Finally, an Answer to How Much Crypto You Should Own

According to new research, there’s reason to believe that 4% may be a good starting point when it comes to allocating cryptocurrencies in the portfolio.

The cryptocurrency niche of the global financial markets has been on quite the rollercoaster in recent weeks.

Leading up to the Coinbase (COIN) initial public offering (IPO), excitement in the space pushed the best-known digital coin, bitcoin (BTC), to all-time highs—well above $60,000 per coin.

However, in the aftermath of that frenzy, bitcoin experienced a sharp correction and pulled down the entire sector in the process. As of April 24, bitcoin prices were hovering right around $47,000, roughly 26% lower than the all-time high set on April 13.

Whether the correction was due to technical weakness or qualitative factors is very much in the eye of the beholder. Pundits have suggested that a potential tax increase in the U.S. on capital gains could have catalyzed the recent wave of profit-taking in cryptocurrencies.

However, this isn’t the first time that cryptocurrencies have experienced a sharp correction, so it’s possible there’s more than one factor weighing on the space at this time.

Depending on one’s perspective—as well as strategic trading approach and risk profile—the current pullback in BTC may be viewed as an attractive opportunity. Importantly, however, cryptocurrencies aren’t necessarily suitable for every investor and trader, and the inclusion of such assets in one’s portfolio must be carefully analyzed.

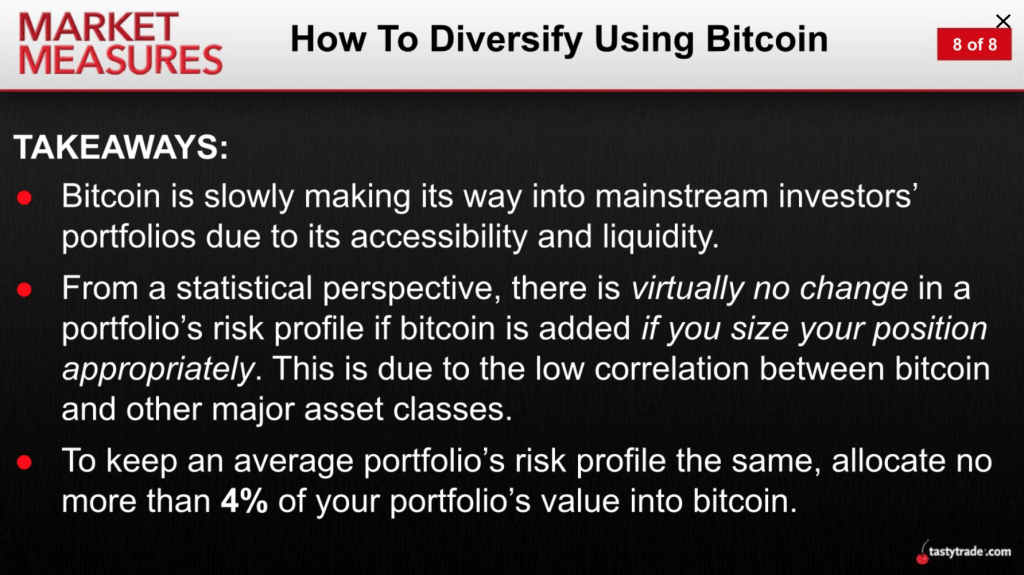

Market participants looking for more insight into cryptocurrencies, and specifically how they can fit in a broader portfolio, may therefore want to tune into a recent installment of Market Measures on the tastytrade financial network.

Instead of examining individual coins, this episode reviews the overall crypto space as an asset class, and how it can fit into a diversified portfolio—alongside stocks, precious metals, foreign currencies and bonds.

