Trends

The Smartest Guys in the Trade

By Tom Preston

Traders don’t need the highest IQ in the room—they can succeed with discipline, quick calculations, confident decisions and a little online help

People are sensitive about IQ. It’s a metric that purportedly reveals intelligence, and everyone wants to be thought of as smart—or at least smarter than average. And in the 100 years or so since IQ tests arose, proponents and opponents have argued vigorously for and against them.

One of the most contentious discussions of IQ centered on the 1994 book The Bell Curve by Charles Murray and Richard Herrnstein. The authors analyzed and plotted IQs and saw that they fell nicely along the shape of a bell curve, more properly known as a normal distribution. Most IQs were clustered around...

The Normal Deviate

-

Probability Matters

By Tom Preston

|Get serious about investing by attaching a numerical probability to every trade It’s fun to speculate about cultural, political or economic events that might happen in 2023. But when it… -

Margin of Error Matters

By Tom Preston

|Voters can interpret the true meaning of a poll if they understand the importance of the margin of error, confidence interval and sample size. A poll’s margin of error can… -

Probability Reigns

By Tom Preston

|Unless we know the chances they’ll come true, predictions mean almost nothing The new year brings resolutions and predictions. Spend time with friends or family in late December or the… -

Watch These 3 Inflation Indicators

By Tom Preston

|I remember seeing the “WIN” buttons when I was a kid and having my parents explain inflation to me. The buttons, distributed at the behest of President Gerald Ford in 1974,… -

Trading Digital Currency’s Volatility

By Tom Preston

|Trading Digital Currency’s Volatility Volatility. Without it, the world would be pretty dull. It’s what makes cryptocurrencies so appealing to traders and so frightening to regulators. Dramatic price swings—both up… -

Trading with a Casino’s Edge

By Tom Preston

|Active investing isn’t gambling for traders who know the odds When someone’s interested in options trading but doesn’t know quite how to approach it, ask a question that provides context… -

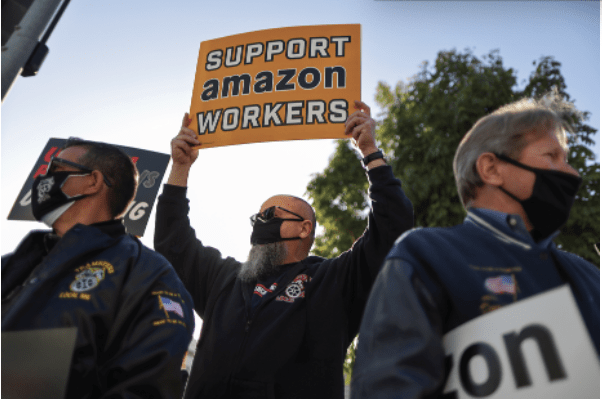

Amazon Primed

By Tom Preston

|Public enemy No. 1, or Wall Street hero? Either way, odds say Amazon will dominate competitors for a long time to come. Consider the great accomplishments of humankind—harnessing fire, inventing… -

Volatile SPACs: Welcome

By Tom Preston

|As low-cap stocks, SPACs have built-in volatility. That’s a good thing. During the past year, special purpose acquisition companies (SPACs) have grown in popularity, not only because they finance companies… -

Beware of These Two Mental Traps

By Tom Preston

|What can we learn from the possibility of alien life or the idea that we live in a massive simulation? If someone wanted to make the Hawaiian language a larger… -

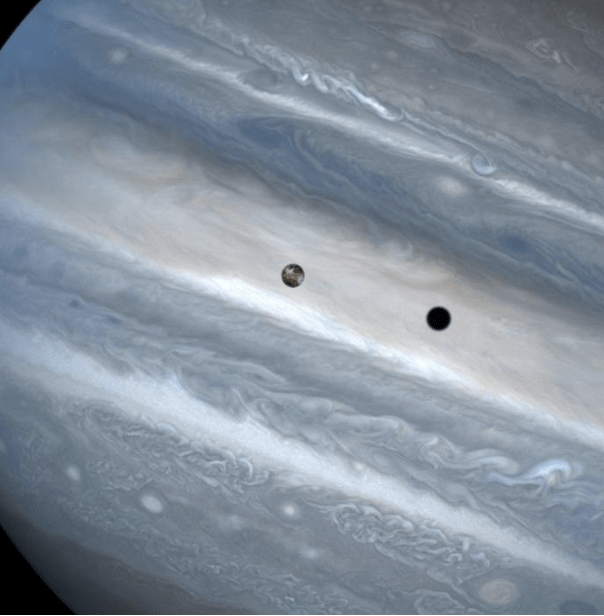

Counting on Volatility

By Tom Preston

|Scientists can only guess when the next pandemic or earthquake will strike, but with the help of volatility traders can quantifiably predict stock prices The year 2020 will be remembered… -

