It’s Not Easy Being Green

Lawyers, lobbyists, legislators and lizards impede America’s transition to electric vehicles

Environmentalists are seeking to curb carbon emissions, Congress issues tax credits to encourage Americans to buy electric cars, and regulators have nixed natural gas leases and banned drilling for oil on public lands.

It’s all in pursuit of a green utopia where everything is electrified and 15-minute cities are free of downtown pollution.

But this all-encompassing transition isn’t going to happen in the expected time frame. In fact, we might never achieve it.

Gas-guzzling conveyances aren’t the only reason. Yes, a sizable chunk of the citizenry is choosing internal-combustion over battery-powered transportation. But federal regulation, global supply chain issues and questionable American lawsuits are combining to render the green revolution impossible.

It’s been two years since Congress passed the huge Inflation Reduction Act, but it’s hard to tell where money is going and who’s getting it—except for one big winner. Lawyers. But we’ll come back to them.

Russia and China and Congo … Oh my

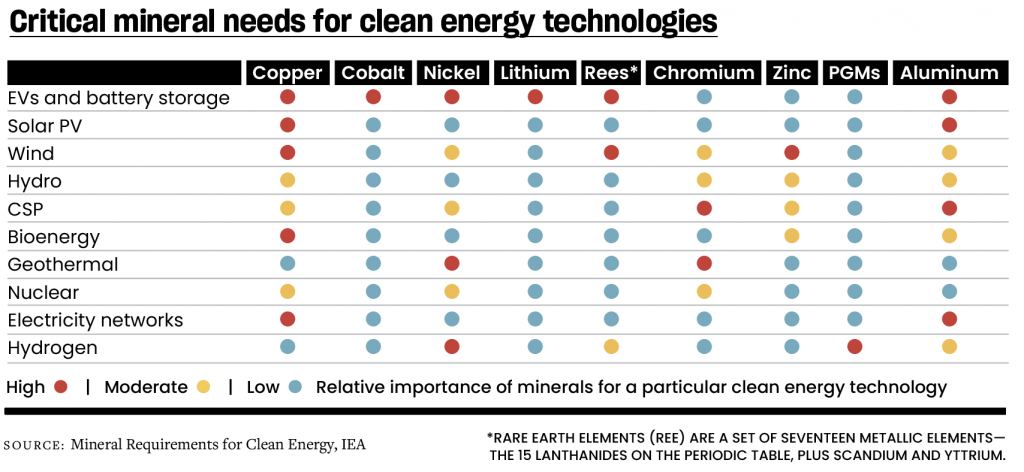

Let’s look at the big picture. The green transition needs an incredible quantity of minerals—at least three times the amount of copper produced annually, for example. These numbers come from geopolitical strategist Peter Zeihan.

On a global scale, producing nations have never doubled their output of any metal in a decade. The 3X figure for copper is the lowest of the production requirements listed on the table accompanying this article. It applies to at least 14 metals needed for the green transition in different sectors of the alternative-energy world.

The switch to green living requires at least four times the chromium, 10 times the lithium, 10 times the nickel, 10 times the cobalt and 18 times the graphite now produced, Zeihan said in a 2023 presentation.

It turns out Russia is a top producer of these commodities, and it’s difficult to ramp up production in a war zone.

China, a top supplier of global rare earth materials, has taken over the supply chain for solar panels and other major goods.

At the same time, China has benefited from America’s Inflation Reduction Act. Before the act, the U.S. imported about $2 billion in Chinese lithium-ion batteries in 2020, according to U.S. Census data. By 2023, that figure exploded to $13 billion.

Lawyers and lizards

The Bipartisan Infrastructure Law and the Inflation Reduction Act showed the need to make critical EV materials in the U.S. That includes domestic refining, processing and manufacturing. But last year, the biggest challenges in mineral extraction became even more difficult.

Still, a lack of materials isn’t holding back America’s mineral and energy production. Instead, it’s mired in regulation and legal problems.

First, participants spent too much time waiting for guidance from regulators. Business leaders understandably wanted to know about qualification criteria and tax credits before committing themselves to action.

