Short Puts to Get Long

A look at Intel says a lot about how to study laddering

It may seem absurd to discuss long equity opportunities in 2021, a year of nonstop new highs in the stock market. However, tried-and-true trade hunters can always find a stock beaten down off its highs with hopes of recovery.

A good example would be Intel (INTC), which was trading below $54 in August. Intel fell from its high of $68.14 in April of this year despite beating earnings estimates in both April and July. Traders and investors who expect Intel to move back above $55 or $60 have plenty of strategy choices, given that it’s a stock with high share volume and tight, liquid options markets.

One strategy investors might consider, should they expect that Intel will stay at current prices or rally higher, is laddered puts. Laddering puts entails selling different strike puts across various expirations. This shifts the strategy into a medium- to long-term outlook while continuing to profit as long as Intel doesn’t drop.

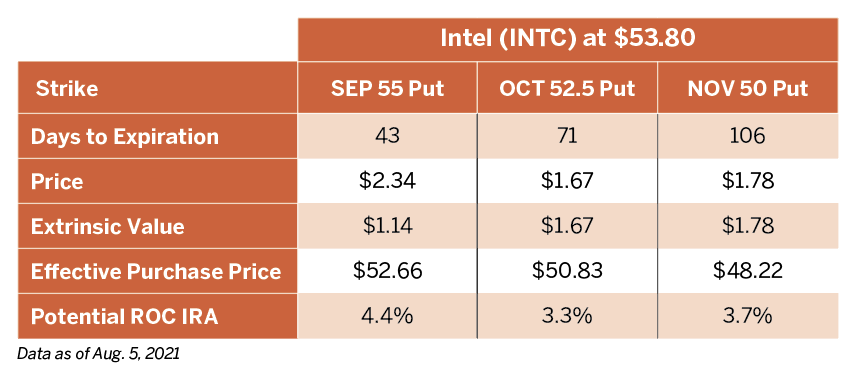

Consider the example of Intel in the table below.

By selling three separate put options across the September, October and November options cycles, an investor has three potential opportunities to be assigned long Intel shares if the stock continues to fall.

If the stock increases, the options will decay and can either be bought to close when showing a satisfactory profit or held until expiration. While the theoretical return on capital (at expiration) for an IRA is naturally lower than a margin account, the average is still 3.8% across the strategy.

The September trade, the 55 short put, is theoretically a covered call replacement as the put strike is slightly above the current price of Intel. If Intel is below 55 at expiration, the trader will be assigned stock. But because of the option premium collected, the effective purchase price, known as basis, is actually $52.66 (option strike minus premium collected).

In a worst-case scenario where Intel continues to fall and the trader takes assignment on all three puts (totaling 300 shares), the average purchase price would be $50.57.

Intel provides one example of how to apply a laddered-put strategy to get long on any desired underlying product with liquid options markets. Traders typically use laddering puts when they assume the underlying stock will increase in value but they’re comfortable owning shares should the price continue to fall.

Each option controls 100 shares, so every month that traders use adds a potential commitment of an additional hundred shares. That’s why lower-priced stocks may be better suited for the strategy, depending on the size of an investor’s account.

As with any strategy, traders should consider their risk tolerance and capital commitment for the opening trade and for the trade they could end up with.

James Blakeway serves as CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment analysis services for self-directed investors. @jamesblakeway