Ford vs. General Motors

Two venerable automakers face political and economic hassles. Are they good investments?

Interest rates remain stubbornly higher for longer, credit card debt has ballooned to an all-time record and housing prices have grown downright prohibitive.

But one sector really needs attention—automakers.

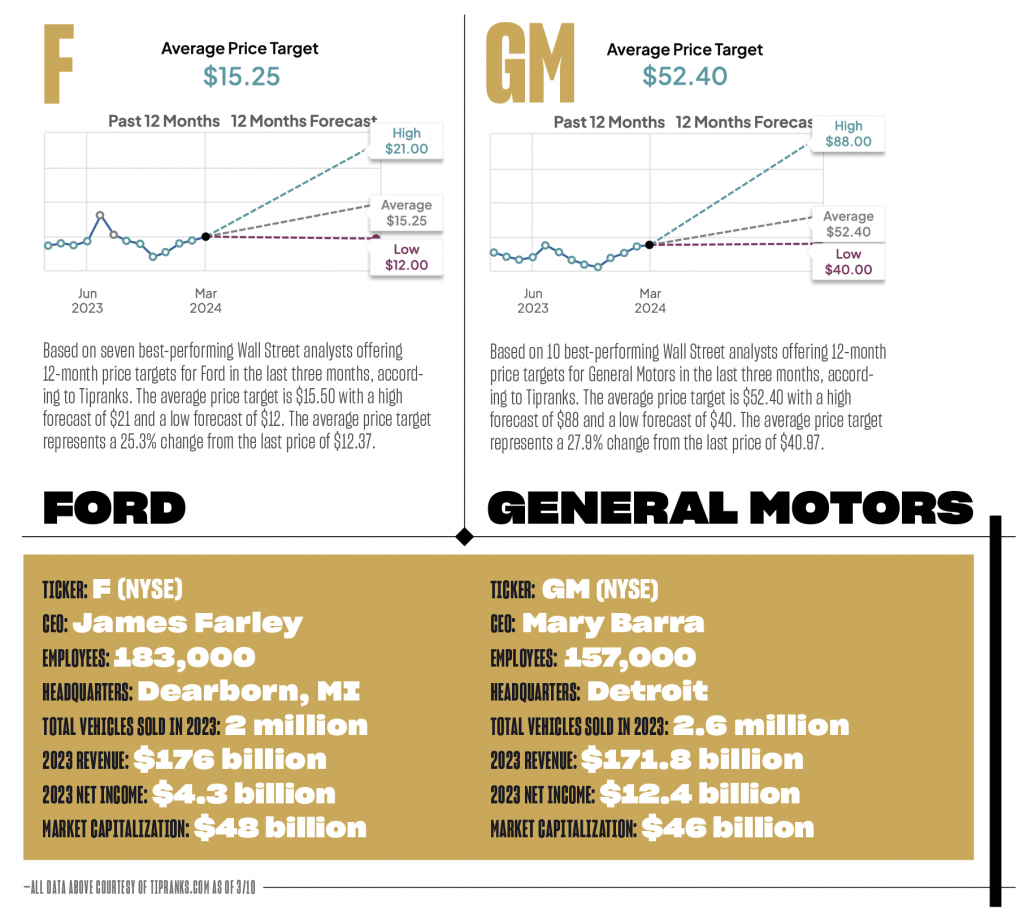

The auto industry has benefitted from a decade of quantitative easing and fairly recent low-interest car loans. Yet share prices for Ford (F) and General Motors (GM), the two largest auto manufacturers based in the United States, have slid back to where they started in 2013.

