3 Options Trading Strategies for Q2 Earnings Season

Q2 2023 earnings season has arrived and that means options traders are gearing up to deploy a wide variety of earnings-focused strategies.

- Options allow for greater flexibility when it comes to expressing a wide variety of market outlooks.

- Implied volatility tends to rise into earnings events, providing options sellers with potential opportunities to sell options premium.

- Some of the more popular earnings-focused options strategies include “earnings straddles,” directionally-focused naked options and calendar spreads.

Q2 earnings season is officially underway in 2023, which means the options marketplace is hotter than ever.

Options are a popular vehicle for earnings-focused trades because they offer additional flexibility for deploying a wide range of outlooks.

For example, if an investor or trader believed that an earnings event was going to be a non-event, he might elect to sell volatility (i.e. options), with the expectation that the stock will sit still in the wake of the earnings release.

On the other hand, investors expecting a big move in a given stock might do the opposite—purchasing options with the goal of making a profit on a high-magnitude move.

Of course, options may also be used by investors and traders that have a directional bias heading into an earnings event.

For example, a bullish investor might buy calls for earnings, while a bearish investor might buy puts. Depending on one’s outlook and risk profile, a directionally-focused options position may be preferred over a traditional long or short stock position.

Along those lines, three popular options-based earnings strategies are detailed below, along with helpful video content from the tastylive financial network.

Quick Background on the Earnings Trade

In the financial markets, “earnings” refers to the release of financial results by publicly traded companies, which by rule must be done four times a year. Investors and traders follow earnings extremely closely because the release of this information provides valuable insight into ongoing operational/financial performance.

After the release of earnings, investors and traders are theoretically better equipped to make evaluations about the underlying value of a company, and therefore, its future prospects.

As most market participants are well aware, there isn’t a single day that every public company releases its earnings. Instead, each company maintains a different “calendar year,” which is also referred to as an “accounting year.”

That means earnings season actually encompasses the rolling release of quarterly reports over the span of numerous weeks. One day there might be 20 companies reporting, and another there might be 30, and so on.

While traditional long and short investors follow earnings releases closely to monitor how positions in their portfolios are affected, options traders frequently use volatility-based strategies to capitalize on upcoming or recently-released announcements, as well.

The latter approach is predicated on the fact that implied volatility tends to rise into earnings because of the uncertainty associated with the release of unknown and pertinent financial data. Increased implied volatility translates to higher option prices, which is why volatility sellers are particularly active during earnings season.

On the other end of the spectrum, long volatility positions may also be attractive if an investor or trader believes that the implied volatility for a given earnings event has been priced too cheaply. Traders often use data from past earnings to track the average behavior of a given symbol on its upcoming earnings day.

To do this, traders typically compare past earnings moves to the “expected move” for the upcoming earnings release, which is implied by the value of the at-the-money (ATM) options in the expiration month which captures the event. If a trader does elect to deploy an earnings trade, it is often in the form of a long or short straddle, which is essentially a long or short volatility trade.

Trading Earnings-Focused Straddles

One popular way to trade earnings using options is to buy or sell a so-called “earnings straddle.”

A straddle involves an at-the-money (ATM) call and put with the same expiration date. When the call and put are sold simultaneously, the associated position is referred to as a “short straddle,” and when both options are purchased, it’s referred to as a “long straddle.”

The key to this approach is to analyze past earnings moves and compare them to the expected move for the upcoming earnings event.

For example, imagine hypothetical stock XYZ had moved on average 5% on the day of its earnings release during the last five years. Now, for the upcoming earnings event, the market is pricing in a 10% move for earnings.

In that case, an investor might elect to sell a straddle to try and profit from a smaller-than-expected move on the day of earnings.

On the other hand, what if the market was expecting hypothetical stock XYZ to move 2% on the day of earnings? In this case, an investor might elect to purchase the earnings straddle, to try and profit from a larger-than-expected move on the day of earnings.

Under this scenario, the earnings straddle would turn a profit if stock XYZ moved more than 2%, and especially if it made a move that was closer to its historical average of 5%.

It’s important to note that the “past move vs. expected move” analysis represents only one component of the trade evaluation process, and an investor or trader deploying an earnings trade will need to ensure that a given trade meets his standard in every regard, not just from an expected move standpoint.

To learn more about using the expected move metric, readers can check out this installment of Options Trading Concepts Live on the tastylive financial network. For more context on the earnings trade, readers can also check out this episode of Options Jive.

Trading Calendar Spreads During Earnings

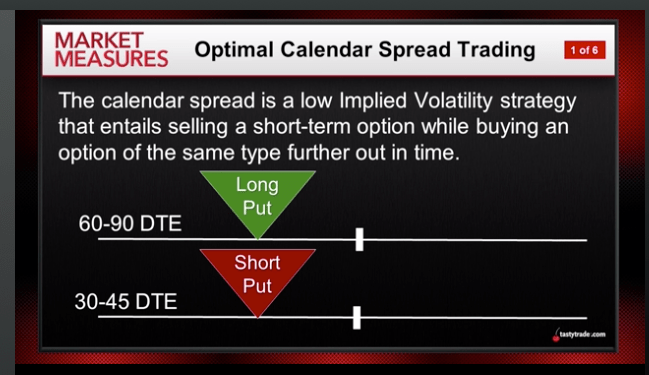

Another popular earnings approach using options is known as the calendar spread.

