Calendar Spreads: How to Trade the Calm Before the Storm

A calendar spread involves simultaneously buying and selling options with the same strike price but different expiration months. Calendars perform optimally when the underlying hovers close to the strike of the near-month short option.

One of the best things about trading options is that they are dynamic and can be used to deploy a wide range of market opinions.

Expecting a big upward move in your favorite stock? Buy a call or sell a put. Expecting a stock to trade sideways for the foreseeable future? Sell a straddle or strangle.

But what if one expects a calm market for several weeks, followed by a sharp increase in market volatility? For this outlook, market participants can consider the calendar spread.

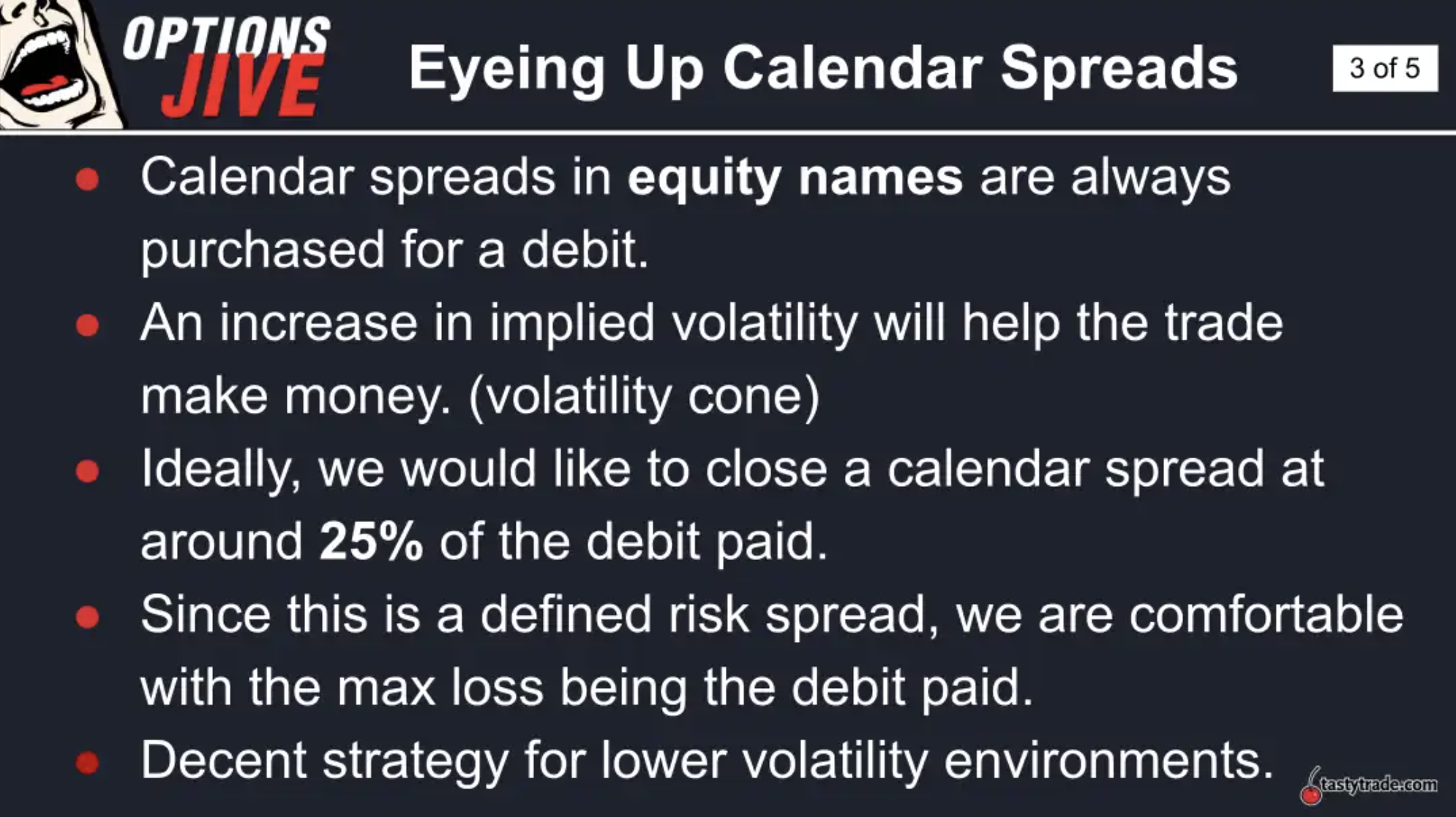

A calendar spread involves simultaneously buying and selling options with the same strike price but different expiration months. When executed for a debit (i.e., cash comes out of the account), the position entails selling the near-month option in favor of purchasing an out-month option.

Debit calendar spreads, or long calendar spreads, are theoretically bullish volatility because after the near-term option rolls off, the position is left with only the long premium leg of the trade. If volatility expands, that remaining position wins.

Calendar spreads perform optimally when the underlying hovers close to, or right on, the strike of the near-month short option during the life of that option. In this scenario, the premium from that short option bleeds off and funnels straight into the trader’s wallet. And that cash helps pay for the second leg of the trade.

Per the above, several of the most important considerations when trading calendar spreads include the following:

Unfortunately, the financial markets are still making big moves at this time, which means that criteria #1 listed above isn’t necessarily applicable at this time. The major market indexes are still making fairly big moves, as evidenced by the 2% move in the S&P 500 on June 28.

However, market volatility does traditionally contract during the summer trading months. And while that hasn’t happened yet, it’s possible that scenario could still play out in the coming weeks.

The CBOE Volatility Index (VIX) is currently trading at about 28, which is roughly nine points higher than its long-term historical average of 19. That level suggests that implied volatility is currently elevated—suggesting that premiums are rich for those looking to sell options volatility.

Rich options prices suggest that if market volatility does hit a wall sometime soon, the calendar spread could be one of the choices available for deploying new capital.

Earnings season considerations

One other X-factor for the financial markets is that Q2 earnings season is set to kick-off during mid-July.