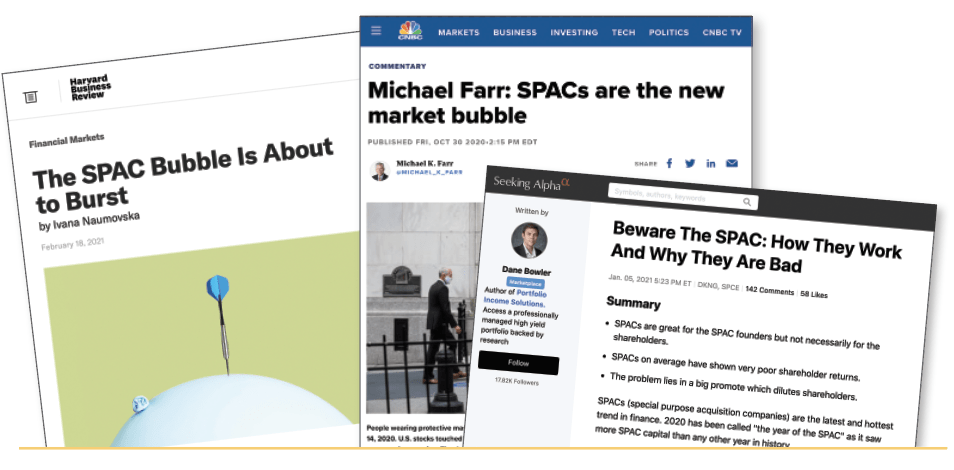

These stocks look cheap. But de facto electric vehicle mandates and surging consumer debt weigh on their valuations. Is there an opportunity to profit from these equities, or have America’s top auto nameplates become value traps?

EV challenges

Recent earnings reports signal demand for electric vehicles continues to weaken.

Stock prices for startups Rivian Automotive (RIVN) and Lucid Group (LCID) fell when the companies reported earnings in February. Rivian declined 25% and Lucid 17%. Both said they expected to produce the same number of vehicles in 2024 as last year.

Meanwhile, Volvo (VLVLY) announced plans to reduce its stake in EV maker Polestar (PSNYW), and Mercedes Benz (MBGYY) scrapped its 2030 EV targets, citing high costs and weak demand. In late February, Apple announced it is abandoning its Project Titan EV initiative.

It seems the EV sector isn’t exhibiting the strong demand nearly everyone expected. The federal government may be eager to save the planet from climate change, but The New York Times reported in February that the Biden administration is considering delaying emissions standards that would amount to EV mandates.

