Meet Rich Dvorak

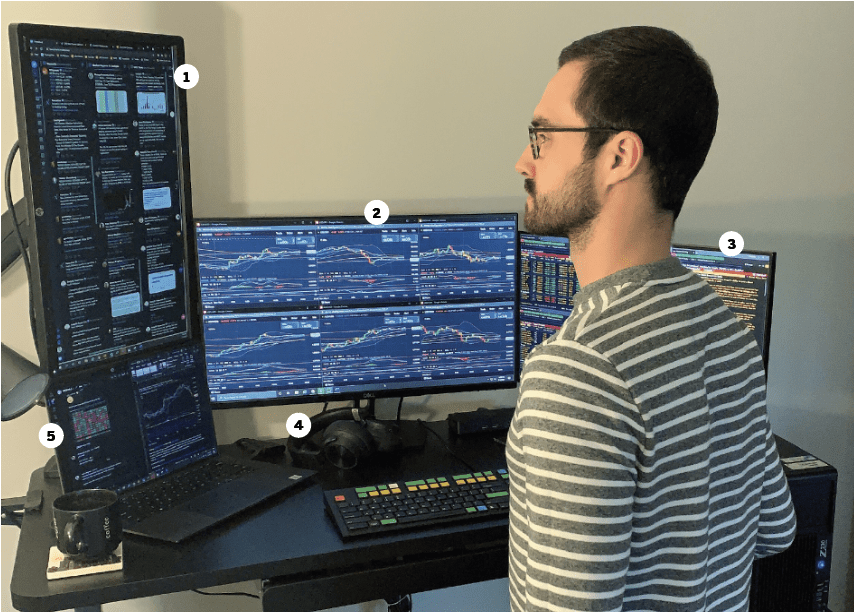

4. Headset for conference calls and tuning in to press conferences

5. Market notes, trading journal, and conversations with other analysts

Rich Dvorak, IG Analyst @richdvorakfx

Home/Office location Chicago

Age 27

Years trading Nine

How did you start trading? I opened a brokerage account on my 18th birthday. I discovered my passion for finance the moment I was exposed to the law of compounding interest. This passion blossomed as I learned to exploit market inefficiencies. My initial experience with investing was refined during my college years when I had the opportunity to earn degrees in both finance and economics. At the same time, my knowledge of the markets grew exponentially as the co-founder and portfolio manager of the Bellarmine University Sustainable Equity Balanced Fund. This helped me gain invaluable experience that prepared me for my first full-time job out of school with a derivatives exchange. The fast-paced nature of trading derivatives excited me, which led me down the road to working for a research desk where I could follow the markets closely and trade on the side.

Favorite trading strategy for what you trade most? My favorite trading strategy takes a comprehensive approach that incorporates both fundamental and technical analysis. In my experience, there is no foolproof trading strategy that is successful over the long run. Markets are dynamic, so I believe my trading strategy should be too. That said, conducting top-down global macro research is Step 1 of my trading strategy because doing so helps me determine a fundamentally influenced directional bias for a given market. I actively track market-moving economic data and commentary from important policymakers to help gauge this. Secondly, to prepare for possible risk events, I ensure that I do my homework by creating a decision tree gaming out potential scenarios and their probabilities.

Average number of trades per day? Two to three, but this varies depending on market conditions.

What percentage of your outcomes do you attribute to luck? Less than 1%. While many traders think being lucky is crucial for success, and others argue we make our own luck, I believe trading outcomes are a function of preparedness. We all may encounter a lucky trade at some point during our careers, but luck only lasts for so long and eventually runs out. This is why “lucky” traders end up getting washed out more often than not. Truly successful traders, on the other hand, are consistent and have tenaciously crafted their skills to master the art of trading by improving outcomes.

Worst trading moment? My worst trading moment was an unforgettable and costly experience during the September 2019 Federal Reserve meeting. Markets were awaiting updated economic projections from FOMC (Federal Open Market Committee) officials, and considering this was in the midst of peak trade war tension between the United States and China, I anticipated downgraded outlook and a bearish reaction by equities. The Fed ended up announcing a 25-basis point interest rate cut, which I was not expecting. Although, stocks did respond negatively and started to head lower at first. I chased the move by picking up exposure via put options on an S&P 500 ETF (exchange-traded fund), when in retrospect, I should have sat on my hands and done nothing because I did not have a well-thought-out strategy for the trade. My initial hesitation led me to practically short the intraday bottom by the time I actually pulled the trigger. To make matters worse, I continued to let the trade run on the mere hope that markets would turn back lower in my favor, and was blind to a glaring comment made by Fed Chair Jerome Powell, who hinted that the central bank may have to resume organic balance sheet growth. This exacerbated the late-session bid beneath stocks, pushing my trade deeper into the red and to the point where my option contract was near worthless. Following this poor trading moment, I went into a self-imposed timeout and prohibited myself from trading for an entire month. I reflected on the trade during this time to understand what went wrong and how to avoid making a similar mistake in the future.

Favorite trading moment? So far, the best trade of my career was going long volatility in February 2020 before market turmoil was ignited by the COVID-19 pandemic. On Feb. 18, 2020, I wrote an article that said “stocks to slide next?” right in the title, which was two days before the market topped and subsequently crashed. I often look back at this accomplishment.