Nutritious Meals and the Markets

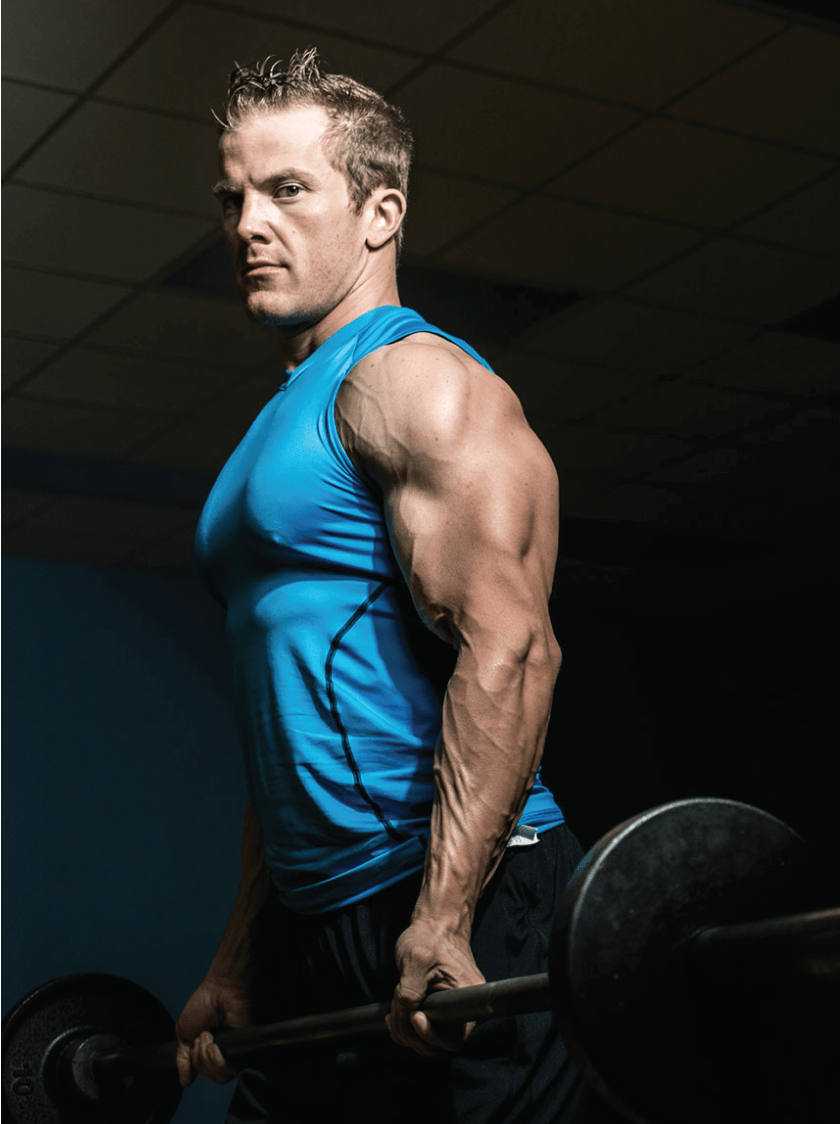

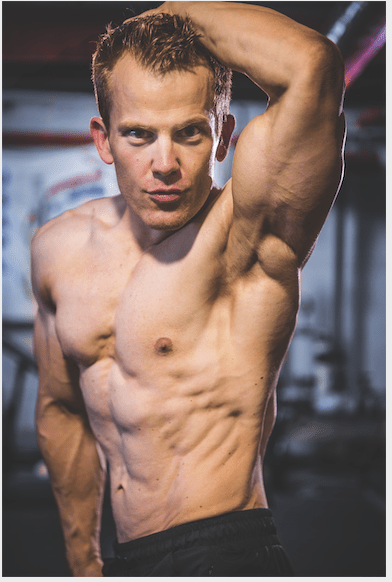

Just as fitness devotees ponder the nuances of nutrition, investors consider the subtleties of trading

There’s more than one way to get downtown—the highway, side streets and back roads all lead there. Each has pros and cons, benefits and drawbacks, or gimmes and gotchas. Some are quick, others scenic. Where one zigs, the other zags.