Electrification delayed

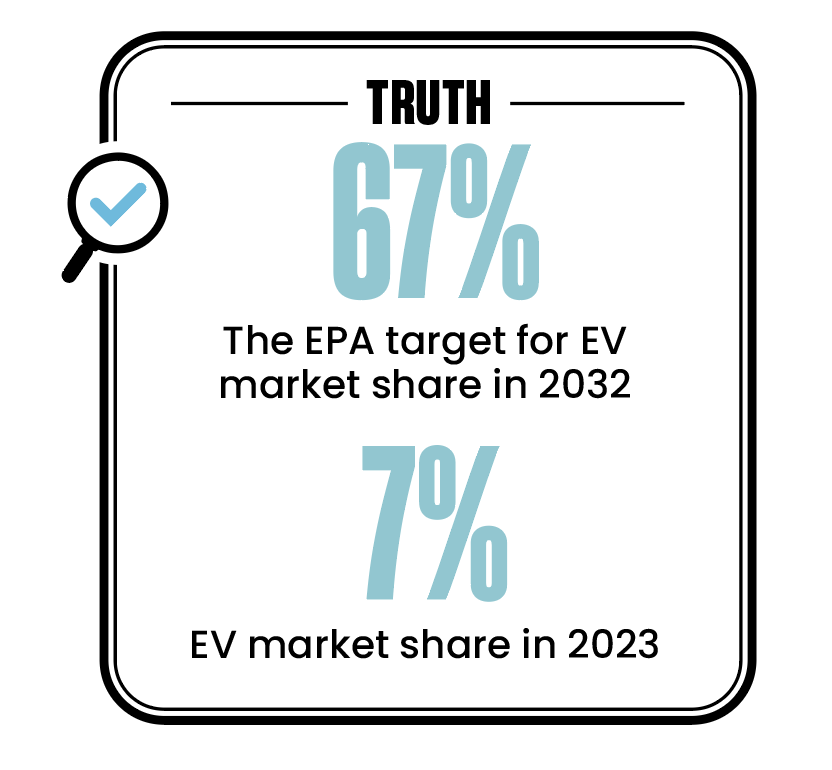

In April, the Environmental Protection Agency proposed regulations that would lead companies to make approximately 67% of their cars electric by 2032. That’s later than the original target of 2030, but it still calls for a significant increase from the 7% of sales achieved in 2023. It would also require big targets for buses, garbage trucks, and both short- and long-haul freight tractors.

So, why the delay?

Feel free to place most of the blame on macroeconomic conditions and higher interest rates. But remember that the economy is doing fine, according to Paul Krugman, a Nobel Prize winner in economics and an op-ed columnist for the aforementioned Times. Markets largely ignored the Federal Reserve’s warnings of tighter policy in 2024 but got hammered by inflation and shifting rate cut expectations for this year. CME Group’s forecasted rate cuts have fallen from six to four. The Fed has forecasted just two.

Meanwhile, consumer credit is hitting a wall. Defaults and repossessions are rising. Americans got stimulus checks in 2020 and 2021 that fueled demand for cars in a tight market. Now, higher prices and higher interest rates are leading to a deteriorating market outlook.

Then there are the consumers themselves. Fifty-seven percent of Americans say they’re unlikely to choose an EV for their next car, according to Ipsos, a multinational market research and consulting firm.

Its survey also showed motorists are not only rejecting EVs but also electric hybrids. But the federal government and states are still moving full-speed ahead with EVs and charging stations.

So, the question becomes whether American auto producers can capture market share in this new era of electric cars and trucks.

Ford: 2023 revisited

In 2023, Ford saw significant growth in its EV sales. The company sold 72,608 EVs, an 18% increase from the previous year. The Mustang Mach-E sold 40,771 units, up 3% from 2022. The F-150 Lightning, Ford’s electric pickup, sold 24,165 units, a 55% jump from 2022. The E-Transit, the company’s electric van, sold 7,672 units, up by 18%.

Ford sold 26,000 EVs in Q4 2023, a 24% increase over the previous quarter. The Lightning was America’s top-selling electric truck in 2023.

Those successes made Ford America’s second-biggest EV brand behind No. 1 Tesla (TSLA). Elon Musk pointed out in 2021 that among thousands of EV manufacturers only Tesla and Ford have never declared bankruptcy.

Yet despite the wins, Ford faces challenges, prompting it to change its EV strategies. The automaker has slashed planned investment in future EV battery plants and reduced its 2024 Ford F-150 Lightning production estimates.

GM: 2023 revisited

Despite challenges, including a United Auto Workers strike and production issues, General Motors posted strong sales last year.

It sold 75,883 EVs in 2023, a 93% jump from 2022. Sales rallied thanks to increasing demand for the Chevrolet Bolt and Bolt EUV.

The company also reported higher demand for its new Cadillac Lyriq. The luxury EV sold 9,154 units for the year, an increase from 122 in 2022. The company also plans to expand production.

It will add more electric cars to its lineup, including a Chevrolet Silverado EV pickup, GMC Hummer EV and Chevrolet Blazer EVs.

That said, GM’s financial performance isn’t promising. Last October, the company withdrew its 2023 forecast, citing concern about the UAW strike and EV sales. Barron’s magazine noted in February that the company wiped out its stock losses linked to the strike in September and October.

But this analysis ignores the broader market sell-off. Global liquidity problems and a sharp rise in the 10-year U.S. Treasury bond fueled it. These events happened at the same time. General Motors— like most of the S&P 500 stock—rebounded into the end of the year. Shares have moved higher as part of a broader market run with record levels of global money and AI fever as the fuel.

So, GM’s not out of the woods, and its valuation challenge explains why.