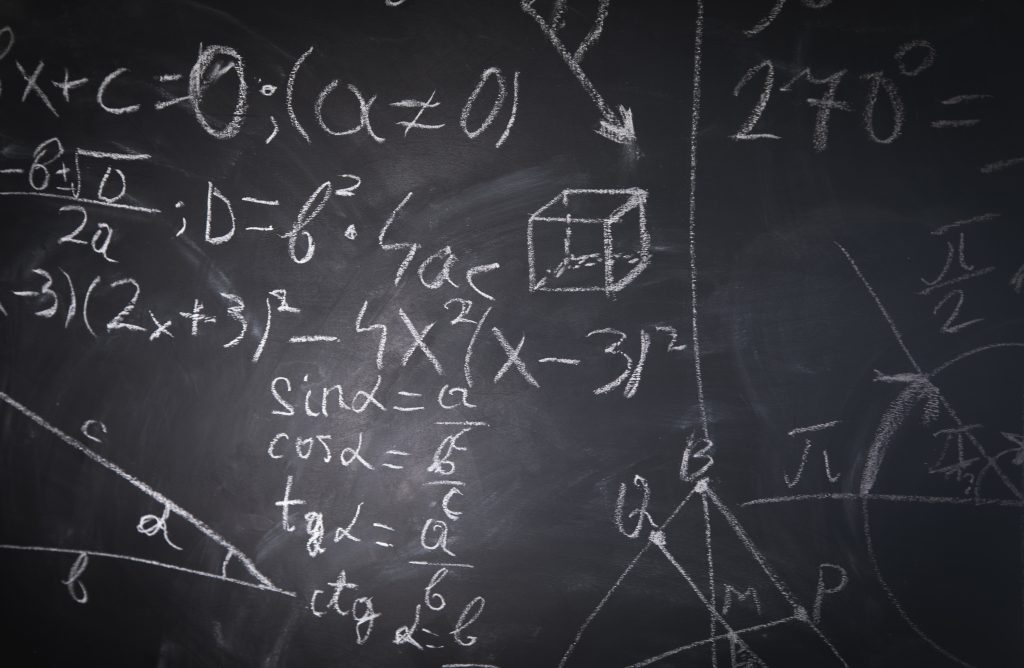

One strong suit for bitcoin is that it hasn’t historically shared a strong correlation with the stock market. For example, tastytrade estimates that bitcoin’s correlation with the S&P 500 is about 0.22, indicating a fairly weak correlation.

The above is important because when it comes to diversification, investors and traders often filter for assets/products that don’t share a strong positive correlation with existing positions in the portfolio.

For example, an investor holding a long gold position might not add a long silver position to the portfolio because those two precious metals share a very strong historical correlation (roughly 0.89). That means that most of time that gold prices increase, silver prices do as well—and the same goes when they are moving lower.

In that sense, investing in both gold and silver simultaneously amounts to what’s often referred to as a “Texas hedge”—basically doubling down on the same bet. The same might be said of buying the Nasdaq 100 and Tesla (TSLA), given that TSLA is included in the index and they are highly correlated.

So from a diversification standpoint—considering its correlation to other asset classes and high liquidity—bitcoin appears to pass the eye test for inclusion in the portfolio.

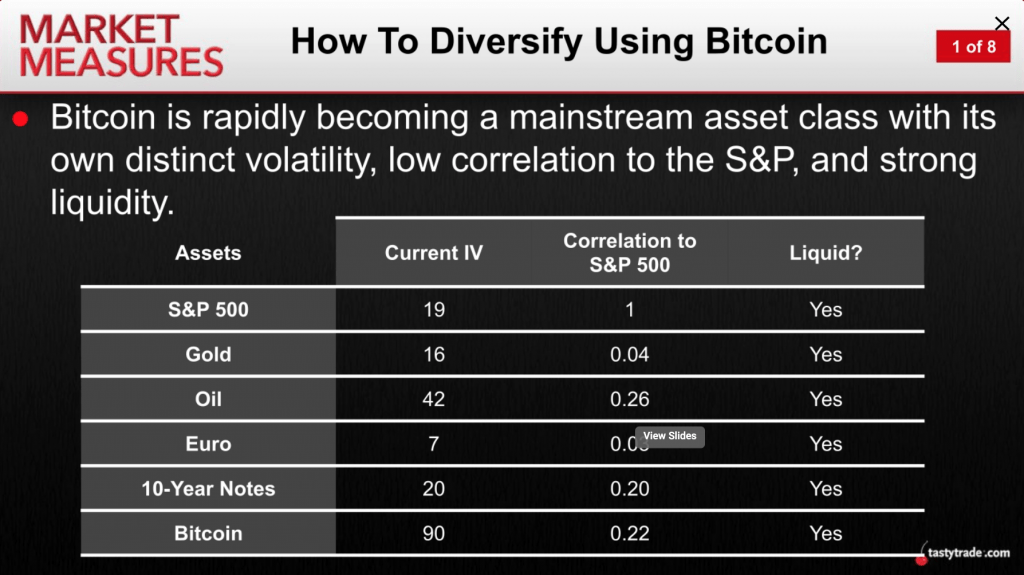

However, one other important consideration involving bitcoin—and other cryptocurrencies—relates to its extreme volatility. The tastytrade financial network previously investigated the relative volatility of bitcoin and found that it tends to exhibit much higher volatility than some of the other high-volume products on Wall Street.

As shown above, bitcoin was more than twice as volatile as crude oil (/CL) from 2014-2017. That’s significant because crude oil has been extremely volatile in recent years and is one of the more volatile products in the traditional world of finance.

