4 of the Most Highly Anticipated IPOs in 2024

The market for IPOs has been weak since the start of 2022, but there are several exciting companies expected to debut in 2024

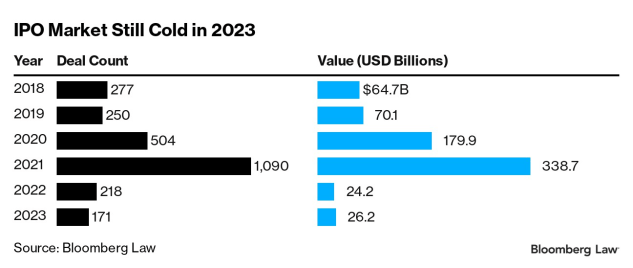

- IPO activity has been depressed during the last two years, falling well below the levels seen in 2018-2021.

- That said, the Arm Holdings (ARM) IPO from last year has been wildly successful, with shares up roughly 120% since the September listing.

- Despite the gloomy outlook, several exciting companies are expected to IPO in 2024, including Shein, Reddit, Stripe and Databricks.

After a dismal year in 2022, most pundits expected the number of initial public offerings (IPOs) to increase in 2023.

They didn’t, and IPO activity remains extremely depressed as compared to the years leading up to the pandemic. Not surprisingly, many of those same IPO experts—especially those that profit from IPOs—are now expecting new stock offerings to rebound in 2024.

Don’t hold your breath. After the first six weeks of 2024, some of those same prognosticators are already modifying their forecasts to the second half of 2024. In the near future those predictions will likely be amended to next year.

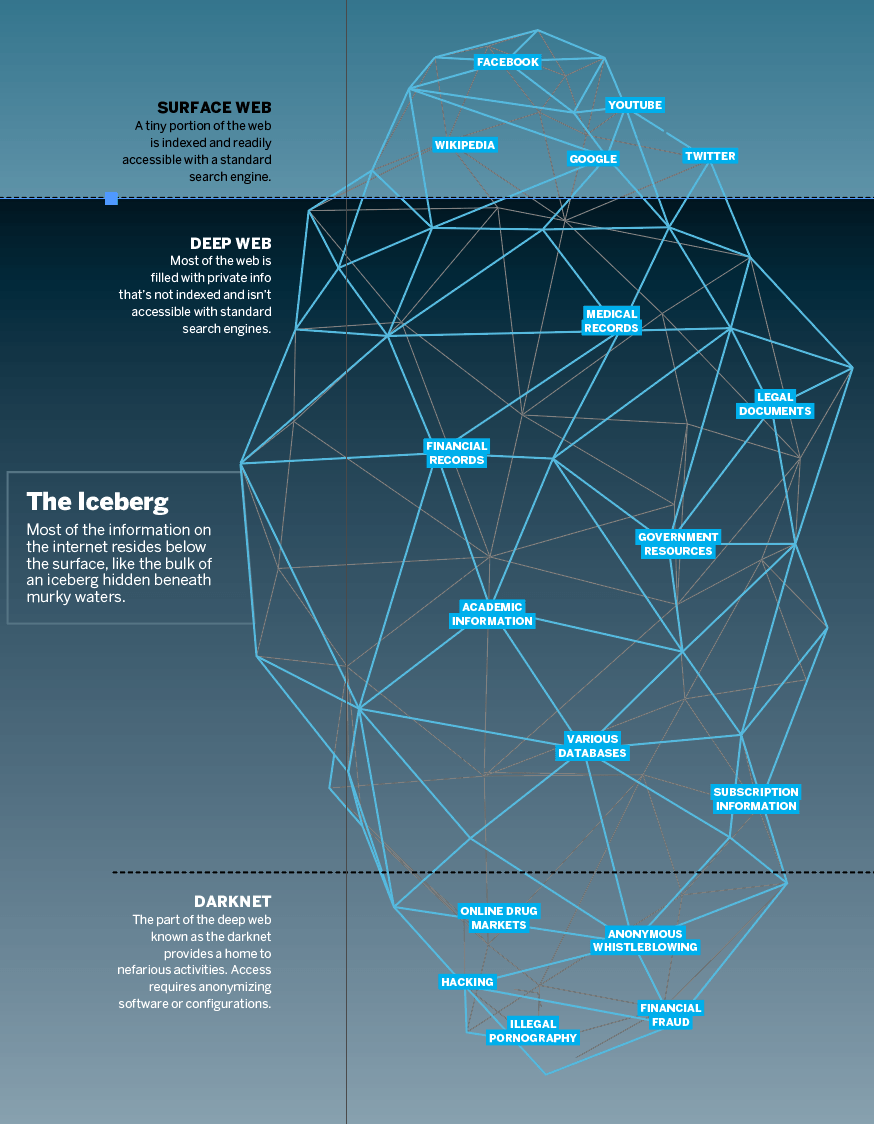

Unfortunately, it’s not easy to predict when the IPO market will get hot. After all, nobody really predicted that it would go cold in the first place. As highlighted in the graphic below, new IPO offerings in 2022 and 2023 were well below the levels observed from 2018-2021.

Historically, IPO activity picks up when the stock market is rallying because it’s more attractive to debut a new stock in a bullish market environment than it is in a bearish one.

The stock market has been on a strong bull run since mid-October of last year. That’s clearly evidenced by recent performance in one of the top IPOs from 2023, Arm Holdings (ARM). Shares of Arm Holdings are up roughly 120% since they debuted in September of last year.

