Hedging Crypto Exposure with Crypto Futures

Cryptocurrency futures were first introduced in 2017, and these instruments can be utilized to speculate on the sector or to hedge other cryptocurrency exposures within the portfolio.

For longtime bulls, the cryptocurrency sector isn’t performing as expected in 2022.

So far this year, the value of a single Bitcoin (BTC) has dropped by about 11%. It’s a similar decline as seen in the broader stock market, considering that the S&P 500 is down about 9% in 2022.

As highlighted previously by Luckbox, trading behavior in the cryptocurrency sector—at least among the best-known coins—has correlated with the U.S. stock market.

But the aforementioned data doesn’t mean the sector has been bereft of opportunities this year. The list below highlights some of the top-performing digital coins in 2022 (among those with market capitalizations above $1 billion):

- UNUS SED LEO (LEO): +58%

- Zilliqa (ZIL): +42%

- Waves (WAVES): +38%

- DeFiChain (DFI): +33%

- ThorChain (RUNE): +22%

- FTX Token (FTT): +12%

- Monero (XMR): +11%

- Ethereum Classic (ETC): +11%

When expanding the filter to include digital coins with market capitalizations above $100 million (instead of $1 billion), the list of top-performing coins expands. For example, Kyber Network Krystal (KNC) is up 230% in 2022, and Maple (MPL) is up 201% in 2022.

There are other ways to play the sector other than just simply long bets, though. Futures and options are now offered in the cryptocurrency sector, which means that investors and traders can play the sector from the short side, or even use options to play potential long/short volatility opportunities.

These products can also be used to hedge a cryptocurrency position or a broader portfolio of digital coins.

What is Hedging?

In the trading world, hedging is a method of reducing risk in the portfolio and can be conducted at the position level, the portfolio level, or both.

The intent of a hedge is to reduce the risk in another position or to reduce risk in a group of other positions.

For example, a traditional buy and hold investor in the stock market might use index futures to help protect his or her stock portfolio when fear creeps into the stock market. That same mentality and approach can be utilized in the cryptocurrency market—especially because of recent additions in the crypto marketplace.

One of the most important aspects of hedging is that an investor or trader selects the appropriate product to use as a hedge.

For example, if a traditional buy and hold investor in the stock market wants to protect his or her portfolio during corrections, then it’s critical to choose a product that’s highly correlated with the stock market, such as a stock market index future (S&P 500, Nasdaq, Russell 2000).

That way, if the stock market drops, and one’s portfolio loses value, at least the hedge will produce a profit.

The same goes for a HODLer in cryptocurrency that wants to protect his or her portfolio during a downturn. In order to deploy that position, one needs to utilize a pure-play cryptocurrency futures product.

The Small Cryptocurrency Index

Crypto market participants looking to hedge a specific exposure, or their overall portfolios, may want to learn more about crypto-focused futures, which were first developed in 2017, and derivatives products.

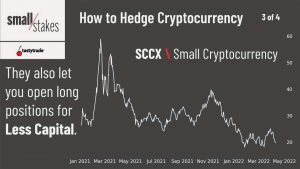

For example, the Small Exchange offers the Small Cryptocurrency Index (SCCX)—a futures product that closely tracks performance in the overall cryptocurrency sector.

A market participant that wants to get long cryptocurrency exposure buys the SCCX, and a market participant looking for short cryptocurrency exposure sells the index. The latter position—a short cryptocurrency futures position—is one that might theoretically be utilized by a HODLer that wants to hedge a concentrated long-only crypto portfolio.

Products offered by the Small Exchange are specifically tailored for retail market participants because the overall level of exposure represented by the Smalls is considerably less than that of traditional futures contracts.

To learn more about hedging with cryptocurrency futures, readers are encouraged to review this short installment of Small Stakes.

For updates on everything moving the markets, readers can also tune into TASTYTRADE LIVE, weekdays from 7 a.m. to 4 p.m. CDT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.