CoreWeave: Poised to Transform AI

CoreWeave, a Nvidia-backed pioneer of cloud services for artificial intelligence, is preparing for an IPO

- Nvidia has helped CoreWeave evolve from a cryptocurrency miner into a leading AI cloud provider.

- CoreWeave’s IPO promises to reshape expectations for AI-driven cloud services.

- The company has attracted a high-profile client base and raised $12.7 billion in the last 18 months.

CoreWeave, once a relatively unknown cryptocurrency miner, has become a disruptive player in the fast-growing AI infrastructure business. The company was started in 2017 in Roseland, New Jersey, and quickly embraced a new vision: Building infrastructure robust enough to handle AI’s immense computational demands. Now, with an initial public offering (IPO) on the horizon, it’s positioned to attract plenty of attention.

Central to this ascent is CoreWeave’s strategic partnership with Nvidia (NVDA), the reigning giant of GPU (graphics processing unit) technology. Nvidia’s support not only empowered CoreWeave to grow but also helped it become a force in reshaping how cloud computing can fuel AI breakthroughs. With this alliance, CoreWeave isn’t just entering the cloud market. It’s redefining what AI-driven infrastructure can achieve and commanding the attention of investors, tech leaders and an industry hungry for speed, scale and groundbreaking potential.

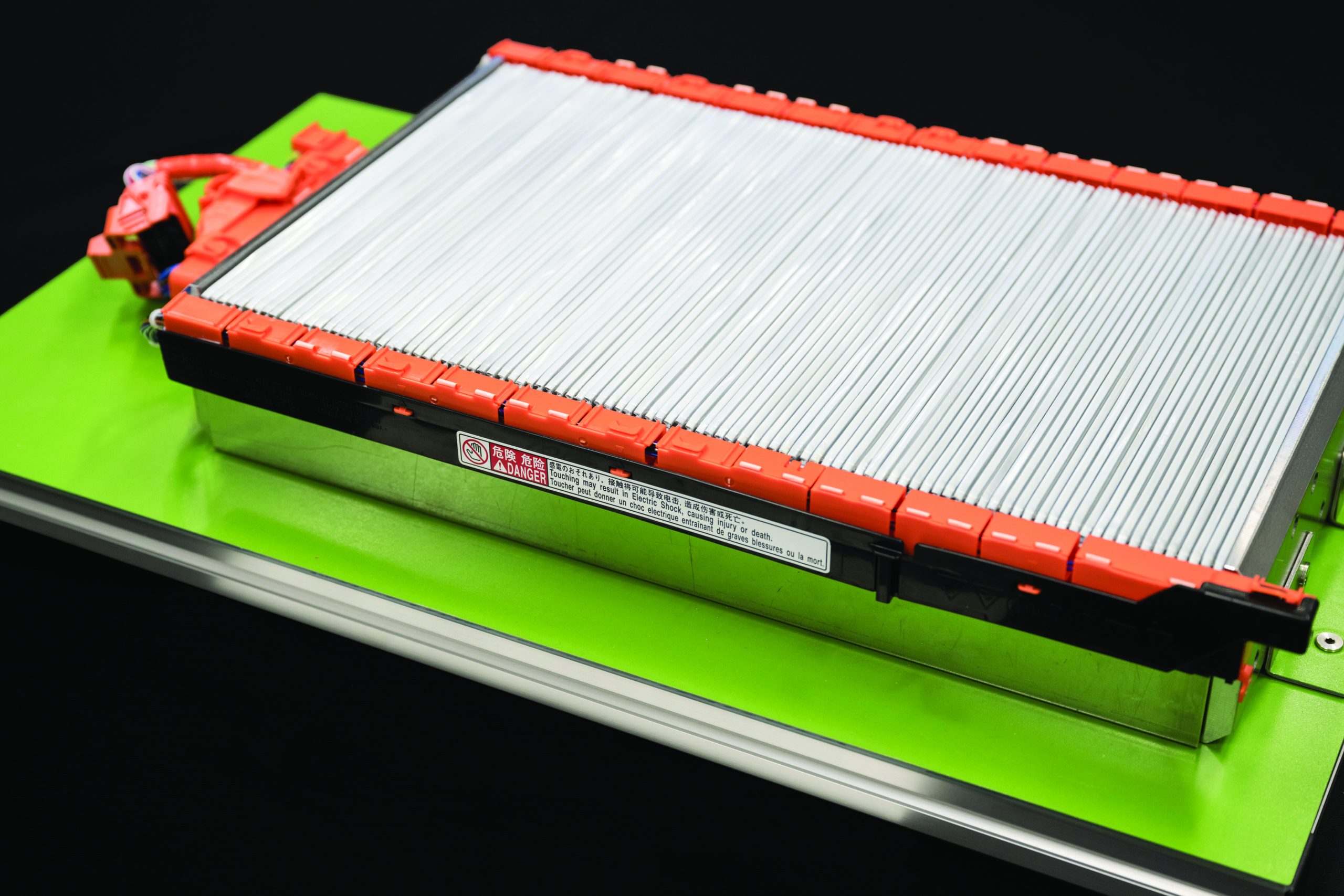

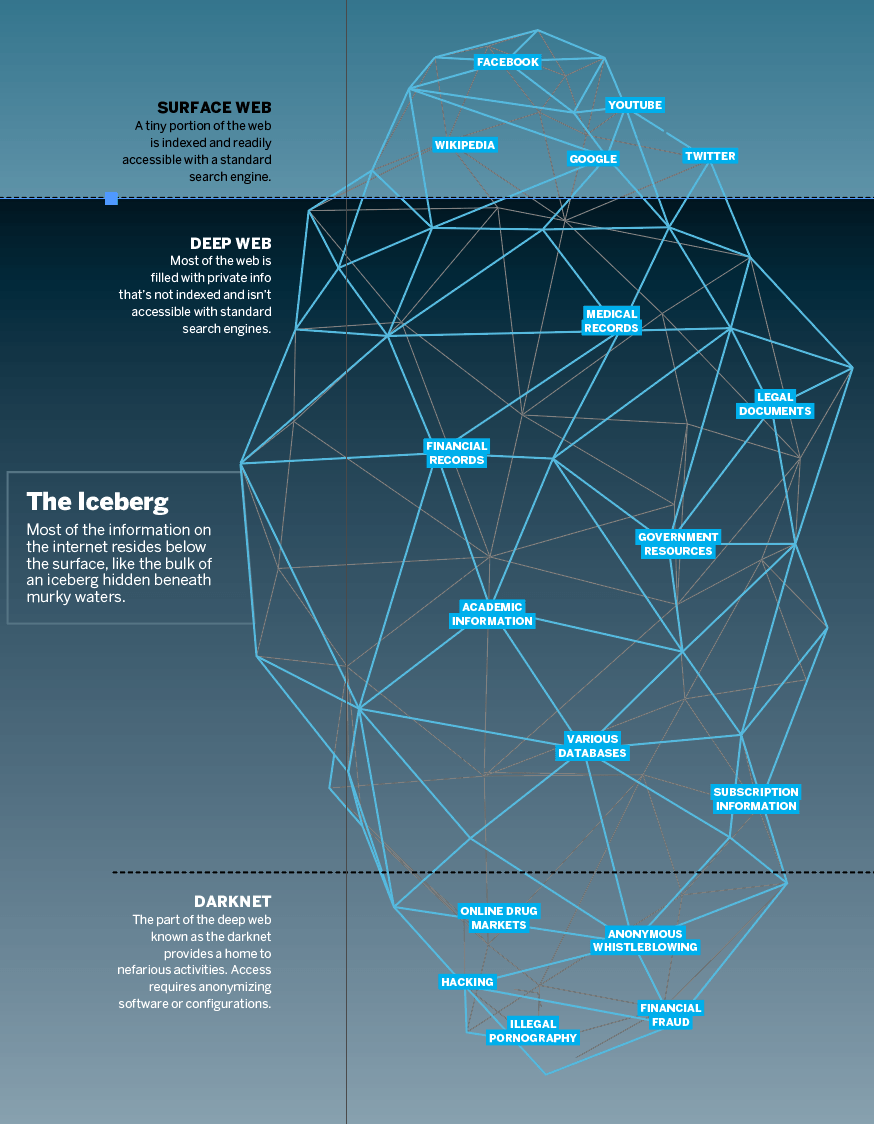

Cloud infrastructure in the AI era