Second, we saw the rise of “sue and settle.” Ballotpedia says the phrase “describes cases in which a federal agency is sued by an interested party, declines to defend itself in court and negotiates a settlement with the plaintiff in a non-adversarial process.”

It’s keeping lawyers wealthy while putting America’s energy security on the sideline, some observers say. Some even contend “sue and settle” provides a backdoor method for advocacy groups and federal agencies to shape policies outside of traditional lawmaking.

In recent years, “sue and settle” tactics have targeted key parts of the energy transition. Some cases have led to policy shifts, and others have delayed production. But no matter what, taxpayers shoulder the cost of defending the government in these cases.

Cases that slowed EV-related production include one against lithium mining that threatened a rare flower species in Thacker Pass, Nevada. In another, the Center for Biological Diversity (CBD) sued to halt oil and gas production because of an endangered lizard species native to the Permian Basin in West Texas and southeastern New Mexico.

The CBD has tried to stop Navy and Air Force training and sued over the construction and expansion of military bases, according to Common Sense America (CSA), a right-leaning nonprofit promoting government policy. CBD also sued the U.S. space program, taking the Federal Aviation Administration to court over SpaceX, according to a CSA press release.

Critics note about 30% of the CBD’s 170 employees are lawyers.

“Sue and settle” cases declined drastically between 2016 and 2020 but came roaring back in 2021.

But the Sierra Club argues the cases labeled “sue and settle” serve constructive purposes like compelling the EPA and other federal agencies to take timely action on regulations. The suits have been unjustly maligned,

according to the club’s website.

Either way, some promising news is emerging.

Hope in Wyoming?

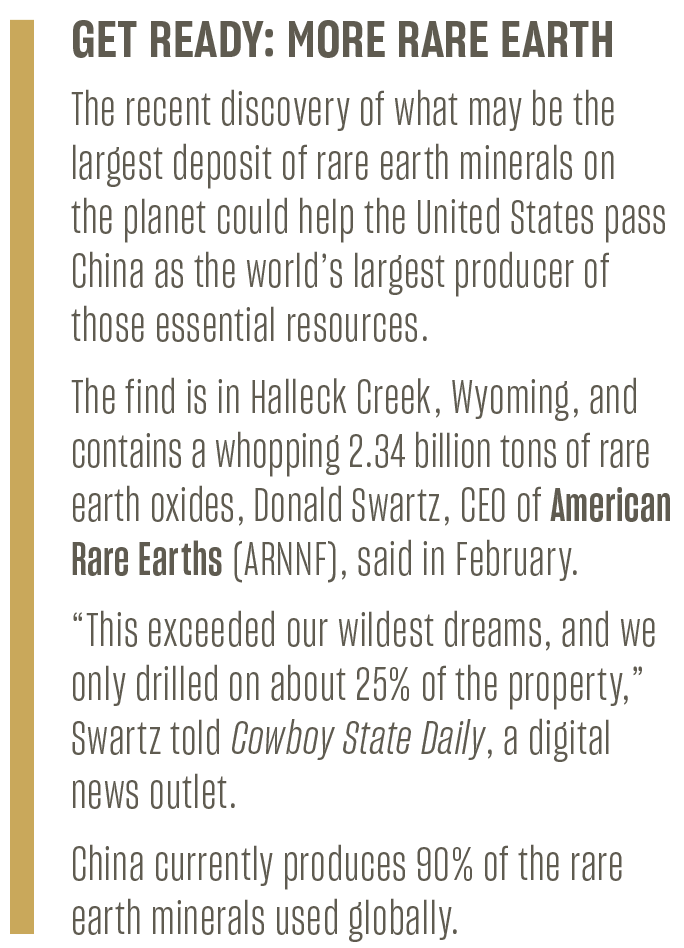

A measure of optimism emerged for America in recent weeks with the discovery of a large cache of the rare earth metals in Wyoming. (See sidebar, lower left.) This find could eventually rescue the nation from dependence on China for EV batteries.

The path to extracting minerals is rife with challenges. Environmental regulation, community concerns and indigenous rights come into play. Moreover, the specter of “sue and settle” looms large.

The discovery in Wyoming could become the latest target for legal action. How will America’s rare earth mining and electric vehicle production ever get off the ground if we can’t even get under it?