Trade Management: Tips for Options Trade Entry and Trade Exit

When trading options and/or volatility, it’s prudent to leverage a systematic approach to trade entry and trade exit because a so-called “mechanical approach” can help maximize potential gains and minimize potential losses.

In the financial markets, “mechanical trading” refers to a methodical approach to portfolio management. This mindset is particularly important when trading options and/or volatility, because these strategies rely heavily on statistics and probabilities.

In order to produce optimal results, volatility traders attempt to remove emotion from the portfolio management decision-making process and instead rely upon disciplined decision-making that can push probabilities and positive outcomes in their favor.

Generally speaking, volatility traders filter global financial markets seeking to purchase option premium when they think expectations for ongoing market volatility are too low, and for opportunities to sell premium when they think expectations for ongoing market volatility are too high.

The reason a mechanical approach is so critical to this type of strategy is because opportunities in this niche of the markets don’t revalue instantly. That means traders are required to monitor and manage numerous positions in their portfolios for several days, or even several weeks, with the goal of producing the maximum possible return, while also minimizing risk.

In order to achieve these goals, options/volatility traders tend to focus on the following:

- Occurrences: deploying a high number of diversified positions

- Trade entry: trade duration, and delta-neutral hedging

- Strategy diversification: naked options, covered calls, straddles, etc.

- Trade exit/trade management: a systematic process for managing/closing positions

- Liquidity: Trading only highly liquid underlyings (stocks, options, futures)

This post will focus on trade entry and trade exit/trade management—particularly for short options/volatility positions.

Trade Entry

The first stage of the trading process is to identify an attractive opportunity, which involves building a market assumption, and then executing on that assumption.

That might be as simple as selling options in a technology stock because implied volatility has reached the upper end of its 12-month range, or buying naked call options in oil-related companies due to a large-scale war involving one of the world’s largest oil producers.

Regardless, once an idea has been crafted, it needs to be deployed in the marketplace. The next step is therefore to consider the expected duration of the trade. How long will the trade remain open?

Trade duration can vary widely based on the specific idea. But when it comes to a systematic short volatility approach, previous research conducted by tastytrade has demonstrated that 45 days-to-expiration (DTE) can be a good rule of thumb when deploying short options positions.

There are two factors that play a role in this 45-day window: theta decay and “time to be correct.” Theta decay refers to the fact that short options theoretically lose value as time passes.

“Time to be correct,” on the other hand, refers to how the 45-day target provides the position with a long enough window to move in the trader’s favor, even if the trade were to temporarily move into negative P/L territory.

A series of market studies conducted by tastytrade have consistently demonstrated that short options trades with 45 days-to-expiration have produced the most attractive results, as highlighted in the graphic below.

The above suggests that market participants seeking to deploy a systematic short options/volatility approach can use 45 DTE as a potential guideline for trade entry.

Trade Exit

Once a trade goes live in the market, the next step in the process involves trade management. This encompasses both trade adjustment and trade closure.

As referenced earlier, investors and traders can leverage a variety of mechanical trade management approaches to help assist with this process. These approaches basically boil down to making decisions based on P/L, the passage of time, or a combination of both.

Managing positions based on P/L is often referred to as managing winners/losers, whereas managing based on the passage of time is typically referred to as managing early.

At its core, managing winners is all about closing high-performing positions while they are ahead. Managing early, on the other hand, relies on the fact that theta decay decelerates as expiration gets closer, meaning that traders may prefer to the trade as potential rewards decrease and potential risks increase.

A couple of well-known approaches to managing winners include closing strangles at 50% of the credit received and closing straddles at 25% of the credit received. In the former case, this would mean that if you sold a strangle for $2.00, the strategy would call for closing the position once the market value of the strangle had decayed down to $1.00.

In terms of managing early, the goal is to systematically remove positions from the portfolio before expiration, after the majority of the time premium (i.e. extrinsic value) has already decayed out of the option’s value. Accordingly, a trader might decide to close positions after a certain number of trading days has elapsed or with a certain number of days left until expiration.

The research team at tastytrade has conducted studies on both managing winners as well as managing early, and data from these studies have shown that both approaches produce attractive results.

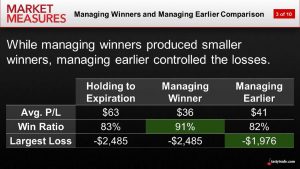

In one study, a short strangle was backtested in SPY using market data from 2005 to 2017. The associated backtests were run three different times, each utilizing one of the following trade management techniques: holding through expiration (i.e. control group), managing winners (50% of credit received), and managing early (midpoint of the expiration cycle).

The graphic below summarizes the performance for each of those three trade management approaches:

As one can see in the above data, there were certain advantages and disadvantages to each approach. Notably, managing winners produced the highest win rate, which is of course attractive for any systematic trading approach.

However, the managing early trade management approach maintained a high overall win rate, while reducing the largest loss, as compared to the other two approaches.

To learn more about these trade management approaches (i.e. trade exit), review this previous installment of Market Measures. For more perspective on a mechanical approach to trade entry/exit, check out this episode of Best Practices.

Tune into TASTYTRADE LIVE for daily updates on everything moving the markets.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.