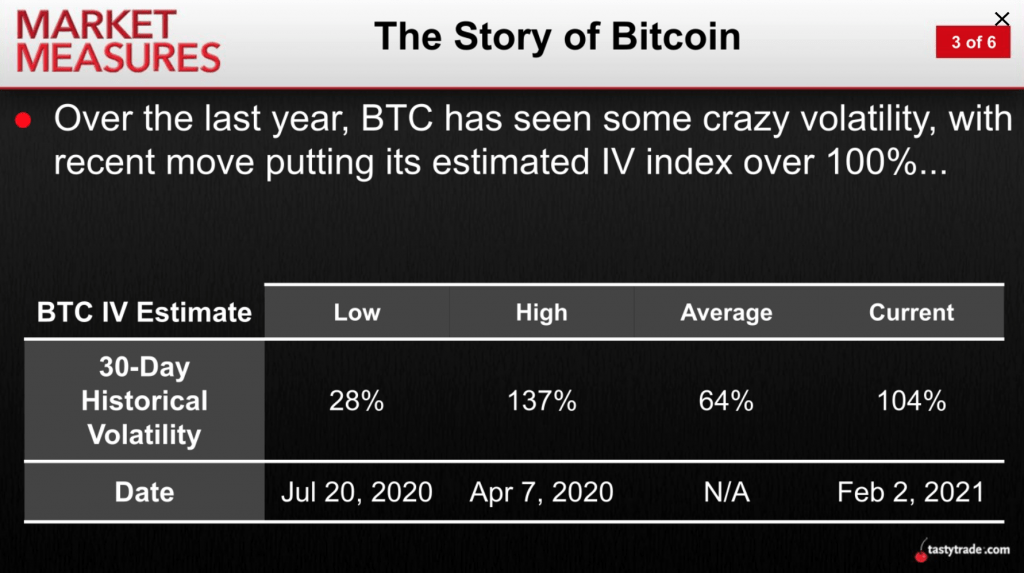

Another constraint of cryptocurrencies is that options markets on such assets aren’t yet fully developed. As a result, the implied volatility of a cryptocurrency such as bitcoin can’t be easily (or accurately) derived. That means the market’s expectation for volatility in bitcoin and other cryptocurrencies remains largely a mystery.

However, historical (aka realized) volatility can be calculated using historical trading data. So while implied volatility isn’t known, historical volatility can at least be used as a point of reference. A comprehensive analysis of bitcoin’s historical volatility (i.e. actual volatility) was conducted previously by the tastytrade financial network.

As highlighted in the chart below, 30-day historical volatility in bitcoin averaged about 64% over that 12-month window (February 2020 to February 2021). However, the most recent 30-day historical volatility in bitcoin (February of 2021) was quite a bit higher, at 104%.

For the purposes of comparison, it’s important to note that the recent 30-day volatility of the SPDR S&P 500 ETF (SPY) was 26%, suggesting that bitcoin volatility can be four to five times greater than that of the SPY.

It’s the extreme volatility of bitcoin that theoretically impacts its potential inclusion in the “average” investor’s portfolio. That’s because the vast majority of “normal” investors don’t like to see big swings in the value of their life savings—especially of the downward variety.

Accordingly, tastytrade conducted new research to evaluate what percent of the portfolio could be allocated to bitcoin without theoretically altering the overall risk profile of the portfolio (in terms of daily volatility).

This analysis revealed that limiting BTC exposure to no more than 4% of the total portfolio resulted in almost no change to the underlying volatility of the overall portfolio.

That certainly doesn’t mean that every investor should run out and immediately dedicate up to 4% of their portfolios to this asset class. It’s entirely possible that some investors and traders simply can’t accept the high-risk nature of cryptocurrencies and choose to avoid this asset class completely.

Others may view cryptocurrencies as appropriate for their trading accounts, but not for long-term investment/retirement accounts.

Ultimately, this research should assist those currently invested in cryptocurrencies (or considering doing so) to further evaluate their optimal level of exposure. The 4% allocation target—and associated tastytrade research—should provide a helpful guideline to work from.

It should be noted that this allocation analysis was specifically conducted using bitcoin, meaning other cryptocurrencies—especially those that are more volatile than bitcoin—may not call for the same level of allocation, if any.

To learn more about how cryptocurrencies such as bitcoin can fit in the portfolio, readers may want to review the complete episode of Market Measures.

Additionally, the tastytrade programming listed below—focusing on cryptocurrency trading and associated blockchain technology—may also be of interest:

- Market Measures: How to Diversify Using Bitcoin

- Futures Measures: Historical Volatility in Bitcoin

- The Skinny on Quantitative Finance: What’s a Bitcoin? (Part 1)

- The Skinny on Quantitative Finance: What’s a Bitcoin? (Part 2)

To follow everything moving the markets, TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. Central Time—is also recommended.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.