To appreciate CoreWeave’s appeal, consider the importance of AI cloud infrastructure. Unlike most cloud setups, which can manage general-purpose computing needs, AI cloud infrastructure requires specialized hardware and software. Central to this are GPUs—like Nvidia’s A100, H100 and Blackwell models—engineered to handle the immense parallel processing power for artificial intelligence applications. CoreWeave’s infrastructure integrates these GPUs with advanced data storage and ultra-fast transfer systems, enabling companies to process large datasets in real time and respond to demands for scale.

AI cloud infrastructure is reshaping both AI and data centers. By providing companies with tools to manage compute-heavy tasks without building costly on-site systems, it has democratized access to AI. This infrastructure has enabled companies from startups to huge enterprises to innovate on a global scale, often blurring the boundaries between data center and AI development. CoreWeave is one of the few providers embracing this niche directly, offering on-demand, GPU-accelerated computing to clients with specific high-performance needs, from autonomous driving research to complex natural language processing.

CoreWeave is operating 14 data centers in the U.S., CoreWeave and plans to double that number by the end of this year. It’s expanding its global presence through a recent partnership with EcoDataCenter in Sweden to deploy thousands of Nvidia Blackwell GPUs to meet growing European demand for AI. Similar initiatives are expected in Norway and Spain.

