The Inescapable Forces of Economics

Laws of physics apply to everything, from physique development to trading

Sir Isaac Newton isn’t best-known for his rock-hard abs or unmatched prowess in the capital markets, but that’s not to say that what he is known for isn’t relevant to achieving both: specifically, his third law of motion.

Essentially, for every action—or force—in nature, there is an equal and opposite reaction. Climb up a rope by pulling down on it, for example. Action-reaction pairs sound simple enough, but in practice, they’re even simpler, and their applications transcend high school physics classes. Newton’s laws play out in the world of body development to a great extent.

If sandblasting body fat off of the frame is the goal, when execution goes up, bodyweight goes down. When diligence increases, body fat decreases. When consistency trends higher, jean sizes trend lower.

Immutable Laws

It almost doesn’t matter what strategy is plotted or what program is put into action. Provided one adheres to some central principles, such as caloric deficits, the map doesn’t matter. It’s following the map that ensures an inverse relationship between the action of doing something and the reaction of dropping pounds.

In economics, it’s no different. In fact, undergraduate students in finance etch Newton’s laws into the backs of their brains in hopes of understanding the basics of the bond market. In a seemingly counterintuitive way, bond prices and interest rates are inversely tied. When interest rates rise, bond prices fall. When bond prices fall, interest rates rise, depending on who’s the chicken and who’s the egg.

When interest rates rise, bond prices fall. When bond prices fall, interest rates rise, depending on who’s the chicken and who’s the egg.

The relationship makes logical sense. If interest rates rise, then all newly issued, clean paper will come out at those higher interest rates. Therefore, all that old, crusty, dirty paper must now be discounted to remain competitive.

Fair enough, but it gets even better—the mysterious laws of the universe and their applications in the financial markets don’t stop there. The yin-yang relationship between prices and rates also extends to the equity market. While the specifics of this beast are a bit messier than those of the bond market, the general spirit of the up/down dichotomy remains.

The Inverse

When interest rates rise, stock prices tend to fall, too, and vice versa. Why? One reason is that higher interest rates increase the opportunity cost of buying stocks. Put another way, why would an investor buy shares in Nike, with all of the randomness, unpredictability and uncertainty of those shares, when that same investor could buy a bond in Nike at the now higher interest rate with more predictable cash flows and certainty of return? Thus, those share prices have to be discounted to remain a viable option for investors.

At the same time, when rates are dropping, it’s common to see stock prices rising. Now, stock returns—and their associated dividend payments—appear to be far more attractive options than the paltry returns that bonds offer. Thus, stock demand increases and stock prices rise.

Is it always this clean? No. Do all the bias-driven, emotionally charged participants in the stock market always follow the mathematical laws of rational risk-return optimizers? Not every time.

But could that help explain why the stock market is now brushing back up against all-time highs, even amid a global pandemic, financial problems on Main Street and civil unrest throughout the nation? Not as the sole factor, but certainly as a contributing cause.

If the laws of physics and maintaining one’s physique have taught anything, it’s that they apply just about everywhere.

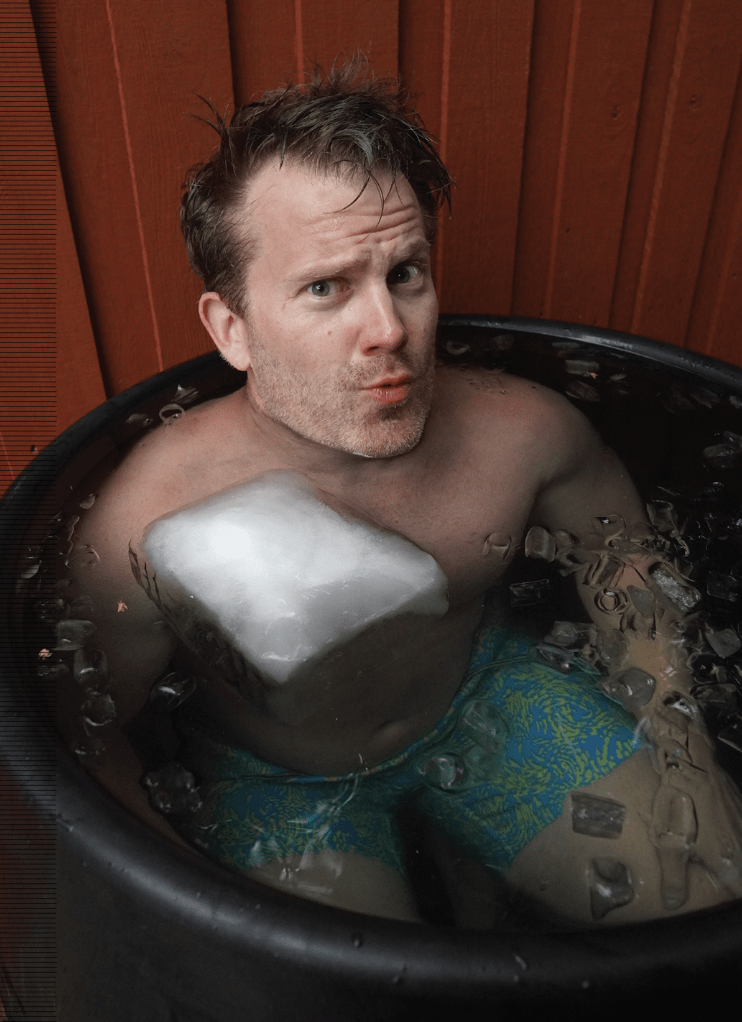

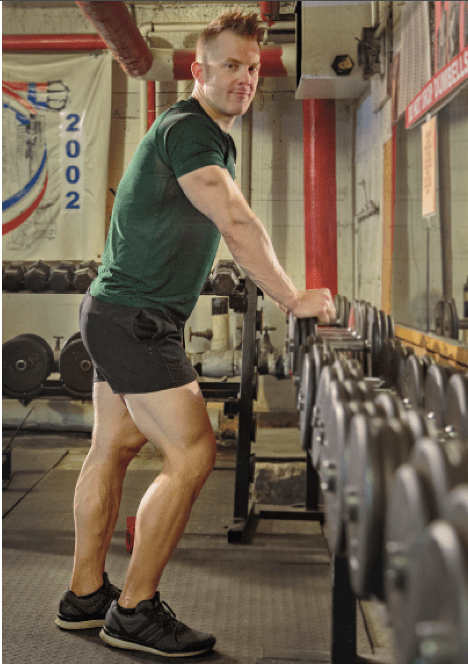

Jim Schultz, Ph.D., a derivatives trader, fitness expert, owner of livefcubed.com and the daily host of From Theory to Practice on the tastytrade network, was named North American Natural Bodybuilding Federation’s 2017 Novice Champion. @jschultzf3