The specific course of action will depend upon one’s outlook and risk profile. With this in mind, five tactics or strategies are outlined below.

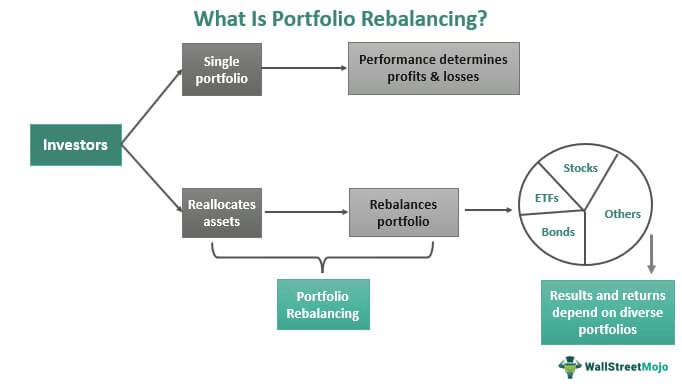

1. Rebalancing the portfolio

Overview: Active investors periodically rebalance the target weights for asset classes in their portfolios. For example, if the target allocation is 60% stocks and 40% bonds, and the portfolio has shifted to 70% stocks and 30% bonds, a rebalancing might involve selling stocks and buying bonds to achieve the desired 60/40 split.

One might also alter the weights during a portfolio rebalancing. A rebalancing may also involve paring back individual holdings to increase of decrease their proportion of the portfolio.

2024 Context: With major indices like the S&P 500 and Nasdaq Composite reaching all-time highs in 2024, many portfolios have become skewed toward high-performing sectors such as communications and technology. At times, over-concentration can increase risks, particularly if these sectors experience a correction. Rebalancing can help mitigate those risks by ensuring the portfolio is aligned with the investor’s outlook and risk tolerance.

Additional Considerations: A potential cut in interest rates by the Federal Reserve could be bullish for the bond market, which means active investors may want to re-evaluate their exposure to this niche of the financial markets vis-a-vis their other holdings.

2. Updating stop-loss and take-profit orders

Overview: Stop-loss and take-profit orders are pre-defined instructions to buy or sell assets once they reach a certain price. Specifically, a stop-loss order is designed to limit an investor’s loss on a position by selling the asset if its price falls to a predetermined level. If a stock is purchased at $100, an investor might set a stop-loss order at $90 to limit potential losses to 10%.

Conversely, a take-profit order allows an investor to lock in profits by selling an asset when it reaches a desired price. If the same stock rises to $120, a take-profit order might be set to sell at that price, ensuring the investor secures the associated gains. Both stop-loss and take-profit orders are used to help manage risk and automate the decision-making process, allowing for a more disciplined approach to trading and investing.

2024 Context: With the major indices bumping against all-time highs, complacency has reached historically high levels in the markets. Despite the calm, risks undoubtedly remain in the market, which is why active investors may want to lean on stop-loss and take-profit orders to help with portfolio risk management.

Additional Considerations: A market participant’s unique outlook will significantly influence the width of stop-loss and take-profit orders in terms of distance from current prices. Those with a more conservative approach may set tighter stop-loss orders to minimize potential losses. Conversely, more aggressive investors might allow for wider margins, allowing for some volatility in the underlying and to target larger gains.

3. Building cash reserves for a potential pullback

Overview: Raising cash requires liquidating assets. This strategy creates a reserve that can be used to take advantage of buying opportunities during market pullbacks. For example, active investors might sell a portion of their top-performing positions—or their underperforming positions. This cash can then be deployed strategically when the market experiences a downturn, allowing the investor to purchase undervalued assets at lower prices. This approach not only provides flexibility but also positions the investor to capitalize on increased corrections or increased volatility, which could lead to attractive gains.

2024 Context: Data from the options market suggests active investors have been especially complacent in 2024. However, with interest rate policy poised to shift and a variety of geopolitical uncertainties in play, significant risks remain. By raising cash, investors can prepare to seize opportunities when they arise. This proactive approach ensures a greater degree of liquidity, enabling active market participants to purchase potentially high-quality assets at discounted prices amid market corrections.

Additional Considerations: Don’t overlook the fact that the presidential election could elevate volatility into the financial markets. With some valuations already stretched to historical extremes, investors may be better-positioned to capitalize on potential opportunities with a more liquid cash position.