Bulls, Bears & Agnostics

By Tom Preston

|Which party will control the White House and Congress? The dirty little secret is the markets really couldn’t care less. You know Xi Jinping? General Secretary of the Communist Party… -

Stocks That Rock

By Yesi D

|Want to make a living from music? Put down the guitar and start picking music-related equities. As AC/DC said, it’s a long way to the top if you want to… -

Home Economics

By Tom Preston

|Even when it comes to a house, active investors don’t have to be passive Sitting down? Good. At home? Even better. Because beneath you lies your biggest single investment. Or… -

When Models Fail

By Tom Preston

|Models aren’t just for pricing options—they can (sometimes) predict the spread and mortality of a pandemic. Just keep expectations in check. Models, by definition, are not precise and, inevitably, the… -

Testing Vaccines and Trading Strategies

By Tom Preston

|Yes, active investment strategy has a lot in common with testing vaccines As though real-life were imitating a medical drama, COVID-19 is providing a glimpse into vaccine development. Testing a… -

Forget the Darknet

By Tom Preston

|The markets can provide the excitement active investors want—without risk of prison time Ah, the so-called darknet. The Wild West of the internet. Where anonymity—or as close as anyone outside… -

Day Trading in China

By Tom Preston

|Even in a communist country, people like to make money The Chinese began gambling at least 4,000 years ago, and they’ve made it a tradition ever since. It’s the reason… -

Options Trading: An Antidote for Division

By Tom Preston

|Smart options traders know that life—and markets—aren’t zero-sum games Trading can bring the country back together. That’s right. Trading. Anyone can see all the anger out there. Over politics, culture,… -

Volatility: Trading’s Best Crystal Ball

By Tom Preston

|Volatility provides a clue about what the future may hold for a stock Long-term stock trader? Short-term options trader? Medium-term money machine? No matter how an investor plans to extract… -

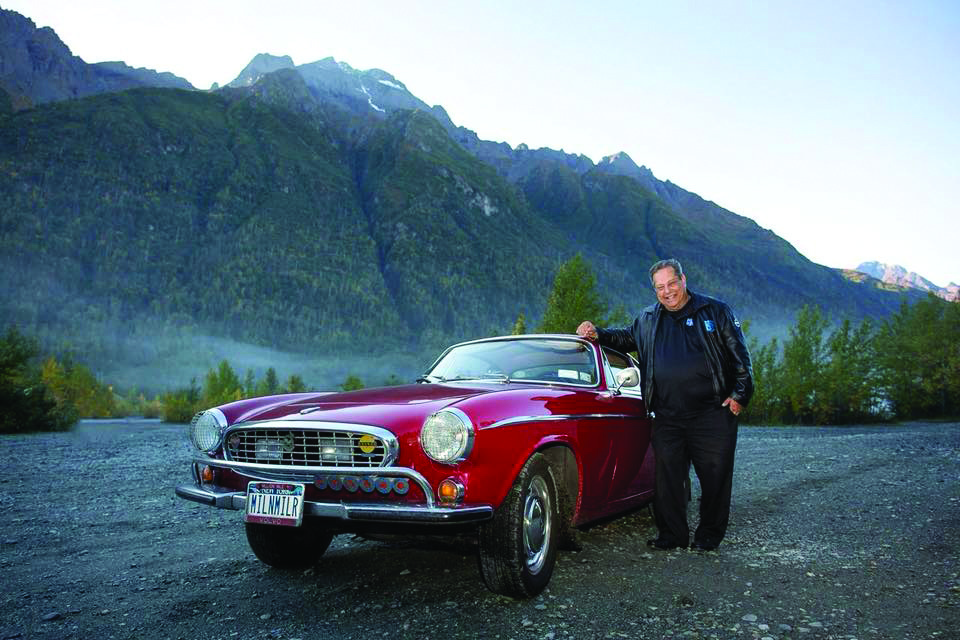

Auto Industry Autopsy

By Tom Preston

|If the average age of a car on the road increases 15% every 10 years, half a century from now the average car would be 23 years old and might…