Unlocking the Hidden Advantages of Sector ETFs

While many volatility traders target the options of broad market ETFs, such as SPY and IWM, there’s an argument to make for sector ETFs, as well.

One constraint with larger cap ETFs, such as SPY and IWM, is that they are high-dollar underlyings that can consume an out-sized amount of capital. And the diversification that many investors and traders seek in products like SPY and IWM can also be found in lower-dollar underlyings —specifically the sector ETFs.

As a reminder, the sector ETFs are a class of exchange-traded funds that invest in the stocks and securities of a specific sector, typically identified in the title of the fund. For example, the XLF is called the “Financial Select SPDR ETF” and is comprised of 62 underlying symbols that operate in the financial sector and are represented in the S&P 500.

Below are some of the best-known sector ETFs (including approximate price and number of components):

- Financials (XLF): Price: $28, Components: 62

- Technology (XLK): Price: $80, Components: 72

- Consumer (XLY): Price: $123, Components: 85

- Health Care (XLV): Price: $92, Components: 59

- Industrials (XLI): Price: $77, Components: 68

- Retail (XRT): Price: $43, Components: 101

As seen in the bullet points above, the lower absolute prices of the sector ETFs means that less capital is required when trading these products compared to SPY or IWM, which are trading for $298 and $155 respectively.

Generally speaking, the higher the value of the underlying, the higher the capital requirement is for a given options position. Likewise, higher-priced underlyings also tend to have higher-priced absolute options, which increases the associated capital requirement, too.

The great thing is that traders entering the sector ETF space don’t have to sacrifice diversity when moving from a product such as SPY to XLV, for example.

This point is illustrated in the bullet points above as all of the listed sector ETFs have at minimum approximately 60 different companies represented. While that may be fewer than the 500 companies represented in SPY, it’s well above the one-company risk inherent when trading single-stock options.

Moreover, research conducted by the tastytrade financial network demonstrates that the overall win rates of short premium strategies deployed in sector ETFs is on par with historical win rates observed in broad-based market ETFs.

The aforementioned research was presented recently on a new episode of tasty Bites.

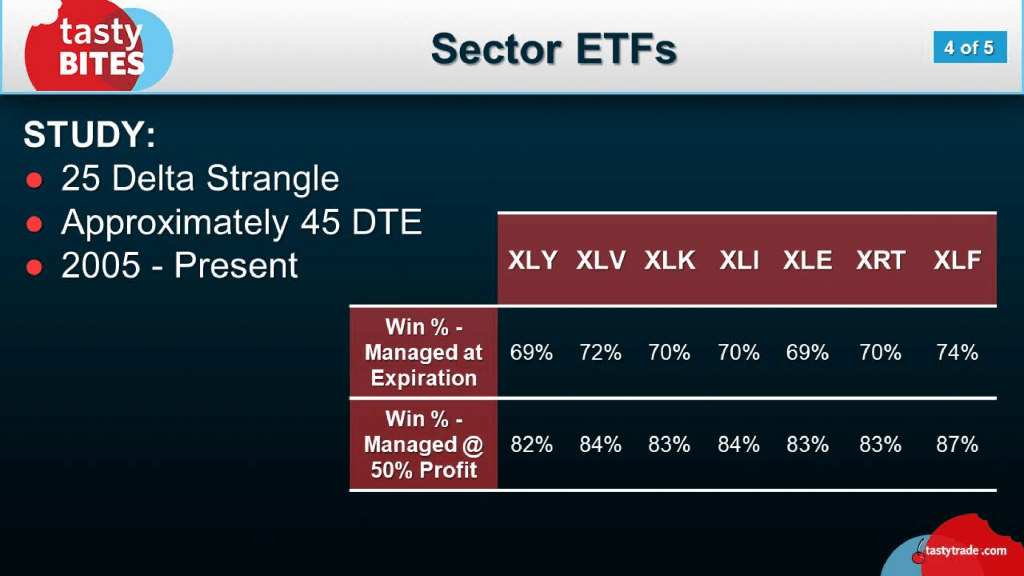

The crux of the tastytrade research approach was to backtest a simple short strangle in a group of sector ETFs using historical data from 2005 to present. For each sector ETF, two trade management filters were applied—holding the position through expiration, and managing winners at 50% of maximum profit.

As one can see in the graphic below, the research revealed that over the period examined, the win rates were almost identical across the board—no matter what sector ETF was selected:

The data above also illustrates that win ratios stayed constant for each trade management filter—assuming the same one was used across the board.

Given that this research encompassed a wide group of symbols over a significant period of time, the results are compelling enough that traders may want to consider the sector ETFs in their ongoing strategy, especially traders seeking to optimize capital efficiency.

Take the time to review the complete episode of tasty Bites focusing on tastytrade research in the sector ETFs when scheduling allows.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about any of the topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.