The Recent Rally in Oil Prices Could Lift the Coal Sector

Coal prices have been trending lower since September 2022, but the recent rally in crude oil prices could provide a boost to the coal sector

- Coal futures are down about 70% since peaking in September 2022.

- Crude oil prices have been rallying in recent weeks, which may indicate increased optimism in the 2024 global economy.

- Much like crude oil, coal prices tend to rise and fall with the underlying economy, because coal is primarily used to generate electricity.

After bottoming in mid-December, crude oil prices have rallied by about 15% during the last eight weeks, climbing to a recent high of about $78 per barrel.

Oil prices had been under pressure during the last quarter of 2023 due to deteriorating expectations for the global economy. And the recent bounce may suggest that market participants are reassessing the possibility of global economic rebound in Q2 or Q3 of 2024.

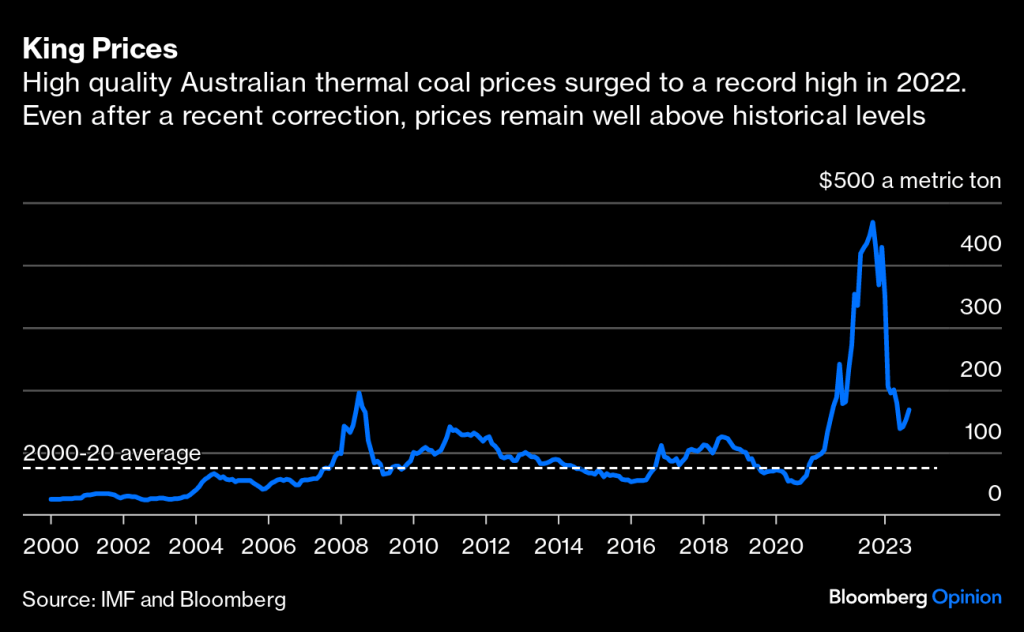

If the rally in oil continues, one of the big beneficiaries could be the coal market. Newcastle coal futures (an industry benchmark) have corrected by about 70% since peaking above $400/ton in September 2022. As of early February, they have settled all the way down at around $120/ton.

Much like crude oil, coal prices are extremely sensitive to prevailing economic conditions, because demand in the coal market tends to ebb and flow with strength/weakness in the underlying economy. Like other commodities markets, coal prices are also heavily influenced by supply-side dynamics.

When supplies are relatively scarce, and demand is rising, coal prices typically move higher. And when supplies are robust, and demand is falling, coal prices usually move higher. But there are other scenarios to consider as well, like the current market environment.

At present, global inventories of coal are relatively robust. Last year, global coal production crested to a fresh all-time high, clocking in at around 8.7 billion metric tons, which was a 2% increase from 2022.

Despite the ready supply of coal, one can’t overlook the fact that prices have been falling for roughly 17 months, and are now roughly 70% lower than they were in September 2022. Considering that long downward trend, one can imagine how a sudden uptick in demand might serve as a catalyst for prices.

Around the world, coal-powered energy is primarily used to generate electricity. So if economic growth is stronger than expected in 2024, an uptick in demand could trigger a significant reversal in coal prices—much like what was observed in the iron ore market during the last quarter of 2023.

Current dynamic in the international coal market

When it comes to demand in the international markets, China and India are two of the world’s largest importers of coal. That’s not necessarily surprising, given that these two countries are the most highly populated of any on earth, and also constitute a couple of the world’s largest economies.

In absolute terms, China has long been the world’s number one importer of coal. But over the last couple of years, India’s economy has been growing at a faster pace than China’s. During 2022 and 2023, India’s GDP grew by about 7% annually.