And choosing a nutritional strategy aimed at physique transformation is no different. There’s no shortage of strategic alternatives for the fitness enthusiast looking to get leaner, stronger, faster, better.

With keto, for instance, the absence of the carbohydrate purportedly shifts all of the body’s processes into fat-blasting mode—total energy and calories consumed be damned. No thought involved, just no more breadsticks.

Then there’s intermittent fasting—long periods of no food followed by short bursts of yes food, an oscillation between starving and stuffed. No critical thinking needed, just eat between 8 a.m. and 11 a.m. only.

And there’s paleo. If it comes in a box, it’s off limits. But if it comes from the ground, it’s open season, unless it’s corn, wheat, soy, rice, oats or potatoes. No problem-solving required, just chicken, lettuce and ice cubes, indefinitely.

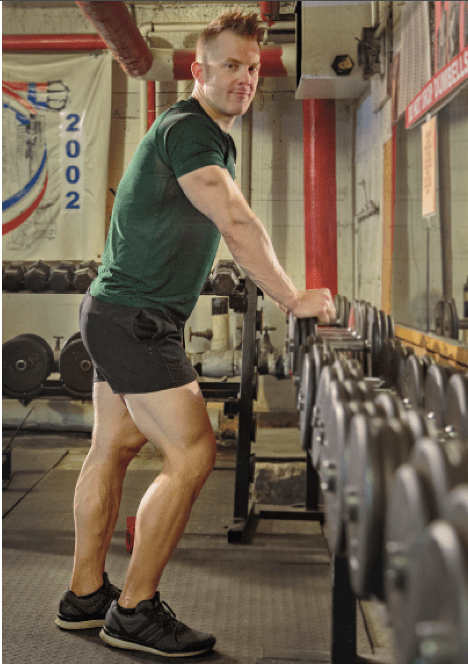

There’s no shortage of strategic alternatives for the fitness enthusiast looking to get leaner, stronger, faster, better.

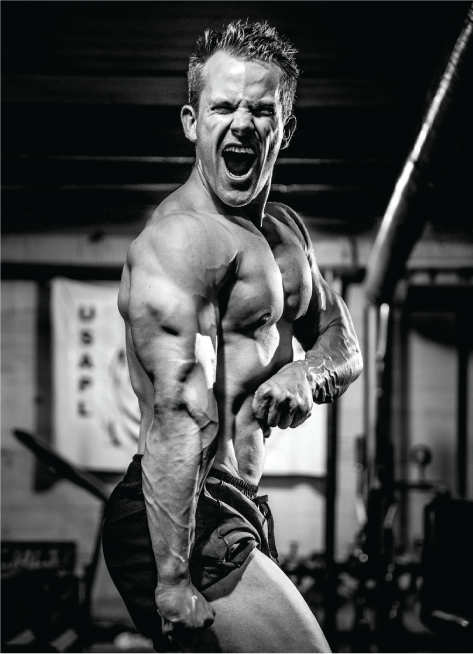

But then, like the first day of spring, there are also macros—the measurement of protein, carbs, and fats to find their optimal distribution for a unique metabolism and a specific goal. No two people need the same levels, and no two metabolic capacities respond identically. Like a jigsaw puzzle, it requires constant thought and consistent analysis. It’s an investment of time, energy and effort.

But in exchange for those gotchas, macros offer a few significant gimmes. First, no food is off limits: Olive Garden breadsticks are back and Honey Nut Cheerios are welcome. Second,, no time restrictions are imposed: Hungry at 3 p.m.? Eat. Want a snack at 7 p.m.? Have one. Late night cravings at midnight? By all means. Third, and arguably most-rewarding, fine-tuning the right protein, carbohydrate and fat inputs will lead to an understanding of optimal levels that no other nutritional strategy can match.