Backed and empowered by Nvidia

CoreWeave’s rapid rise and competitive advantage lie in its strategic partnership with Nvidia. As one of Nvidia’s closest collaborators, CoreWeave has been designated an elite cloud service provider (CSP) in the Nvidia Partner Network, a title that underscores its commitment to providing GPU-accelerated approaches to AI, machine learning and the work of rendering applications. Nvidia has also invested more than $100 million in CoreWeave, a show of confidence in their shared vision.

The partnership enables CoreWeave to offer one of the most comprehensive selections of Nvidia GPUs in the market. With more than 10 Nvidia GPU models available on its platform, CoreWeave ensures clients—from AI researchers to visual effects studios—can have access to the computing resources needed for their workloads. This focus on “right-sizing” computing options, as CoreWeave describes it, reflects an approach that balances performance with cost-effectiveness, offering alternatives up to 80% less expensive than other cloud providers. This flexibility and affordability have positioned CoreWeave as a specialized alternative to larger, generalized cloud providers.

Beyond access to hardware, Nvidia’s support has helped CoreWeave grow rapidly, from three data centers in 2023 to a projected 28 by the end of this year. By collaborating with Nvidia, CoreWeave can stay on the cutting edge of GPU technology, providing powerful resources like the Nvidia Blackwell and A40 GPUs. Nvidia’s endorsement as CoreWeave’s first Elite CSP for compute signifies more than just a supplier relationship; it’s a testament to CoreWeave’s dedication to building a robust, high-performance infrastructure that prioritizes client needs and evolving industry standards.

Growing client list and revenue potential

CoreWeave has rapidly expanded its client base, securing contracts that demonstrate its role in AI infrastructure. Notably, Microsoft has committed to spending nearly $10 billion between 2023 and 2030 to rent servers from CoreWeave, highlighting the company’s capacity to meet the substantial computational demands of tech enterprises.

Beyond Microsoft, CoreWeave has established partnerships with other prominent organizations. For instance, it has signed 12-year contracts with Core Scientific, a leading bitcoin miner, to provide approximately 200 megawatts of infrastructure for high-performance computing services. These agreements are projected to generate over $3.5 billion in cumulative revenue for CoreWeave, averaging around $290 million annually.

While specific details about other clients remain undisclosed, CoreWeave’s contract portfolio is substantial. The company has informed investors that its total signed contracts amount to $17 billion, indicating a diverse and robust customer base. This extensive portfolio has driven remarkable revenue growth, with projections indicating a surge from $440 million in 2023 to approximately $2.3 billion in 2024. One report suggests the company’s revenue could quadruple from there in 2025—toward $8 billion.

As CoreWeave prepares for its anticipated IPO, its impressive client roster and robust revenue outlook position it as a formidable contender in the AI cloud infrastructure market. The company’s ability to secure long-term, high-value contracts with industry leaders demonstrates its capacity to deliver specialized, scalable solutions tailored to the evolving needs of the AI sector.

Previous funding and future IPO

CoreWeave’s ascent has been fueled by a series of bold funding rounds. In August 2023, the company secured $2.3 billion in debt funding, backed by Nvidia chips as collateral, attracting prominent investors like Magnetar, Blackstone and BlackRock. This was followed by a milestone equity round in May 2024 that valued CoreWeave at $19 billion, alongside an additional $7.5 billion in debt financing. By October 2024, CoreWeave had gained further momentum with a $650 million credit facility led by Goldman Sachs, JPMorgan and Morgan Stanley.

In total, CoreWeave has amassed $12.7 billion in funding over the last 18 months, making it one of the best-capitalized players in AI infrastructure. With an initial public offering planned for the first half of 2025, the company is positioned to enter the public markets at a time of heightened investor enthusiasm for AI-driven cloud solutions. The IPO, with Morgan Stanley, Goldman Sachs and JPMorgan as lead underwriters, aims to fuel CoreWeave’s expansion and capitalize on the surging demand for specialized, AI-ready cloud services. This combination of high-profile backing and a targeted focus on GPU-based computing distinguishes CoreWeave from more generalized data infrastructure providers.

Given that CoreWeave is a private company, assessing a precise valuation remains challenging because it is not required to release quarterly financial information. When this information becomes available to the public, however, it will provide a clearer view of CoreWeave’s financial performance and potential market value, offering deeper insight into the company’s growth trajectory and revenue potential.

For now, CoreWeave stands as one of the most compelling stories in AI infrastructure. With its specialized focus on AI-driven cloud services, a formidable financial base and strategic alliances, CoreWeave’s forthcoming IPO promises to be a defining moment—not just for the company but for AI and data centers. Nvidia’s endorsement amplifies investor anticipation, underscoring CoreWeave’s growing influence in AI infrastructure. As it prepares to enter the public market, CoreWeave is setting a bold new benchmark in computational power and scalability, reshaping what’s possible in AI-enabled cloud services.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. He is a frequent contributor to Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.