Amazon Doesn’t Sell Sculpted Physiques

Staying fit requires discipline and commitment; the same can be said for profits in trading.

Instant gratification and immediate satisfaction. If the explosion of Facebook (FB), Amazon (AMZN), and Netflix (NFLX) onto the content consumption scene has shown the world anything, it’s this: People want their stuff and they want it NOW.

Bingeworthy content is always available and doesn’t even require tapping a keyboard or touching a screen. This is today’s societal landscape. Wait a week for a new episode of Stranger Things? Not a chance. It’s consumed in its entirety—today.

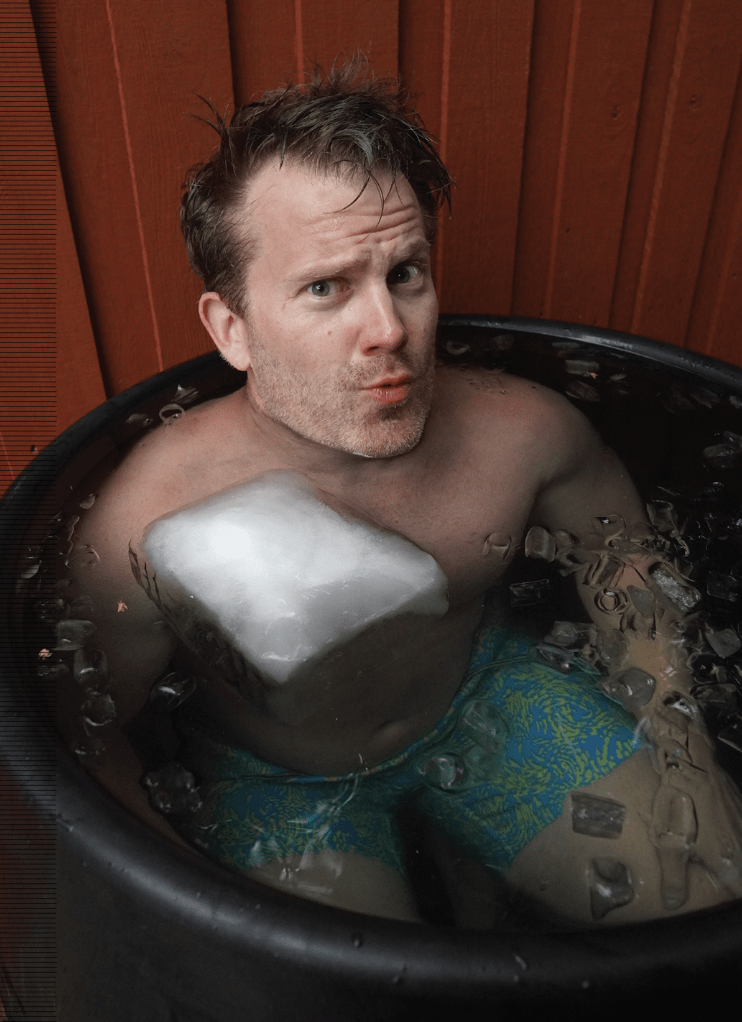

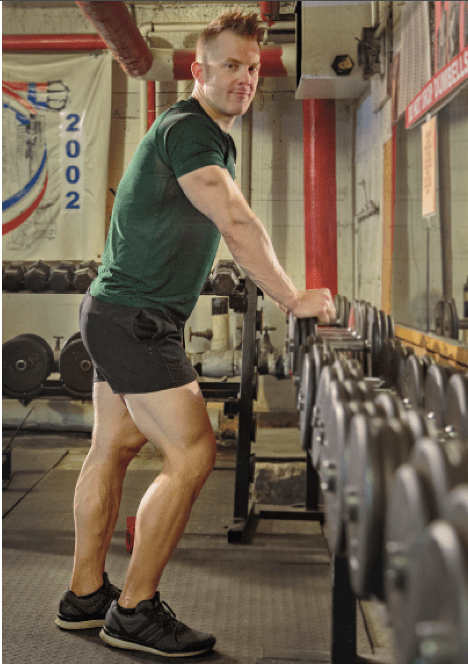

The problem (not to suggest there’s only one) is that nothing important comes this easily—not in life in general and definitely not when it comes to radical physique transformation. Maintaining your body takes time…a long time. Even with hard training, it takes a while to oxidize fatty acids. Caloric deficits don’t immediately shrink fat cells. And building new muscle requires sustained effort. Heavy gym sessions don’t tax and repair the necessary fibers overnight, and caloric surpluses need time to add mass to the body.

In other words, dramatic change to a physique doesn’t come in minutes, hours or days. It’s a matter of weeks, months and years.

But therein lies the problem. Nobody wants to wait six months for a diced up core. They want it now. Nobody cares about a six-pack next summer. They want it today. Regularly, laboriously shaped washboard abs? Nope, not interested. Amazon’s next-day abs, please.

A white van doesn’t double park outside your home and drop off a lean, healthy, muscular physique. Binging won’t bring a sculpted midsection, not literally nor figuratively. It’s earned over time. It’s achieved through sacrifice. Real progress requires patience.

Which is similar to what every trader knows about a portfolio’s profit and loss (P/L). Investors make money in the derivatives market in only three ways: the right directional bias, the right change in volatility or the passage of time. That’s it. The profit or loss generated over a month, quarter or year is a function of those three components. The reliability of each of those metrics increases when investors examine a longer window of time.

If an investor’s long the market, the market will eventually grind higher, providing an opportunity to benefit. If an investor’s short the market, the negative skew, positive kurtosis and sheer downside velocity in prices provide chances to benefit. If volatility contracts, which it normally does, premium sellers can capitalize. Even if volatility expands, premium buyers can benefit. And with the passage of time, the long side of the option contract pays the short side of the option contract an amount equivalent to the daily theta decay for the right to make potentially large profits in the position, should the stock move significantly in the desired direction.

All of the above, each of the three factors influencing a portfolio’s performance, is exponentially more reliable and powerful over longer windows of time. Market movements change from totally random to slowly higher. With time, changes in volatility shift from completely unpredictable to discernibly tradable. And theta decay moves from a small daily pittance to a sizable cycle’s ransom.

So strap in and get comfortable. Train daily. Trade daily. Consistent results in training and nutrition require time. Predictable outcomes with trades and investments take a while, too. Just ask the thousands of committed traders who watch the tastytrade network online each day.

Just because Netflix sets Episode 2 to start automatically in eleven seconds doesn’t mean anything else will materialize that easily.

Jim Schultz, Ph.D., a derivatives trader, fitness expert, owner of livefcubed.com and the daily host of From Theory to Practice on the tastytrade network, was named North American Natural Bodybuilding Federation’s 2017 Novice Bodybuilding Champion. @jschultzf3