Avoiding the Long Premium Trap

The increase in market volatility at the end of summer has become more tempered in recent weeks.

That reality is reflected in the Chicago Board Options Exchange Volatility Index (VIX), which has dropped back to about 15, once again below its historical average.

Depending upon an investor’s approach to trading and current outlook, he or she may be considering the addition of some long premium positions to the portfolio, given the recent decline in VIX.

Investors looking to learn more about long premium could review a recent edition of Market Measures on the tastytrade financial network. The show explores newly published tastytrade research on the historical success of long premium and should provide valuable perspective.

Long premium, as a reminder, is an industry term for buying options. Investors and traders usually purchase premium to protect a position or because they expect implied volatility to increase. Long premium may also be purchased when a big move is expected in a specific underlying.

In the above cases, the addition of long options in the portfolio can significantly boost returns or help offset losses. However, traders should remember that the probabilities of success for long premium positions are somewhat less attractive than for short volatility approaches.

Circling back to Market Measures, the hosts walk viewers through a tastytrade study that examines the historical performance of long premium in SPY. The data in this study was parsed twice so relative performance could be evaluated according to specific market conditions (i.e. high- and low-volatility environments).

The primary strategy evaluated was a long straddle in the S&P 500 (SPY), and the backtest including the following parameters:

- Used SPY data from 2005 to present

- Used options with 45 days-to-expiration (on average)

- Bought at-the-money straddles and compared across two environments:

- All markets (i.e. all instances)

- Only instances in which the VIX was below 15

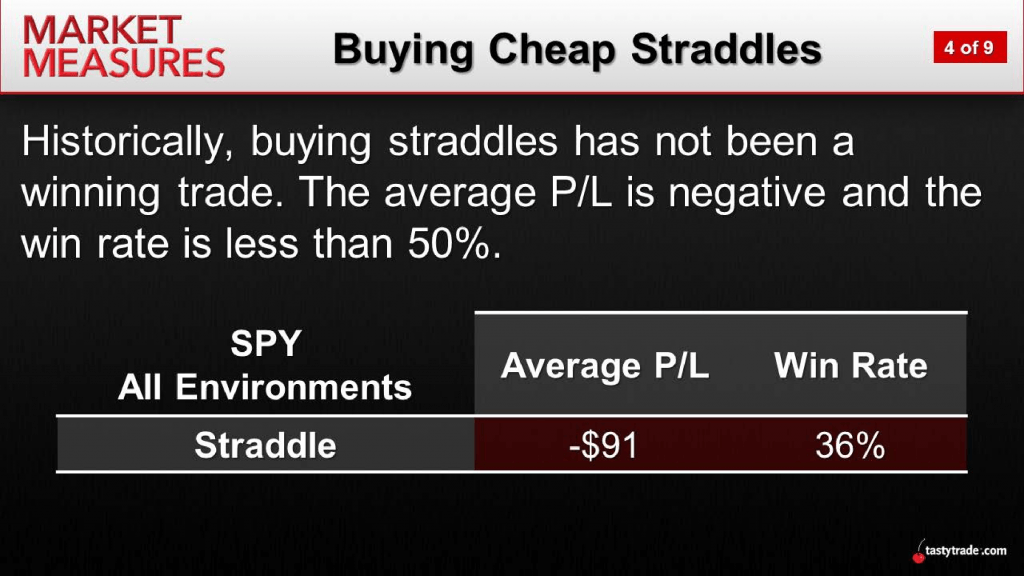

The graphic below summarizes the findings of these backtests in all market environments. As illustrated in the graphic, the average P/L of this strategic approach was negative, and the win rate was likewise below 50%.

While that may not come as a complete surprise to long-time option traders, the second phase of the study also revealed some compelling insights.

When the data was filtered only for instances in which the VIX was below 15, the average P/L and win rates actually declined as compared to all instances. This phase of the study was revealing, as most might assume that a long premium strategy would have performed better historically when premium got “cheaper” (i.e. VIX < 15).

To get the most out of this research, review the complete episode of Market Measures focusing on long premium when scheduling allows.

For an alternative approach to trading low volatility environments, traders may also want to review this other previous episode of Market Measures focusing on trading approaches in the VIX.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.