However, despite the recent bull run in the stock market, IPO activity remains depressed. It certainly doesn’t help that 2024 includes a presidential election. The IPO market often dries up ahead of major U.S. elections because of the potential for elevated volatility in the financial markets, which can complicate the debuts of new stocks.

One of the other problems is that of the last 100 IPOs, 70% are now trading below their IPO price. That’s certainly not the outcome corporate management typically envisions ahead of a new listing, and underperformance in many of the recent IPOs is undoubtedly contributing to the current drought in activity.

Another big obstacle is elevated interest rates. All else being equal, a low interest rates environment tends to be more conducive for growth and profitability. So with the cost of capital still hovering near multiyear highs, it’s starting to feel like the IPO market won’t truly get going until interest rates fall back to more reasonable levels.

Unfortunately, that doesn’t appear likely anytime soon. On Feb. 13, a hotter than expected inflation report triggered the first major downdraft in the stock market since October 2023. At one point on Feb. 13, the Dow Jones Industrial Average was down nearly 1,000 points.

With inflation still above the Fed’s preferred level of 2%, most pundits now expect the Federal Reserve to leave interest rates at current levels for the foreseeable future. That means hopes of a March rate cut have been dashed, at least for the time being. At present, the interest rate futures market implies that there’s a 50% chance the Fed will cut rates by a quarter percentage point in June.

Even if that does occur—which is by no means guaranteed—that likely wouldn’t be enough to catalyze a strong rebound in new IPO listings. Moreover, if rates ever do get cut significantly, that could actually be a bad sign for the IPO market, because it would likely be indicative of a slumping U.S. economy.

Deep rate cuts usually materialize amid recessions/depressions, because the goal of such cuts is to stimulate increased borrowing in the economy. Unfortunately, sharp corrections in the stock market can also develop during economic recessions, and selloffs in the stock market are like kryptonite for the IPO market.

All told, the aforementioned information and data suggests that the halcyon days for the IPO market probably won’t return anytime soon. On the other hand, cream always rises to the top, and the top-level IPOs will still make their way to the market, no matter the prevailing environment.

Along those lines, the next section highlights some of the most highly anticipated IPOs of 2024

Top 4 IPOs expected in 2024

Despite the gloomy outlook for IPOs in 2024, there are several key companies that could debut their public shares in the stock market in the coming months, such as Shein, Reddit, Stripe and Databricks. More details on each of these potential IPOs is highlighted below.

Shein

Shein has taken the retail world by storm, and may do the same in the financial world whenever it debuts in the stock market. Based on recent capital-raising activity, Shein will likely come to market with a valuation north of $65 billion, which would put it among the 10 largest IPOs in American history.

Leveraging a digital-first approach, Shein tracks emerging fashion trends and then uses its extensive marketing savvy to generate demand for products that match those trends. The company’s approach is so effective that many analysts refer to the company’s business model as “real-time retail.”

Shein has aggressively grown its revenues over the last several years and could generate more than $30 billion in sales this year. The Singapore-based company has indicated it intends to pursue an initial public offering in the United States at some point in the near future. One of the primary obstacles for this company is that regulators in the U.S. and China both need to sign-off before the IPO can move forward, and at this point there’s little visibility into when (or even if) that will occur.

Reddit

Another major name that could IPO in 2024 is Reddit—one of the most popular websites in the world, clocking in recently at #17 globally. Reddit offers a vast digital platform that hosts diverse communities where users engage in discussions, share content, and connect over shared interests. Its unique voting system and anonymity contribute to its dynamic nature. With features like the front page showcasing popular posts and events like Ask Me Anything sessions, Reddit maintains an active and engaged user base.

Reddit represents a unique IPO on Wall Street, because one of Reddit’s forums—“r/WallStreetBets”—played a key role in the meme stock craze that hit the markets during the COVID-19 pandemic. Reddit was valued at as much as $10 billion a couple of years ago, but a recent filing by the Fidelity Blue Chip Growth Fund suggests that valuation has slipped to somewhere between $5-$6 billion. That said, the debut of Reddit—whenever it arrives—could be especially chaotic, especially if the meme crowd gets involved.

Stripe

Stripe is essentially a fintech company that focuses heavily on payment processing. Stripe allows businesses to accept payments from customers through various methods such as credit cards, debit cards, and digital wallets like Apple Pay and Google Pay. However, the company also offers other financial services, such as business banking accounts, loans, and financial reporting tools to help businesses manage their finances more effectively. That said, the bulk of Stripe’s revenues are generated through transaction fees, with the company processing hundreds of billions of dollars worth of transactions each year for its clients.

Similar to Shein, the Stripe IPO will likely place it among the largest in American history. However, like Reddit, the company has seen its valuation slip in recent months. At its peak, Stripe was valued at around $95 billion, but that figure is now estimated at $50-$55 billion.

Databricks

Databricks may be listed last, but it’s certainly not the least. Databricks is a cloud-based provider of data analytics tools. The company leans heavily on machine learning, which means it also has exposure to the artificial intelligence (AI) sector. And in the current market environment, that means Databricks could hit hard when it debuts, as observed recently with shares of Arm Holdings (ARM).

Databricks was first founded to commercialize the Apache Spark analytics engine. Today, Databricks has transformed into an open-source platform that helps organizations manage data with machine learning and artificial intelligence-focused capabilities. Last September, Databricks conducted a capital-raising which valued the company at roughly $43 billion. Considering the recent AI craze, however, shares of Databricks could debut at closer to $50 billion, if not higher.

To follow everything moving the markets in 2024, including the IPO market, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.