Retro Cool

An upstart EV recalls a James Bond-like design equipped with a voice- activated cockpit

A recent walk around the Chicago Auto Show made one thing clear: A lot of new vehicles look awkwardly similar to those in their competitors’ showrooms. And many are aesthetically uninspired.

Olympian Motors sees that as an opportunity. Their retro-themed driving machines—the upcoming Model 84 and the sleek Model O1 (on this page and the cover)—look like nothing else on the road.

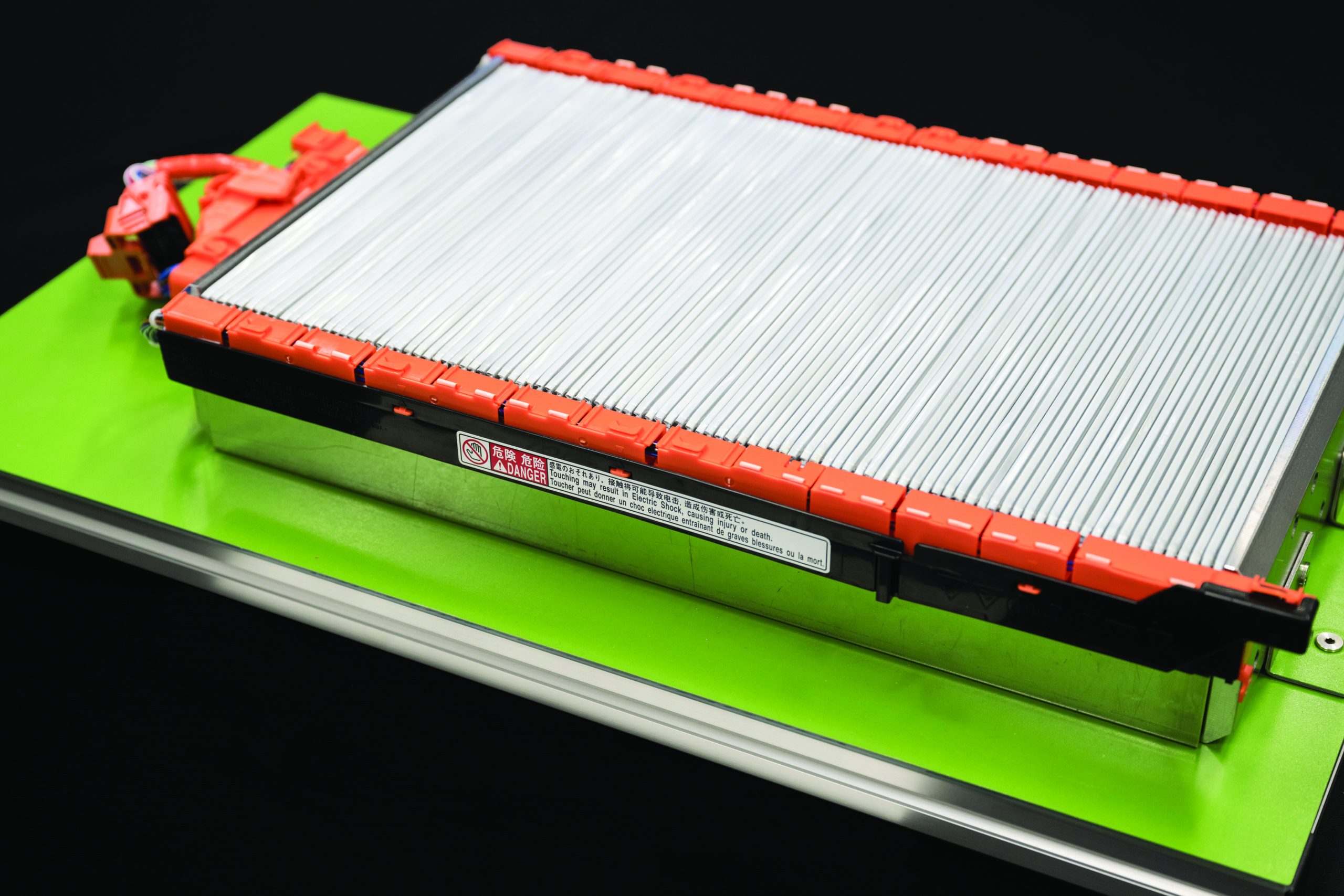

The cars are also built differently. Each uses a modular design built atop the same electric drivetrain. The drivetrain “hosts” four core hardware and two software modules.

But the differences don’t end there. The startup embraces a design philosophy of simplicity and sustainable materials, like wood and steel as opposed to plastic. Eren Canarslan, CEO and chief architect at Olympian, compares assembling the company’s vehicles to putting together a Lego set.

“That’s easy to assemble, easy to manufacture, contains fewer parts, fewer components, and less-complicated electronics architecture,” he told Luckbox. “That means it can be assembled by a team of four assembly employees.”

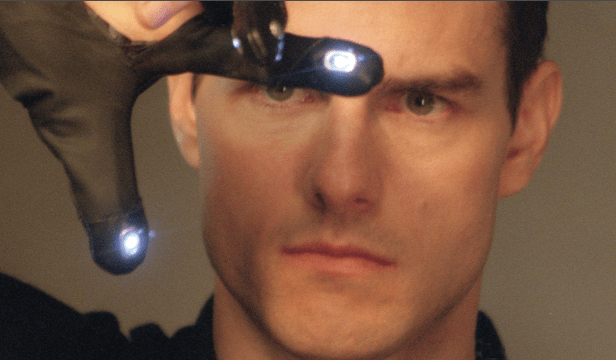

Olympian wanted to avoid the distractions that fill many of today’s vehicles, Canarslan says. The joy of simply driving can get lost amid iPad-like touch screens and lots of other controls, he says, his company puts the driving experience first and keeps the technology in the background.

The upcoming Olympian Model O1—due out in late 2024—eliminates 80% of the buttons and switches in a typical auto cockpit. Instead, it will use a “voice first” control system, a heads-up display and a minimalist analog dashboard. The same philosophy applies to the Model 84.

The Model O1 starts at $80,000.

Hopeful Olympians

Olympian has received funding from venture capitalists Y-Combinator, Collaborative Fund, Climate Capital, Soma Ventures, Reunited Ventures and Mobility Vision.

Now, it’s raising $12 million via an early-series A investment round that had attracted more than 2,170 investors as of February.

It’s also running an oversubscribed but still-open campaign on Wefunder that had raised more than $3.7 million as of early March.