Importantly, however, some earnings release dates will fall in the July expiration period, while others will fall in the August expiration period.

That means that if the financial markets do calm down in the coming days, options traders might get the opportunity to deploy calendar spreads that involve selling July in favor of buying August.

That trade structure likely works best for underlying stocks that report earnings in the August expiration cycle because the release of earnings can sometimes catalyze big moves in the value of the underlying shares. Under this trade structure, the calendar spread would involve a short leg in July (non-earnings expiration month) and a long leg in August (earnings expiration month).

Alternatively, one could wait until after the release of earnings and then sell the front-month options contract in conjunction with buying the September options contract.

For example, if a company was scheduled to report earnings on Aug. 1, one could deploy the August-September calendar spread (or August-October calendar spread) after the earnings release date.

This trade structure would hinge on the belief that a stock could trade sideways in the wake of earnings (i.e., August) and potentially see an uptick in volatility during fall (i.e., September/October).

Historical data shows that market volatility tends to increase after the summer, during September and October.

Investors and traders new to the calendar trade might instead consider mock trading a calendar spread position to see how it performs. Mock trading provides market participants with the opportunity to learn more about how different positions behave without the risk of capital losses.

It’s important to note that calendar spreads are “defined risk positions,” which means the maximum loss from a long calendar spread (short front-month, long back-month) is the premium paid to enter the position—the initial debit at trade deployment.

As detailed in the previous section, calendar spreads are usually deployed when little or no movement is expected in the near-term and when an uptick in movement/volatility is expected in the medium-term. That’s why they are often considered when one expects a “calm before the storm.”

For more information about calendar spreads, check out this installment of Best Practices on the tastytrade financial network, as well as this new episode of From Theory to Practice.

To follow everything moving the financial markets on a daily basis, readers can also tune into TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. Central Time.

Get Luckbox! Subscribe to receive 10-issues of Luckbox in print! See SUBSCRIBE or UPGRADE TO PRINT (upper right) for more info or visit getluckbox.com.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.