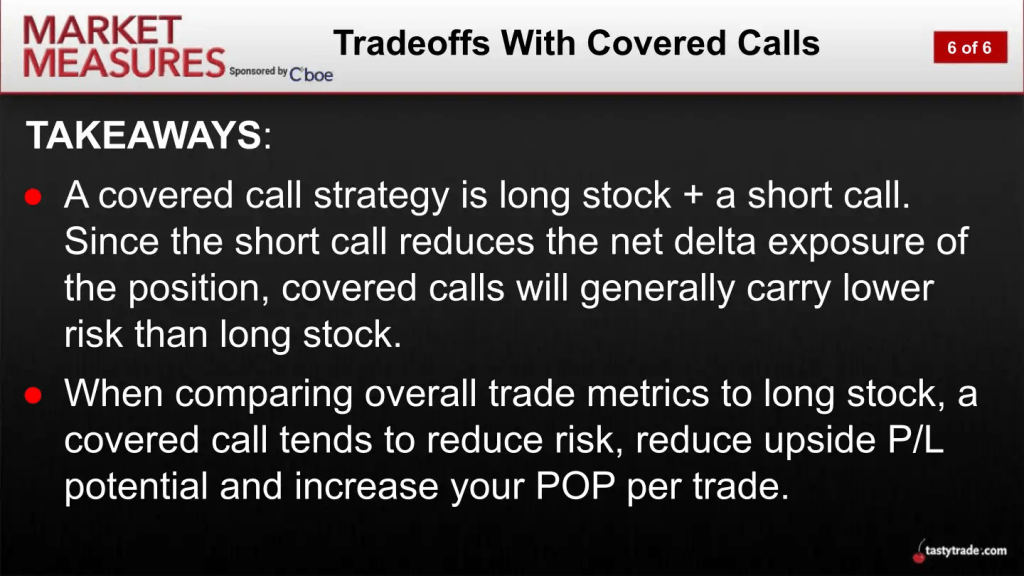

4. Consider covered calls

Overview: With a covered call options strategy, an investor owns a stock or exchange-traded fund (ETF) and sells call options on it to generate additional income. The term “covered” refers to the fact that the investor already owns the asset, reducing the risk of having to buy it at a higher price if the option is exercised.

With this strategy, the income from selling the call options provides a cushion against minor price drops, But the investor gives up some upside potential (above the short option’s strike price). Covered calls are most effective in sideways or mildly bullish markets, where an asset’s price is expected to stay flat or rise slightly. Covered calls generally allow investors to earn income from options premiums while also providing some degree of protection on a pullback in the underlying.

2024 Context: In 2024, the stock market has hit new highs, which arguably makes covered calls particularly appealing. Depending upon one’s outlook and risk profile, active investors can also potentially capitalize on increased valuations by selling covered calls against an existing position. This might suit those who expect sideways movement in the stock market during the life of the short call(s).

Additional Considerations: An extreme move in the underlying stock or ETF isn’t necessarily ideal for a covered call position. If the underlying experiences a sharp spike, the investor will miss out on gains above the strike price of the short call. Similarly, a significant correction is also not favorable, because the long stock position incurs losses. However, in this scenario, the premium from the short call options can help mitigate some of the downside risk. Investors should be aware of these dynamics, and evaluate their market outlook and risk tolerance before employing this strategy.

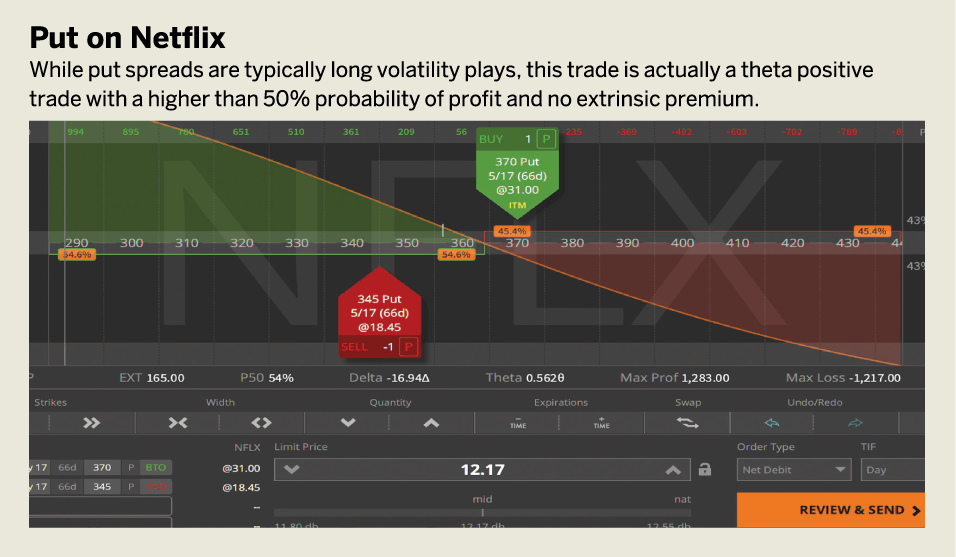

5. Consider options collars

Overview: The options collar strategy is a slightly more sophisticated approach used to manage risk—often in concentrated stock positions. This strategy involves owning the underlying stock and then deploying a long put and short call against it. The simultaneous use of these options creates a “collar” around the long stock position, ensuring that losses do not exceed a certain level and that upside gains, while limited, are still achievable up to a predefined limit. This strategy is often referred to as a “protective collar.”

2024 Context: In 2024, with major indices like the S&P 500 and Nasdaq Composite at record highs, an options collar may be appealing for some risk-averse investors. By purchasing a protective put and selling a call option, investors can guard against significant losses while still generating income. For instance, if the market declines sharply, the gains from the long put option and short call option can help offset losses in the underlying stock position.

Additional Considerations: The unique advantage of an options collar is that the premium from the short call can help offset the cost of the protective put. This makes the protective collar more cost-effective than simply purchasing a downside put on its own, which would be more expensive. However, the short call will also eat into potential upside gains. Depending upon one’s outlook and risk profile, this structure may be attractive.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For more background on trading bonds and interest rates, readers can check out this installment of In This Economy on the tastylive financial network.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.