Betting on the Fed

Incorporating spread trades into a portfolio can open a whole world of opportunity

The once-sleepy interest rate environment is starting to awaken after a recent Federal Open Market Committee meeting. Following the Fed’s announcement at that gathering, U.S. 2-Year Treasury Yields jumped from 0.15% to 0.25% in a matter of days and then remained over 100% for weeks.

While the 2-Year yields have responded swiftly to the Fed’s decision, the opportunity extends beyond short-duration Treasuries with the whole yield curve shifting.

The U.S. Treasury market may be one of the largest and most actively traded markets in the world, but interest rates are still a nascent asset class for many DIY investors and traders. This is probably because of the market’s inherent legacy complexities.

While interest rates are quoted everywhere, trading products—such as the iShares 20+ Year Treasury Bond Exchange-Traded Fund (TLT) and CME Group 30-year Treasury Bond futures (/ZB)—are quoted in terms of price, which moves inversely to yields. Few traders, if any, can convert a Treasury bond price of 160 into an interest rate without a calculator (the corresponding rate is 2.1%).

The Small Exchange offers an opportunity to engage in this market with a suite of treasury interest rate products quoted in yield. Small two-year, 10-year and 30-year interest rate futures remove the complexity of converting prices to yields. So, traders can execute on their ideas as quickly as possible.

Bullish (Bearish) on 10-year yields? Buy (Sell) /S10Y futures. That simplicity enables participants of all types the ability to invest, speculate and hedge one of the most active asset classes.

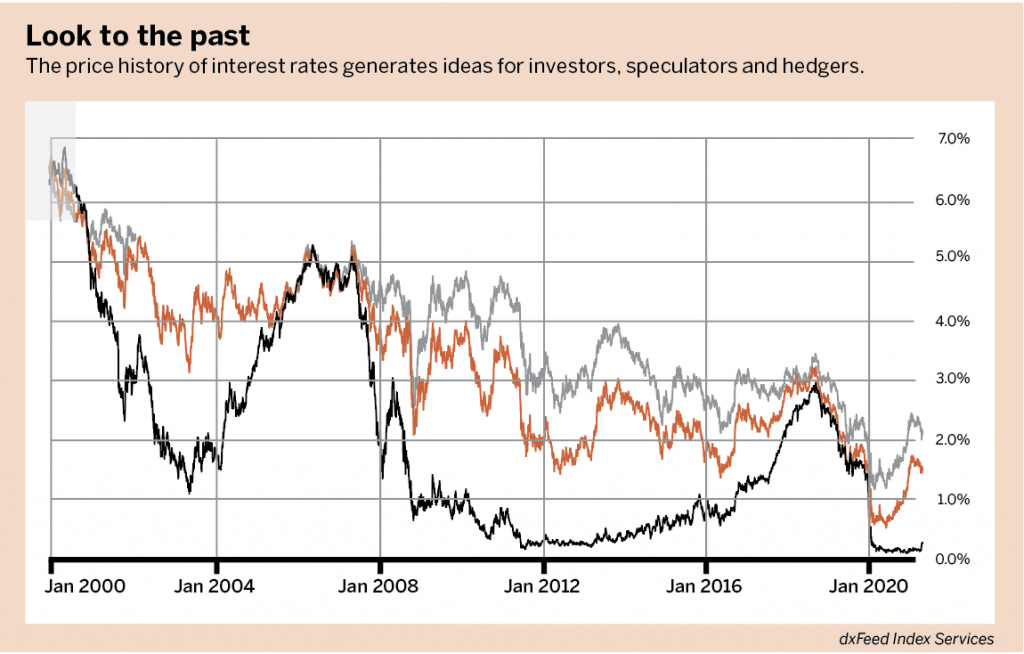

Studying price history of interest rates in Look to the past, below, generates several ideas for investors, speculators and hedgers.

Investors can view interest rates (across the curve) at or near their all-time lows and may believe they’re staging a massive “return-to-normal” trade.

For a speculator, two-year notes are responding sharply to Fed activity with an average historic daily move of $15 and an initial margin of just $62, making them an indispensable scalping vehicle. A hedger would note that interest rates are the epitome of a stock portfolio hedge as exemplified by the -0.12 three-month correlation between 30-year rate futures and the S&P 500.

While investors can play interest rates independently, the simplicity of a yield-based quoting convention enables them to make very clean curve trades, such as flatteners and steepeners.

While experienced traders are all too familiar with DV01 conversions when trying to trade TUT (2-years vs. 10-years) and NOB (10-years vs. 30-years) spreads, all small interest rate futures spread trades can be done on a 1 to 1 basis.

Incorporating spread trades into a portfolio can open a whole world of opportunity.

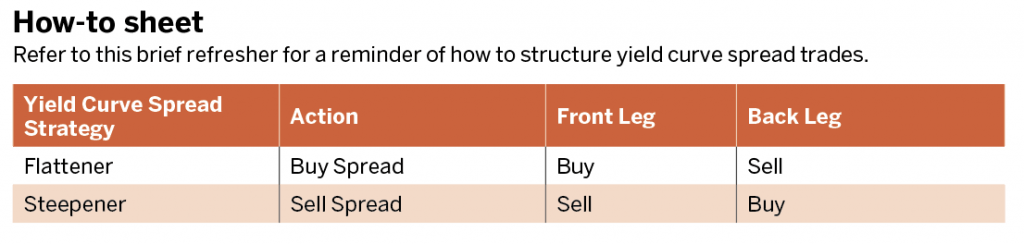

For a brief refresher on how to structure yield curve spread trades, check out How-to sheet, above. Readers should remember that the front leg is always the shorter duration rate product.

Flatteners make money when the yield differential decreases or narrows. Steepeners make money when the yield differential increases or widens.

Michael Gough enjoys retail trading and writing code. He works in business and product development at the Small Exchange, building index-based futures and professional partnerships.