Adjusting Duration in High Volatility Markets

After the conclusion of the current “Coronacrisis,” market participants may look back and realize that an important line has been drawn in the sand: 80.

Eighty is notable because the VIX, also known as the “fear gauge,” has only closed trading above that number three times in its history—the previous Financial Crisis (2008-2009) and the current Coronacrisis.

Using backward logic, should the VIX reach 80 at some point in the future (after the current crisis is long gone), market participants might assume that the newest “crisis” has arrived, based solely on the fact that the VIX is trading in such extreme territory.

And while the VIX has declined since its peak of 82.69 on March 16, it still remains elevated and well above its historical mean of 19.

Under current trading conditions, traders and investors are advised to stick to several important guidelines: trading small, staying nimble, watching liquidity and adhering to strict risk management protocols.

Moreover, based on previous research conducted by tastytrade, traders of options should also pay close attention to duration (i.e. the amount of time a position is open). This tactic may be particularly relevant for short volatility (i.e. short premium) traders.

According to the aforementioned market study conducted by tastytrade, historical data appears to support the notion that trades of shorter duration can be targeted during periods of heightened volatility.

In order to arrive at this conclusion, a market study was designed that examined the historical performance of a short premium trading approach in two different market conditions: high volatility (>40 VIX) and low volatility (<30 VIX).

For the purposes of comparison, a “normal” backtest was also conducted on “all environments” using trades with duration of 45 days. At tastytrade, separate research has shown that “45 days” tends to be an optimal level of duration when it comes to trading short premium in “normal” market environments.

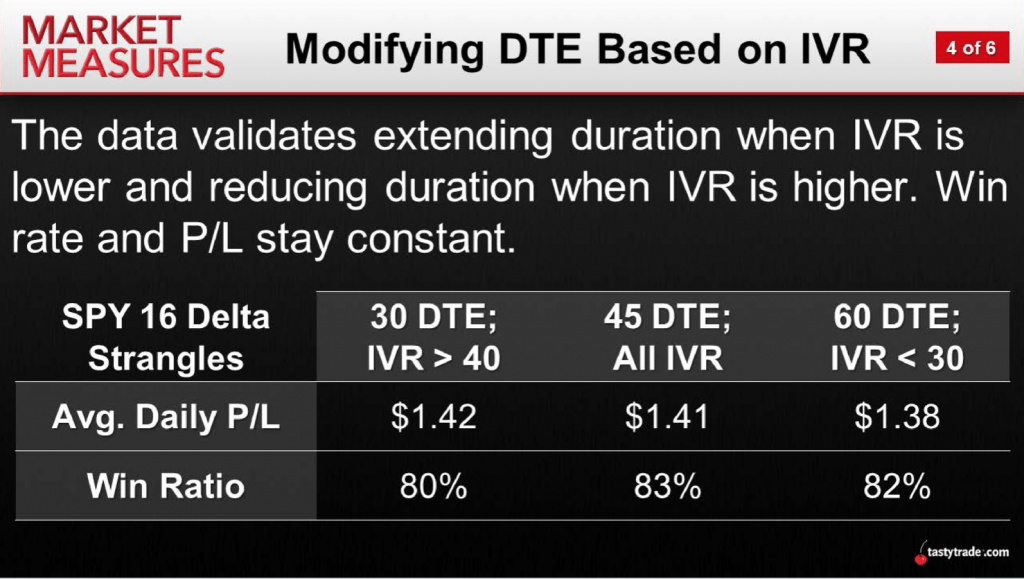

In the market study, the historical performance of a short strangle (16 delta) in SPY was backtested using data from 2005-2017, on the following types of positions:

- 60 DTE short strangles when IVR < 30

- 45 DTE short strangles in all environments

- 30 DTE short strangles when IVR > 40

The findings of all three backtests are highlighted in the chart below:

As one can see in the above data, the shorter duration trades (30 days-to-expiration, or 30 DTE) were able to achieve a similar win rate and average P/L when compared to trades of 45 days-to-expiration in “all environments” as well as trades of 60 DTE in relatively low volatility environments.

Accordingly, the above data indicates that traders might consider targeting shorter duration when volatility metrics such as the VIX are elevated. Alternatively, the data also illustrated that when volatility is muted, traders may want to extend duration in order to produce targeted performance.

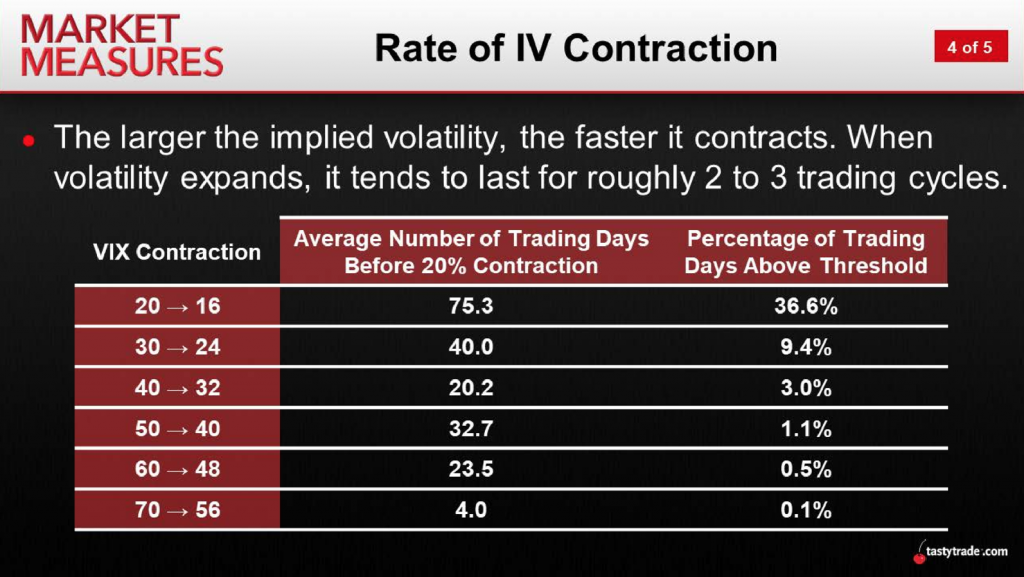

Additional research conducted recently by tastytrade, which complements the above information, suggests that elevated levels of volatility tend to contract more quickly than “normal” levels of volatility. This finding may help explain why short-premium trades achieve targeted levels of performance at a quicker rate, as compared to other trading environments.

The graphic below highlights the average number of days it has taken for the VIX to decline from indicated levels. As one can see, the shortest period of decline tends to be when VIX is near its zenith:

Readers seeking to learn more about short premium trade duration in fast-moving markets may want to review the following episodes on the tastytrade financial network when scheduling allows:

To monitor all the daily action in the global financial markets, traders might also consider following TASTYTRADE LIVE weekdays from 7:00 a.m. to 3:00 p.m. Central Time.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.