Four Pillars of Options

These four elements can provide the key to successful investing.

In statistics, the law of large numbers says that as the sample size grows, outcomes will more closely resemble the expected probabilities. Flip a coin 10 times, and it may come up heads 80% of the time. Flip a coin 10,000 times, and the outcome will be much closer to the expected probability of 50%.

The same applies to options trading strategies: They all begin with and are a function of the likelihood of an outcome generated by many occurrences. For those strategies, traders need a repeatable method.

In other words, the math of many occurrences creates the environment for trading strategies—the “shell of the trade.” When choosing a trade, identify the probability of success by using established mechanics rooted in mathematics and derived statistics.

That way, traders can identify trades that fit their tolerance for risk.

This Cheat Sheet covers the four elements of the shell of a trade that provide the keys to success: liquidity, IV rank, duration and delta. It’s all in the math and the power of large numbers.

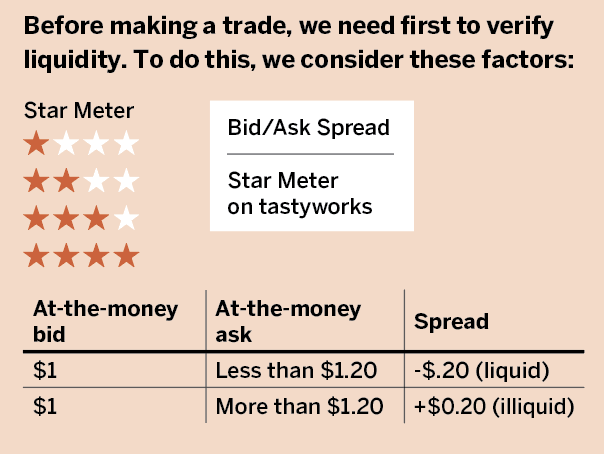

Liquidity

This is the most vital metric. To assess liquidity, based on the “bid-ask spread,” subtract the ask price from the bid price. If it’s less than 20 cents, consider the trade liquid, but if it’s more than 20 cents, it may be illiquid. The liquidity star meter on the tastyworks platform provides another way to judge liquidity. With three or four stars, the trade passes the liquidity test; fewer than three stars indicates the need for caution.

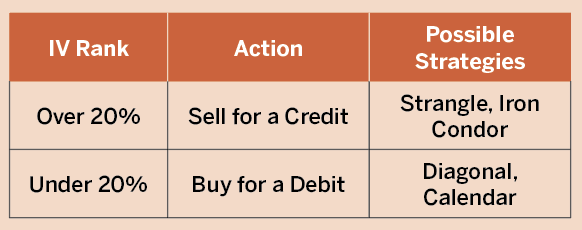

IV Rank

This metric, which measures price volatility, determines what strategies traders deploy. When it’s high (more than 20%), they sell volatility. When it’s low (below 20%), they consider long volatility strategies.

Duration

After considering IV rank, check the duration of the available contracts that expire within the desired period. Traders can maximize profits made from time decay by selling premium between 30 and 60 days. They avoid trades that don’t fit their time criteria. As an option gets closer to expiration, the value associated with time moves toward zero. That’s known as theta decay. Studies have demonstrated that the value lost daily—or what’s called the velocity of decay—is not constant. The option begins to lose value at a greater rate between 30 to 60 days to expiration.

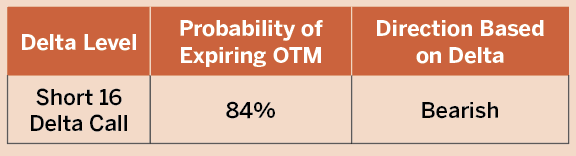

Delta

It all comes together with the use of delta, which measures the potential impact of a move by the underlying and the trade’s overall exposure. The delta value determines direction and probability. It’s easy to determine both when selecting the strike. When setting up possible options trades, look first at the 16-delta level, or one standard deviation. Use that as a starting point and adjust risk and credit accordingly.

Mike Hart, a former floor trader at the Chicago Stock Exchange and a proprietary futures trader, specializes in energy markets and interest rates. He’s a contributing member of the tastytrade research team. @mikehart79