The Short Naked Put

Collect income while waiting for the price of a stock to go down

Ever wanted to own a stock for less than its current price? Or would you like to collect income while waiting for the price to decrease?

There’s a way to do both while putting up less money than it would cost to buy the shares outright. It may sound too good to be true, but it’s achievable via a simple options strategy known as a short naked put.

Short naked put features:

• It obligates the seller to buy 100 shares of the underlying asset at the strike price any time before the expiration date.

• There’s a defined maximum profit; The credit received for selling the put.

• Downside risk is the same as the stock if the price falls below the strike price.

• They’re used by investors who have a bullish stance on the stock.

The ideal time to trade a short put is when implied volatility (IV) and the implied volatility rank of an underlying are high.

When IV is high, the premium collected is higher, so the breakeven for the short put is lower and investors benefit more from a potential decrease in IV.

It’s common to sell out-of-the-money short puts because the premium is composed entirely of extrinsic value. As time passes and volatility decreases, the seller of the put will profit as the price of the option falls.

A good balance of risk and reward may be selling a short put with a delta of between 16 and 30, but investors can adjust that based on their own tolerance for risk and expectations for return.

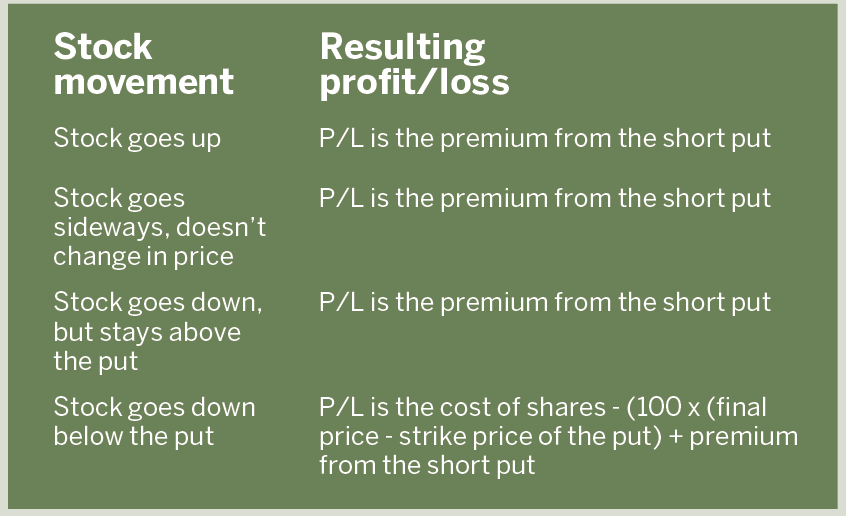

Managing the strategy’s risk:

• The risk is to the downside.

• A decrease in stock price can force the put seller to buy

the shares at the strike price.

• If the stock price falls below the strike price:

– Close the trade by buying back the short put

– Add more time by buying the short put back and selling another short put in a longer-dated expiration cycle,

a practice known as rolling a trade

– Own the shares outright, which means buying them on assignment

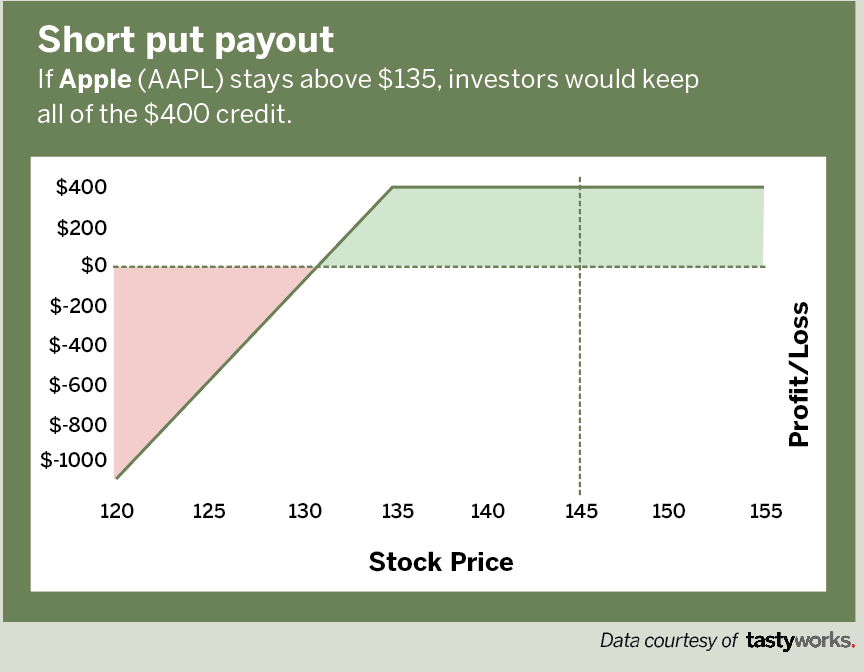

Here’s an example based on Apple (AAPL):

• Assume Apple has a share price of $145.

• An investor could sell a 30 delta put with a strike at $135 for $4 per share.

• There’s a total of $400 of initial credit.

• Breakeven would be $131 ($135 – $4), 10% lower than the current stock price.

• Breakeven represents the investor’s effective share. purchase price if the stock goes below the strike price and the investor decides to take assignment.

Eddie Rajcevic, a member of the tastytrade Research Team, serves as co-host of the network’s Crypto Corner and Crypto Concepts. @erajcevic11