Options Trading: Why Some ‘Greeks’ Matter More Than Others

The Greeks provide investors and traders with insight on given options positions' response to potential scenarios in the underlying stock, but some are arguably more important than others.

Options are extremely dynamic securities, which is why many investors and traders gravitate toward the derivatives market.

Expecting a stock to sit still for the next month? There’s an options-orientated position designed to fit that outlook. Expecting market volatility to pick up? There’s an options-orientated position designed to fit that outlook as well.

In the case of the former, one might sell a straddle or strangle. In the case of the latter, one might buy a straddle, or buy a calendar spread.

The most important takeaway is that options can be deployed to fit a wide range of market outlooks, which is quite different than the somewhat narrow profiles offered by stock positions (i.e. long or short).

Importantly, however, market participants in the options universe also need to be aware of the so-called options “Greeks.”

As a reminder, the Greeks are four primary parameters which include delta, gamma, theta and vega. Each Greek describes a different dimension of risk in an options position. The Greeks are used to help investors and traders more efficiently risk-manage positions, as well as the overall portfolio.

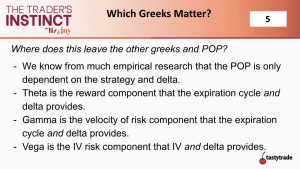

(insert image 2 of 6 from linked episode)

The fact that options positions can be deployed to fit a wide range of market outlooks is one reason the Greeks are so important. The Greeks help market participants better understand their exposure and risk(s) in the marketplace.

For example, a long call or put will be associated with a high theta value, because options lose value as time passes, and expiration draws closer. On the other hand, short options possess negative gamma, which generally means they don’t respond well to big moves in the underlying stock.

Accordingly, the Greeks provide investors and traders with important insight into how a given position will respond under a range of potential scenarios in the underlying stock. And like any worthy endeavor, it can take some time to master these concepts.

But there are some shortcuts that market participants can employ to quickly climb the ladder when it comes to mastering the Greeks—especially for those investors and traders that are new to options.

Prioritizing the Most Important Trading Data

When considering a new options position, most market participants weigh a combination of factors. Some of these include implied volatility, time to expiration, and the type of option position being considered (i.e. strategy).

For example, if market volatility spikes, one might consider selling a near-term option to capitalize on the potential for mean reversion—basically a bet that volatility will revert lower.

On the other hand, an investor or trader might hold a firm belief that a certain stock will get acquired at some point in the future. In this case, one of the most pertinent questions is time to expiration. Will the company be acquired this month? Next month? Next year?

Market participants need to consider a range of factors when building potential options trade ideas, including implied volatility, implied volatility rank, expiration week/month, strategy, probability of profit (POP), delta, theta, vega and gamma.

All of this can be a bit overwhelming for those that are new to the discipline. That’s why it may be necessary to trim down the list, and instead focus on a shorter list of parameters. As outlined in a recent episode of The Trader’s Instinct, that list might include:

-Implied Volatility and IVR

-Price

-Expiration

-Strategy

-Delta

-POP

-Theta

-Vega

-Gamma

That doesn’t mean that POP, theta, gamma and vega aren’t important. Instead, this shortened list eliminates some redundancies. By walking through the first five factors on the list, market participants have in one way or the other also considered the last four.

For example, by identifying a specific options strategy (i.e. naked long call, covered call, etc.) one has also essentially opted-in on the Greeks associated with that strategy. For example, long calls are associated with positive theta, which means they lose value as time passes.

Alternatively, calendar spreads are typically associated with negative theta and positive vega.

A calendar spread involves simultaneously buying and selling options with the same strike price, but different expiration months. When executed for a debit (i.e. cash comes out of the account), the position entails selling the near-month option, in favor of purchasing an out-month option.

The hope is that the short-term option will decay faster than the longer-term option, and that the trader can sell the spread for more than he or she paid for it. Alternatively, this spread would also theoretically benefit if implied volatility were to increase after the expiration of the short option.

As highlighted below, the decisions made by a trader relating to delta, implied volatility, expiration and strategy will therefore greatly influence the nature of the associated Greeks, with the remaining four parameters largely following along.

To learn more about the Greeks, and their place in the options universe, check out the following programming on the tastytrade financial network:

- Tasty Bites: The Main Greeks

- Options Jive: A Greeks Field Guide

- The Trader’s Instinct: Which Greeks Matter?

For daily updates on everything moving the markets, tune into TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. CDT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.