Valuation expedition

On valuation, Ford and General Motors are both attractive value stocks.

Looking under the hood, we see General Motors has been flat over the last five years. It trades for close to $40. This price has haunted the company for roughly a decade. Its yield is 1.2%, and its margins are as sticky. It has a net margin of 5.9%, but its free cash flow margin is -2.1%. On top of that, its return on invested capital is 4.23%.

General Motors looks like a Ben Graham dream value stock. It trades for 73% of book value and 0.8% of tangible book value, while it has a price-to-Graham figure of 0.42%. Danny DeVito’s character in the film Other People’s Money would like this type of stock. “Larry the Liquidator” would break the company into many little pieces for profit. The problem, though, is that GM has too much at stake and remains too close to Washington on EV policy.

Meanwhile, Ford trades at 1.13x book value and 11.2 times earnings. Its price-to-Graham number, which serves as a percentage of a fundamental valuation, is 0.55.

But looks can be deceiving. Ford has been operating with razor-thin net margins of 2.5% and has a return on invested capital of 2.75%. Its free cash flow margin is 3.8%.

Tack on an enterprise value to earnings before interest and tax (EV-EBIT) of 15.7x.

Ford traded in late February at $12.15 per share. This reflected a stock that has yoyoed with interest rates and the economy over the last five years. It also failed to deliver better returns. Even income investors can do better. They can find a 4.95% dividend on companies outside the sector. These companies have better signs of capital efficiency and free cash flow.

Neither GM nor Ford has a gross profit margin of over 20%.

This figure suggests neither has a safe economic moat in the medium to long term. Also, these margins indicate challenges lie ahead in a competitive industry.

Tomorrow’s opportunities

Deciding between the two auto companies for a stock portfolio feels like picking one of the last two players in a sandlot baseball game. But there’s no need to resort to “eeny-meeny-miny-moe” because Ford is the clear choice.

Ford’s competitive advantage isn’t in EVs. It’s in its effort to boost customer loyalty. “Ford Pro,” the company’s dedicated commercial vehicle and services division, is designed to help small businesses that might need a single van or large companies managing vast fleets.

The Ford Pro division covers vehicles with conventional internal combustion engines and electric vehicles. It offers customized help with meeting sustainability goals and operational needs. Ford says the division can improve uptime, productivity and efficiency through aids like telematics and data for fleet optimization. It will tackle everything from company running costs, to vehicle utilization and driver safety.

Last year, Ford Pro had more than 500,000 subscribers at a gross margin over 50%. CEO Jim Farley suggests the division parallels what Deere & Co. (DE) began doing seven years ago. Since then, shares in Deere have increased by more than 220%. In February, Ford announced it expects its Pro unit’s pretax earnings to reach $8 billion to $9 billion in 2024.

Like Ford, General Motors must also address the “elephants in the room.” These take the form of pension reform and the unions. Labor focuses on hourly pay, but better stock incentives for employees could free the company from those twin albatrosses. Instead of competing at the negotiating table, both companies should find ways to collaborate with workers.

Future contracts should address wage increases, job security and benefits. They have to deal with those issues in an industry where shifting to EV production is raising concern about job displacement. Making EVs requires less labor than producing traditional cars, and the situation is also complicated by the globalization of labor and competition from U.S. plants that aren’t unionized.

Meanwhile, the federal government’s push for EVs could boost either Ford or General Motors. Automation will likely cut labor costs during this transition, but the industry faces higher costs for metals and other materials.

Ford would need to gain more momentum and become more profitable to warrant buying its stock. Also, General Motors’ cash flow struggles could hurt the company if the economy weakens in 2025 or 2026 as global liquidity tops out.

Ford is a speculative play. While GM’s challenges from recent contract negotiations are over, tight margins and high costs still present problems.

Garrett Baldwin, a commodity and trade economist, serves as Luckbox editor-at-large. He is the author of Postcards from the Florida Republic on Substack, which focuses on insider buying and momentum trading.