Naked Options: High Octane Directional Plays

In 1931 it took the U.S. stock market 15 days to go from highs to bear market territory—the latter term defined as a decline of at least 20%.

In February and March of 2020, that same plunge took 19 days, meaning this has been the second-fastest pace in the history of trading to a bear market.

Given the above, it’s no surprise that the VIX closed March 12 at its highest levels since the Financial Crisis. All three of the stock markets’ best-known indexes—the Dow, Nasdaq and S&P 500—were down nearly 10% that day.

Closing at 75 and some change on March 12, the VIX was within sight of its all-time closing high, 80.86, which was set on Nov. 20, 2008.

In raw terms, there’s an urgency in the current market environment that simply emanates “a need for speed”—something that has been illustrated through seemingly daily 1,000 point swings in the Dow Jones.

And although fast-moving markets aren’t for the faint of heart, big market swings do open up the playbook in terms of potential trading tactics.

One strategy that can look more attractive when markets are making dramatic moves is naked options. These are high-octane plays that can produce big profits if one can nail down the timing and direction correctly.

But before deploying such an approach, it’s imperative to understand the risk profiles of these positions and make an informed decision as to their suitability in the portfolio.

As a reminder, a “naked option” is a term that refers to any options position that isn’t hedged with underlying stock (or other options)—a “pure-play” directional position.

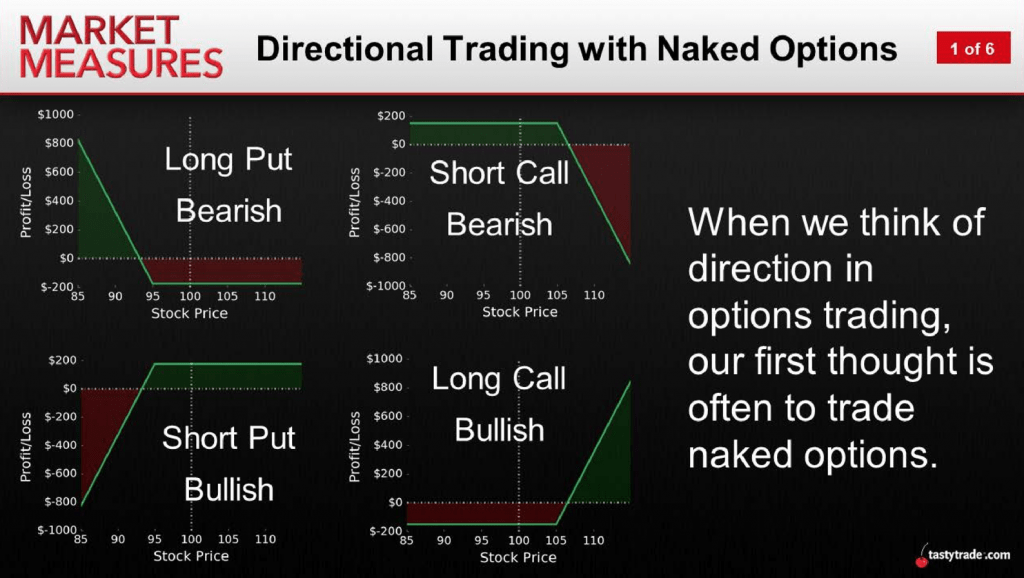

A naked option position may take the form of a long call, a short call, a long put, or a short put, all of which have clearly defined risk parameters.

One huge positive for long options positions (i.e. buying options) is the defined risk profile associated with these structures. The maximum loss when purchasing a call or a put is the amount of premium paid to establish the position. That’s it.

Juxtaposing long options to long stock, one can see how the risk profiles of each are different. For example, if one were to buy 100 call options for $0.05 each, then the total premium outlaid is $500. The worst possible outcome for that position is that the call option value declines to zero, in which case the trader loses $500.

On the other hand, for an investor or trader who purchases 1,000 shares of stock for $20/share, the total amount invested is $20,000. If the stock price were to decline to zero, the investor will lose the full $20,000 invested.

It should be further noted that short naked options positions possess a much different risk profile than long options—more similar to a short stock approach. When an investor or trader sells a naked option, whether it be a call or put, the risk of such a position is not defined.

If one were to sell a call and the underlying stock went to “infinity and beyond,” one can just imagine how severe the losses would be.

Another important differentiation between long and short options is the associated directional exposure represented by each.

For example, a long call is inherently bullish and theoretically outperforms as the underlying goes higher. Long puts, on the other hand, theoretically outperform when the associated underlying is declining.

For short options, it’s the opposite. Short calls are inherently short delta, meaning as the underlying rises, short calls underperform. That means a short call position does best when the associated underlying is declining.

Short puts are inherently long delta, meaning they theoretically perform best when the underlying is rallying. In turn, that means short puts underperform when the associated underlying is dropping.

The slide below summarizes the risk profiles of each respective naked option position: long put, short put, long call and short call.

While most traders know the above to be correct, one thing that’s less well-known is how each respective strategy performed in the wake of the last major market correction and the decade after. During the 2008-2009 Financial Crisis, stock indexes dropped more than 50% from their previous highs.