Much like China, India relies heavily on coal to power their electric grid. According to The Times of India, coal-fired power accounts for roughly 70% of India’s total electricity on an annual basis. That means if India’s economy continues to grow at a rapid pace in 2024, additional coal imports will likely be required.

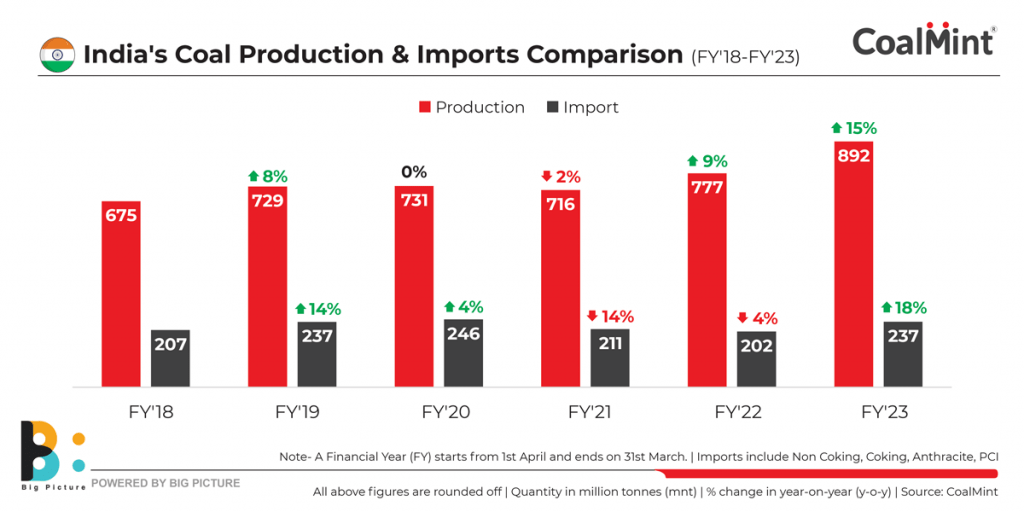

Corroborating that outlook, the International Energy Agency (EIA) recently stated that increased coal demand from India will be the primary driver of growth in this sector for the next several years. To satisfy this level of demand, India has been producing more coal domestically, and importing more from abroad. As highlighted in the graphic below, India’s coal imports rose by 18% in 2023 as compared to the year prior.

The aforementioned data indicates that continuing strength in the Indian economy will be a lynchpin for the global coal market in 2024. But what about China?

The Chinese economy (and stock market) have been under pressure since early 2021 (when the stock market selloff first started). Based on recent data, China’s economy continues to be mired in the doldrums. In the last quarter of 2023, the Chinese economy grew by 5.2%, which was below expectations—and also well below India’s current pace of growth.

But what if China’s economy were to bounce back in Q2 or Q3 of 2024? If that comes to pass, the bull case for coal prices gets even stronger. Along those lines, a general uptick in global economic activity would also suffice to help push coal prices higher, even if the Chinese economy continues to move sideways.

Key investment/trading takeaways

Based on the aforementioned information and data, investors and traders bullish on the Indian and Chinese economies—or the broader global economy—might consider a long position in the coal market at this time. On the other hand, market participants who think the global economy will continue to slow in 2024, may want to hold off before initiating a new position in the energy sector.

Prior to the pandemic, thermal coal prices were trading between $60 and $70/ton. That means if the current selloff continues, coal prices could drop further. However, with India’s economy still humming, and the summer season approaching, that seems fairly unlikely.

According to India’s Central Electricity Authority (ICEA), electricity demand in the country tends to peak during the summer months, particularly in May and June, when temperatures soar to their highest levels. Power utilities and grid operators must therefore anticipate and manage this seasonal spike in demand to ensure the reliability and stability of the electricity supply.

Similar to India, electricity demand in China also tends to increase during the summer months due to increased usage of cooling systems, particularly air conditioners. China, with its vast territory and diverse climatic zones, faces varying levels of temperature extremes during the summer season, with some areas experiencing sweltering heat.

Taken all together, this information suggests that the recent slide in coal prices may represent an opportunity for those that are bullish on a potential economic rebound in 2024, especially with the hot summers in India and China drawing closer on the calendar.

To track and trade the coal sector, readers can add the following names to their watchlists:

- Alliance Resource Partners (ARLP)

- Alpha Resources (AMR)

- Arch Resources (ARCH)

- BHP Group (BHP)

- Consol Energy (CEIX)

- CNX Resources (CNX)

- Hallador Energy (HNRG)

- NACCO Industries (NC)

- Natural Resource Partners (NRP)

- Peabody Energy (BTU)

- Ramaco Resources (METC)

- SunCoke Energy (SXC)

- Teck Resources (TECK)

- Warrior Met Coal (HCC)

To follow everything moving the markets in 2024, including the options and futures markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.