Beware of These Two Mental Traps

What can we learn from the possibility of alien life or the idea that we live in a massive simulation?

If someone wanted to make the Hawaiian language a larger part of our lexicon, the word “oumuamua” would be a good start. When astronomers spotted a smallish (by astronomical standards) object back in 2017, it entered the scientific literature as comet C/2017 U1. A short time later, it was promoted to asteroid A/2017 U1.

But upon further observation, astronomers noted characteristics unike those of the icy rocks that zip past us, and more like, well, something else. A new classification was created for it: “I” for “Interstellar Object.” And in a nod to the Haleakala Observatory where it was spotted, it got the name “Oumuamua.” That’s Hawaiian for “messenger from afar.” Plus, it sounds cool.

Oumuamua is one of the latest in a string of encounters with unidentifiable objects that are pushing scientists and the general public toward accepting the existence of alien life. For decades, Tic Tacs, cubes and saucers have been seen performing feats that shame Newtonian physics, and now developments in our own radar and video technology have made these “encounters” more vivid. And that’s just what our modern brains—thirsty for entertainment—love.

Beware the trap

Every piece of UFO news grabs our attention and pulls us into a mental trap. The lack of empirical data points makes it hard to make any determination except the theoretically statistical. The universe is so big, the odds that there isn’t some life form outside of Earth are as close to zero as you can get. So, each UFO event becomes paramount in our assessment of alien life. A sighting might not be representative, but our brains make it so. Our imaginations helpfully play along.

One idea of our interaction with aliens would be The War of the Worlds sort, where a hostile force descends on Earth to wreak destruction. Another is the ET sort, where a benevolent being teaches a new way of thinking or shares technology that would bring peace and prosperity to our planet. Notice how the descriptions rely on hugely successful books, movies or radio programs.

One momentous observation informs all future observations.

Imagination takes over when data is so sparse. But what if the development of extraterrestrial life forms was normally distributed? And what if the mean development was somewhere south of ours? Maybe most of the other life forms have absolutely nothing to offer us. And maybe other more advanced ones just flew on by.

But what if neither is true? As long as we’re talking about theoretical statistics, what about the possibility that the UFO sightings are bugs in an Asimovian simulation that we’re living in? The objects violate Newtonian physics? A simulation could do that. To be rare enough to be special but not so rare that we forget about them? Sounds like bugs in a computer program. Play with our minds for a predictable response? Who better to do that than the programmers who put those responses there in the first place?

The possibility that we’re in a simulation doesn’t mean there isn’t also a possibility of alien life, but if you think the simulation has a lower probability, what do you think the odds are of two life forms finding each other in an infinite universe?

But this speculation about aliens also points to another major issue in trading—that one big, momentous observation both 1) informs all other future observations and 2) will be repeated. These are mental traps that manifest themselves in trading in a couple of ways.

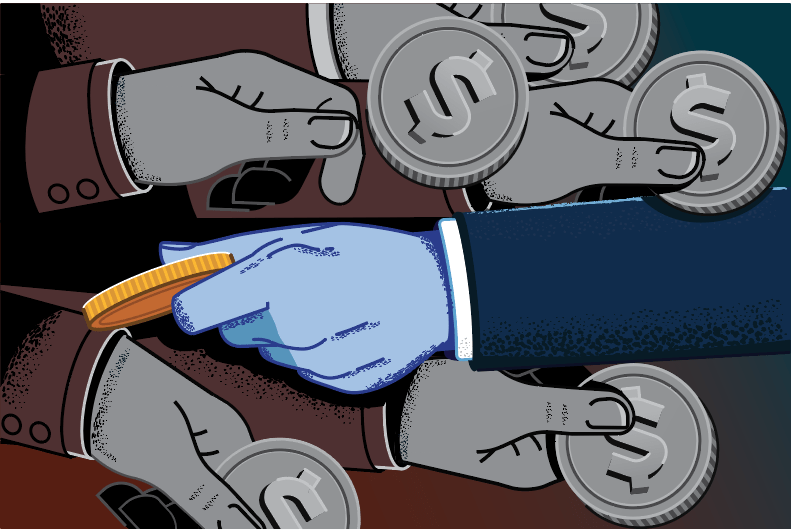

Following false flags

Traders who have big wins early in their careers tend to lean on whatever strategy generated that win, even if the trade had a low probability of success. Becoming “married” to a particular strategy regardless of market conditions is not conducive to long-term success.

Another problem occurs when traders focus on the times a stock or index has had huge price changes of four, five or more standard deviations from the norm. When traders look at charts, their eyes focus on the highest of highs and the lowest of lows, or the big gaps higher or lower.

That ignores the fact that most of the time, most stocks and indexes don’t move much at all. The daily and weekly price changes are usually pretty small in statistical terms. Yes, over several months or years, a stock can have a big price change, but traders can build high-probability trading strategies for shorter time frames to take advantage of the smaller moves.

As traders, we need to break free from these mental traps. Yes, recognize winning strategies, but be flexible and respond to changes in market volatility. Yes, some symbols have huge black swan moves, but recognize that it’s impossible to predict them, and traders who try to capture them typically have lower probabilities of success than those who benefit from the times when stocks don’t do that. Mental traps don’t have big consequences when it comes to debating UFOs, but for traders, they can make the difference between long-term success or failure.

There’s a common element in all of this. Three huge mental challenges—the possibility of alien life, the idea that we live in a massive simulation and the prospect for success in trading—should each fill us with humility. It’s true of trading in particular.

Traders can do everything right—high probability, positive theta—and still make a losing trade. If that doesn’t make a trader feel humble, I don’t know what would. The market, just like the universe, is bigger than any one of us. Approach it the right way, and you just might be able to squeeze money out of it.

Tom Preston, Luckbox contributing editor, is the purveyor of all things probability-based and the poster boy for a standard normal deviate.