Economic Insensitivity

Traders can reduce risk by trading products that aren’t closely tied to unpredictable macroeconomic swings

Basing trading decisions on an opinion about the economy isn’t easy. One indicator may signal strength while another indicates weakness. Meanwhile, economists and the Fed hedge their statements.

It’s enough to make an investor yearn to be free from economic risk. With that in mind, let’s review some products that aren’t tied too closely to macroeconomic swings.

First comes the definition of a macroeconomic swing. To keep things simple, use the S&P 500 Index as the gauge for how the economy is performing. Basically, when the index goes up over a long period of time, consider that a “good economy,” and when the index goes down, consider that a “bad economy.”

Next, determine what defines a “relationship” between two products. In finance, correlation is the most commonly used measure for determining such relationships. Correlation is a number, ranging from -1 to +1. Where the number is in that range shows the strength or weakness of the relationship between the two products.

If two products have a correlation close to + 1, then they’re strongly related. So when one product rises, the other does, too. When one product falls, so does the other. If the S&P 500 and the ecomomy move in tandem, and a product has a correlation to the S&P 500 of close to +1, then that product is economically sensitive. If the product has a correlation to the S&P 500 of close to -1, it’s also economically sensitive. An (inverse) correlation of negative 1 means the two prices move in opposite directions—when one goes up, the other goes down, and vice versa. The main point, however, is that the prices affect each other.

If two products have a correlation close to zero, then there’s no relationship between the two products. In other words, the movement of one does not affect the other. To find products that have little or no relationship to macroeconomic swings (i.e., the S&P 500), look for a correlation of close to zero with the S&P 500.

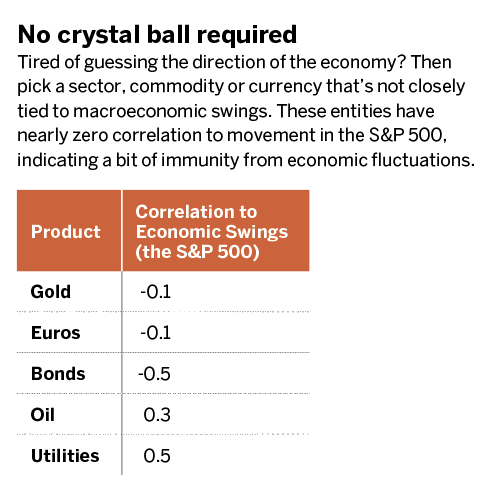

Five entities—including economic sectors, commodity products and currency products—that bear the smallest correlation to the S&P 500 are listed to the right.

Notice that the utilities sector is the least-affected economic sector that isn’t commodity—or currency-based. Overall, commodities and currencies provide great diversification to an equity portfolio because their prices do not depend on economic swings.

Adding a little more complexity to this, by selling an at-the-money put in each of these underlying every 30 days, actually reduces the risk of the overall position by roughly a third, compared with buying and holding 100 shares of the outright underlying. This is because options have other factors that determine their price besides just the underlying price. This reduction in risk also happens because even though options prices are correlated to the underlying, they are not 100% correlated. This lower overall correlation between the underlying and the at-the-money put option means that the option has an even lower correlation with the S&P 500 than the outright stock would have.

When making trade decisions going forward, look at the correlation to the S&P 500 when determining how sensitive or insensitive a stock, commodity or sector is to economic swings. The information’s easily accessible on most trading platforms.

Anton Kulikov is a trader, data scientist and research analyst at tastytrade.

@antonkulikov97