Costless Collar

A costless collar is formed from a combination of strategies to create a “free” position protecting 100 shares of stock. Here they are:

- A covered call, which is a two-part strategy consisting of long shares of stock and short calls.

2. A protective put,which is a risk management strategy that enables investors to protect themselves from a stock’s near-term moves lower. The cost of the protective put should be canceled out by selling a call against the long stock position.

Investors use a collar to hedge against volatility in a stock’s price, and the two options create a floor and ceiling on profits and losses. The strategy is routed as one order for a credit, or a small debit. That depends on the risk and return desires per investor, as the distance of the call and put from the stock price determines a net debit or credit. Routing as a small debit, investors can choose a call farther from the stock’s price than the put. To route this trade as a small credit, investors choose a put farther out of the money than the call.

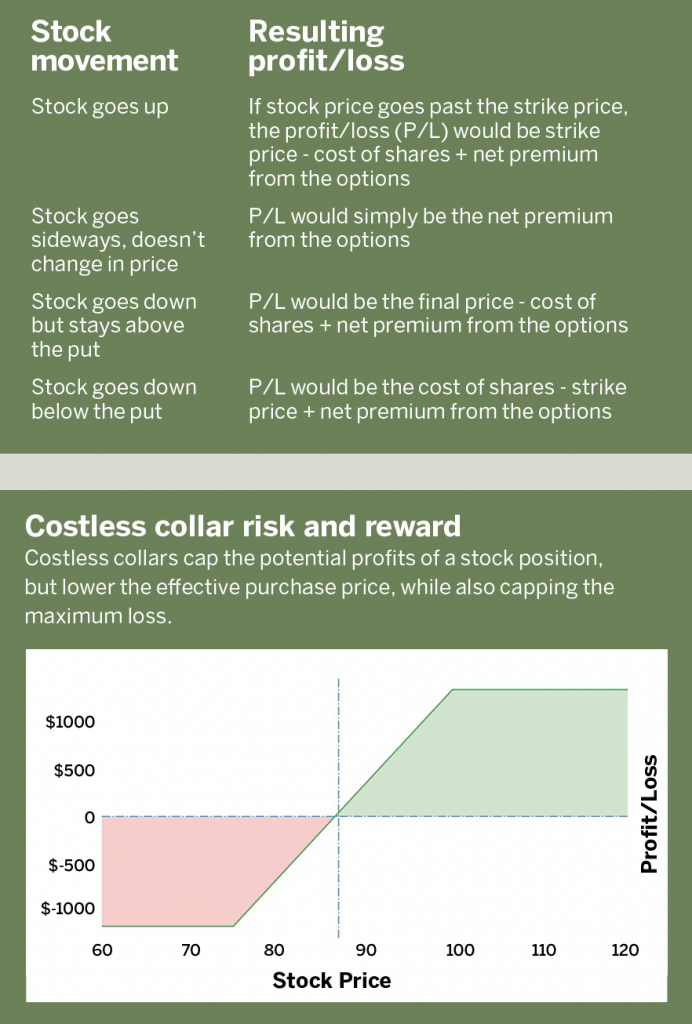

A collar potentially creates a target price to sell a stock position. Instead of timing the market, the short call means if that price is reached before the option expires, the stock is sold. Another benefit is the protection to large down moves, enabling investors to mitigate losses or ensure they lock in a profit on a pre-existing stock position. These benefits provide certainty to investors of potential future payouts, taking guesswork out of investing.

However, the strategy limits the potential profit on the stock position. If the stock goes beyond the strike price of the call, the investor misses out on profits above the strike price. For some, this trade-off is worth it.

Consider a costless collar using a crypto stock Block (SQ). Assuming Block’s share price is $87, it would cost $8,700 to buy 100 shares and we could sell a call with a strike price of $100 for approximately $3.40 per share. To turn this covered call into a costless collar, we would then buy a put that is cheaper than the call, such as the $75 put for $3 per share. This makes our effective purchase price $86.60 per share. What would happen to this position if the stock price moved?

Eddie Rajcevic, a member of the tastytrade research team, serves as co-host of the network’s Crypto Corner and Crypto Concepts. @erajcevic11