A calendar spread involves simultaneously buying and selling options with the same strike price, but different expiration months. When executed for a debit (i.e. cash comes out of the account), the position entails selling the near-month option, in favor of purchasing an out-month option.

Debit calendar spreads (aka long calendar spreads) are theoretically bullish volatility because after the near-term option rolls off, the position is left with only the long premium leg of the trade. If volatility expands, the remaining position wins.

Calendar spreads perform optimally when the underlying hovers close to, or right on, the strike of the near-month short option. In this scenario, the premium from that short option bleeds off and funnels straight into the trader’s wallet.

Moreover, if the underlying makes a big unexpected move in either direction, the most a debit calendar spread trader can lose is the amount of premium paid to establish the position—meaning the debit calendar spread is a defined-risk position.

One important thing to keep in mind is that the success of a debit calendar spread hinges on muted movement in the underlying during the life of the short near-month option.

Considering the above characteristics, one can see how the calendar structure might be attractive during earnings season if an investor or trader is expecting a stock to sit still, or trade sideways, in the wake of earnings.

Because the calendar spread falls into the defined-risk category, the maximum loss from the position is known prior to trade deployment. In this case, the maximum loss is the net premium paid (i.e. the debit) to establish the spread.

However, investors need to keep in mind that the reverse structure—buying the near-month option in favor of selling the out-month option— has a vastly different risk profile. In this case, the risk is theoretically unlimited, because after the near-month position rolls off, the investor/trader is left with a naked short option.

To learn more about trading calendar spreads, readers can check out this installment of Options Jive on the tastylive financial network.

Using Naked Options During Earnings

Beyond the options spreads detailed above—straddles and calendars—investors and traders may also consider “pure-play” directionally-focused options positions during earnings season.

Naked options positions—such as a long call or long put—are a lot more similar to traditional stock positions (i.e. long stock and short stock), except that they can provide additional leverage in terms of capital efficiency.

Technically, there are four types of naked options positions—long calls, short calls, long puts and short puts.

However, investors need to understand that these positions have different risk profiles—especially the short options positions. The latter are especially risky because they are undefined-risk positions—meaning the risk is unknown and could be substantial.

In the case of long calls and long puts, the risk proposition is much different because the maximum loss from these positions is the amount of premium outlaid to enter the position.

On the bullish side, long calls and short puts perform well when the associated underlying stages a rally. Obviously, the degree to which these options perform is dependent on the precise move in the underlying, and the strike of the naked option that is selected.

On the other hand, when a given underlying suffers a correction, it’s short calls and long puts that outperform—these are naturally short delta (i.e. short directional positions).

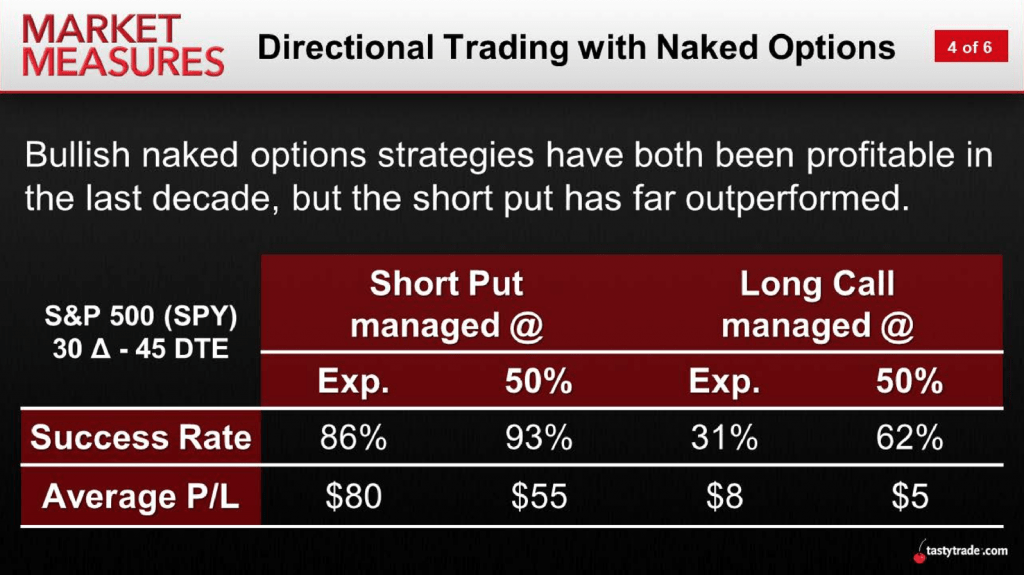

As illustrated below, research conducted by the tastylive financial network has shown that over time, short puts have outperformed long calls in the SPDR S&P 500 ETF Trust (SPY).

However, considering the potential for a large move on the day of earnings, it may be prudent to avoid selling naked options that are exposed to an earnings event.

In that regard, a long call or long put may be more suitable for deploying a bullish or bearish outlook leading up to earnings in a single stock, depending on one’s trading approach, outlook and risk profile.

For more background on trading naked options, readers can check out this installment of From Theory to Practice on the tastylive financial network. To follow everything moving the markets, readers can also tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.