Volatility Arbitrage

When VIX hits an extreme, options traders often seek to pair cheap and expensive volatility against each other using a strategy known as “volatility arbitrage.”

When market volatility hits an extreme—on either end of the spectrum—investors and traders often use that situation to pair index volatility against single stock volatility.

For example, when the VIX is screaming higher, some market participants choose to sell volatility in indexes as opposed to single stocks—because indexes are inherently less risky than single stocks—and then pair that short index volatility against long volatility somewhere else.

The reasoning behind this tactical adjustment is rooted in a concept called “idiosyncratic risk” (aka unsystematic risk), which basically refers to company-specific risk. Essentially, this speaks to the potential for individual companies to make gap moves on highly impacting negative or positive news.

Short volatility traders can suffer outsized pain when exposed to extreme forms of idiosyncratic risk in single stocks.

Indexes and ETFs, on the other hand, are far more diversified and can therefore insulate investors and traders from company-specific risk. For example, if a single company in the S&P 500 goes bankrupt, the S&P 500 wouldn’t suffer to the same degree as the shares of that single stock.

Previous research conducted by tastytrade helped illustrate those nuances and showed that when overall market volatility is elevated, the risk-reward dynamic for short volatility tends to be more favorable for indexes and ETFs.

In the current market environment, however, volatility has moved to the other end of the spectrum. And as a result, some market participants are now pairing index volatility against single stock volatility, but in reverse fashion.

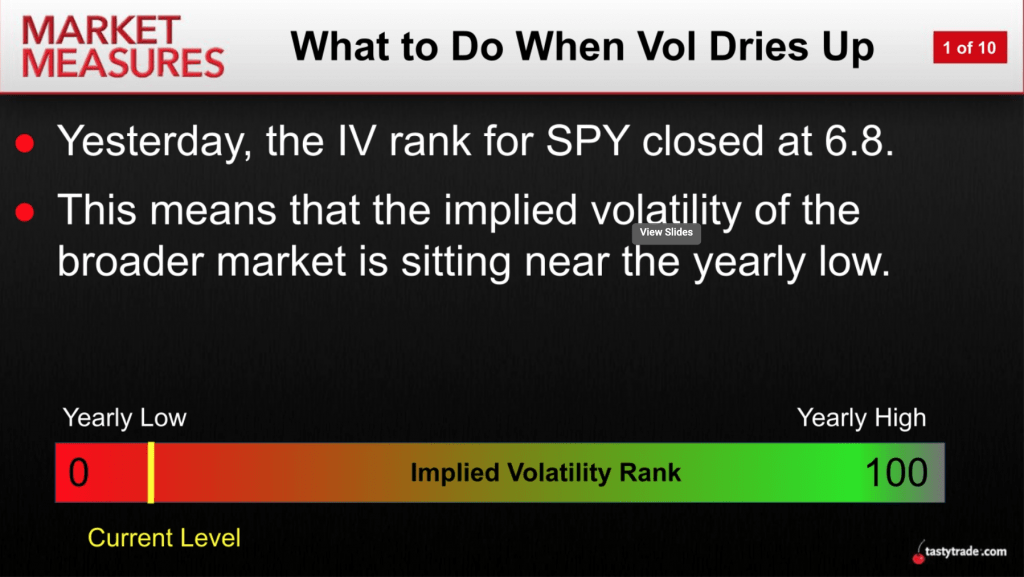

For example, implied volatility in the SPDR S&P 500 ETF Trust (SPY) recently dropped toward the lowest levels observed in the last 52 weeks. For traders already holding a portfolio of short volatility, that development may present an opportunity to balance risk exposure by going long index volatility—depending on one’s market outlook, unique trading approach and risk profile.

Pairing long and short volatility opportunities together in the same portfolio is sometimes referred to as “volatility arbitrage” or “dispersion.” Volatility arbitrage basically entails buying and selling volatility in a balanced manner, and preferably in underlying symbols that share a strong correlation.

For example, a “vol arb” energy trader might buy “cheap” premium in Exxon Mobil (XOM) versus selling “expensive” premium in Chevron (CVX), with the goal that implied volatility in both will revert to the mean and produce a positive return on capital. Kind of like a pairs trade, but involving volatility.

Obviously, a critical element to this strategy is an ability to consistently and correctly evaluate whether implied volatility is “cheap” or “expensive.” That’s one reason tastytrade devised the Implied Volatility Rank metric.

One risk to this approach, especially when dealing in single stocks, is that the short premium position experiences a “big move,” while the long premium leg of the trade fails to follow suit.

That’s why some volatility traders elect to sell volatility in a diversified underlying such as an index or an ETF instead of a single stock.

So instead of pairing long volatility in XOM against short volatility in CVX, a vol arb trader might pair short volatility in an energy-focused ETF, such as Energy Select Sector SPDR Fund (XLE), against long volatility in a single stock from the energy sector—preferably one that is highly correlated to XLE.

In the current environment, with index volatility trading at the other end of the extreme, the reverse position might also be constructed. Meaning that a portfolio with short single stock volatility exposure might be paired with long volatility exposure in an index or ETF.

Theoretically, a portfolio composed of balanced long and short volatility positions is less exposed to directional risk (assuming it’s hedged delta neutral) and also reduced volatility in P/L. The latter point assumes there are no outsized positions and that the portfolio is constructed with similar-sized exposures.

Of course, the pairing of short volatility and long volatility positions may not be for everyone. Some market participants are averse to long options positions due to the existence of theta decay, which is basically the reality that as time passes, options lose value.

Due to theta decay, long options positions have historically produced far less attractive win rates than short options positions over the long run—even when implied volatility is low.

However, the risk associated with long options and theta decay is theoretically reduced when those long options are paired in tandem with short volatility positions.

Regardless of one’s precise approach in the market, investors and traders should always be cognizant of the volatility environment—and even more so when it hits an extreme.

To learn more about volatility arbitrage, readers can review a previous installment of Market Measures on the tastytrade financial network. For more information on the current low-volatility trading environment, these new episodes are also recommended:

- Options Jive: When to Sell Volatility in Single Stocks

- Market Measures: Differences in Equity Index IV

- Market Measures: What To Do When Vol Dries Up

For updates on everything moving the markets, readers can also tune into TASTYTRADE LIVE weekdays from 7 a.m. to 4 p.m. Central Time at their convenience.

Get Luckbox! Subscribe to receive 10 issues of Luckbox in print! See SUBSCRIBE or UPGRADE TO PRINT (upper right) for more info or visit getluckbox.com.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.