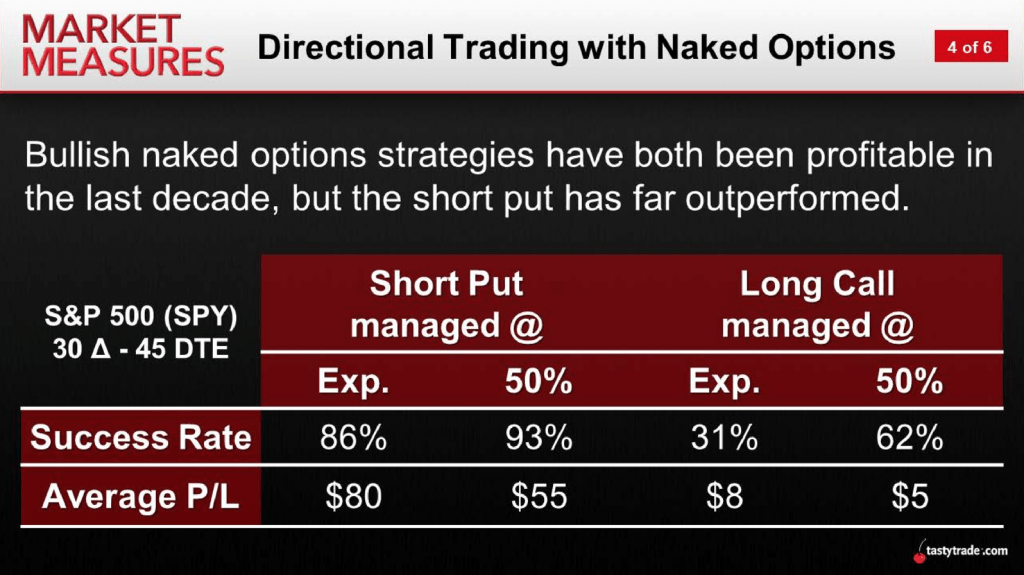

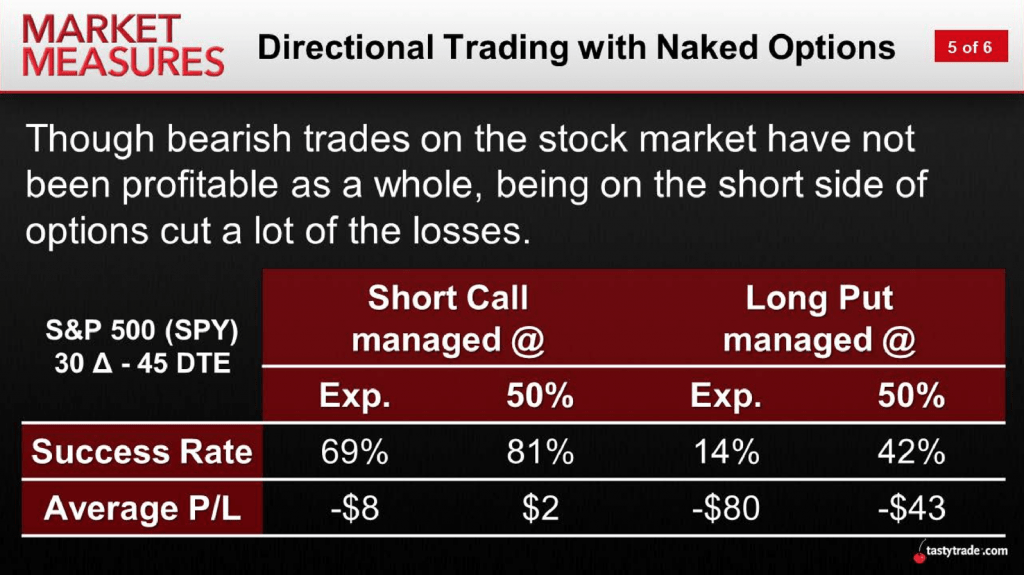

As such, the tastytrade financial network conducted a market study to help illustrate the performance of each respective naked option approach using a decade worth of trading data (from 2008 to 2018).

This involved backtesting each of the four strategies individually over the 10-year window. The underlying used for the backtests was the SPY (S&P 500 ETF) and associated options.

Each naked options strategy was backtested twice using different trade management approaches—holding the position through expiration, and closing the position after achieving 50% of maximum profit potential.

The two graphics below summarize the findings from all four backtests and are grouped into “bullish” positions (short put, long call) and bearish positions (short call, and long put):

What sticks out initially in the above data is that the short premium strategies (short call and short put) both outperformed no matter which trade management technique was applied.

This is especially interesting because one of the outperforming strategies was bullish (short put), while the other one was bearish (short call).

This indicates that the directional bias of the position was, on average, less impacting when compared to the question of whether it was a long or short option. Both of the outperforming strategies involved short options.

The key takeaway appears to be the fact that short options theoretically possess a higher probability of profit due to the existence of time decay. Time decay dictates that as options get closer to expiration, they lose value, all else being equal.

However, one also must keep in mind that short options do come with a higher degree of risk.

In terms of naked options trading approaches over the last decade, the middle ground of risk and reward appears to be the long call approach, which produced an overall win rate above 50%.

With equity indexes trading a lot lower in recent days, the long call (inherently bullish) may be something to further consider. For those willing to accept slightly more risk, the short put may also be a consideration.

It can be prudent to mock-trade potential trade ideas before deploying naked options live, that way traders can learn how such positions behave.

More information on naked options can be found by reviewing a previous episode of Market Measures on the tastytrade financial network when scheduling allows.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.