Soon enough, it becomes a game of execution. Eat X and achieve Y. Consume A and produce B. The thought process unlocks an entirely new world of possibilities, all because the mind was pushed and stretched. It’s not unlike adding derivatives to an investment portfolio.

There’s always the option of buying some SPY shares, stuffing them into the sock drawer and then collecting an average of 9% to 10% per year. That road certainly requires knowledge and discipline. But like Keto, intermittent fasting or even the alkaline diet (not that anyone actually thinks that’s a good idea), it’s the lazy approach to portfolio construction. No brain power is needed, and no difficult decisions arise.

Cookie-cutter investing protocols are like that. Traders who use them ignore the strategic options available to the savvy investor who’s willing to learn about beta-weighting position deltas or boosting portfolio thetas. They dismiss the alternatives available to market practitioners ready to take advantage of nonconstant heteroskedastic volatility and leptokurtic distributions unusually close to the mean. Just beneath the surface that is a long S&P 500 Index Fund lies an untapped world of dynamic directional biases and strategically diversified positions. It’s a world available to every retail investor with a brokerage account and an internet connection.

So, whether the blank canvas in question is a physique or a portfolio, never discount the most powerful asset on the board—the mind.

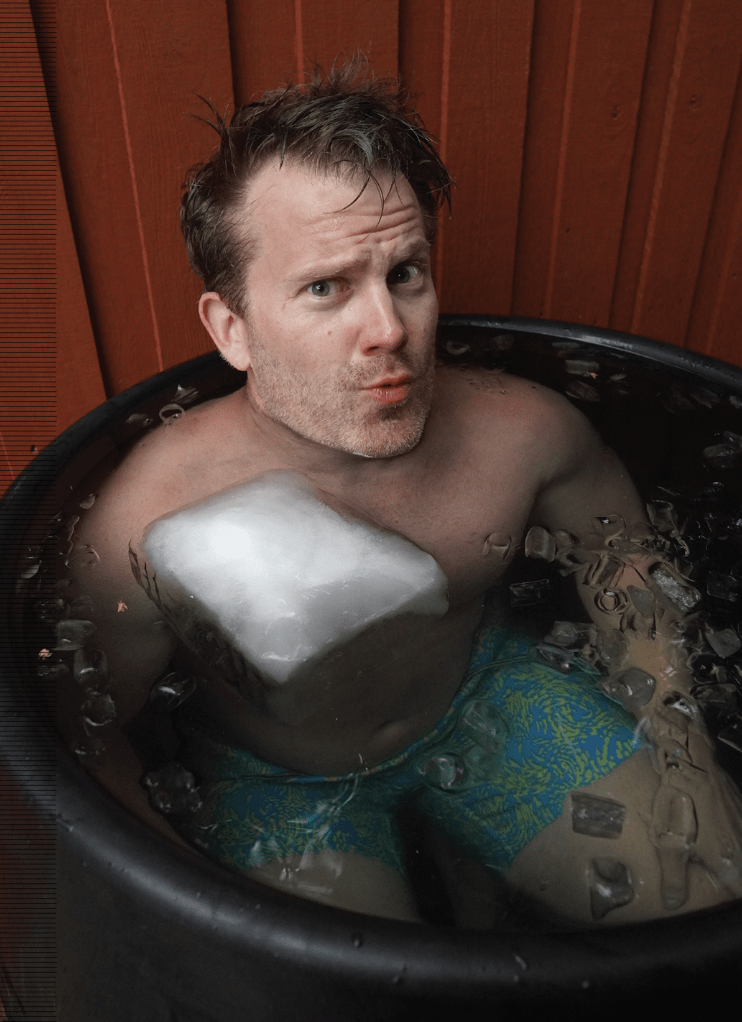

Jim Schultz, Ph.D., a derivatives trader, fitness expert, owner of livefcubed.com and the daily host of From Theory to Practice on the tastytrade network, was named North American Natural Bodybuilding Federation’s 2017 Novice Bodybuilding Champion. @jschultzf3