Meet the SPAC: IPO 2.0

What investors need to know about the recently resurrected investment structure

For decades, the Russian proverb “Trust, but verify” has guided the United States in its dealings with the Soviet Union and Iran. Today, the same principle applies to SPACs, the special-purpose acquisition companies formed to take private entities public.

Investors hand over cash to SPACs because the sponsors assemble trusted executive teams to identify undervalued assets or forge associations with celebrities. Fortunately, investors who decide they don’t like the company a SPAC targets for acquisition have the right to reclaim their funds and pull out of the deal with no questions asked.

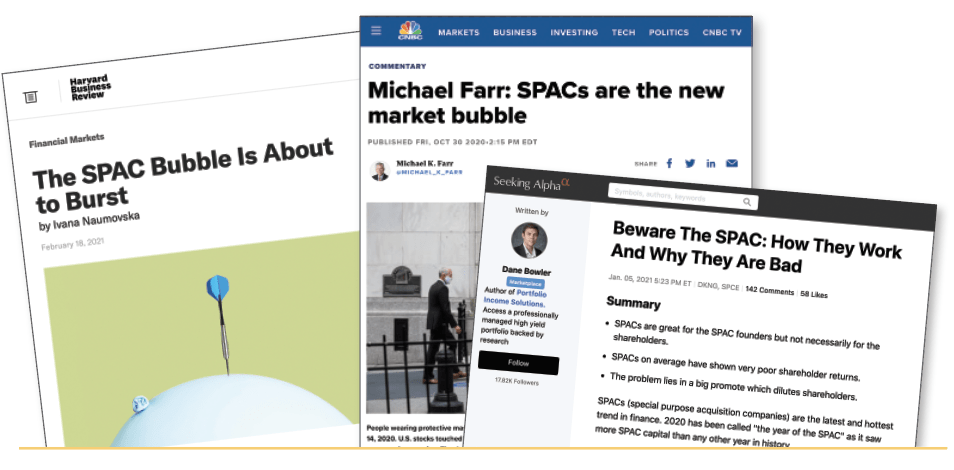

Still, some observers deem that safety valve insufficient. They complain that SPAC sponsors want a blank check to buy an unknown asset. They decry SPACs as a boon for early investors and a boondoggle for later investors. Even the Securities and Exchange Commission is weighing in with warnings about celebrity-endorsed SPACs.

The truth, it would seem, lies elsewhere. But regardless of one’s point of view, the wild resurgence of interest in SPACs has been something to behold.

And now Luckbox sorts out the details in this special section on SPACs, which some regard as IPO 2.0. Coverage begins with an explanation of why financiers developed the investment vehicle and how it works.

The author of another article dispels baseless but damaging myths about SPACs. The report begins and ends with WeWork.

Busting another myth, Luckbox demonstrates that celebrities who lend their names and reputations to SPACs often offer more than a pretty face or familiar persona. Many who became famous as sports or entertainment figures also have valuable business experience that can inform potential deals.

Members of another SPAC-related group have achieved something akin to celebrity status solely on the basis of their work in finance. They’re well-represented in this section in interviews with lawyer Doug Ellenoff, the reputed “King of SPACs,” and ETF manager Mark Yusko, founder of Morgan Creek Capital Management.

The section finishes big with an op-ed piece on how and why SPACs get an undeserved bad rap in the media. But this issue’s SPAC coverage doesn’t end there. Check out the Trends, Trades and Tactics sections for more articles on one of the biggest stories in investing.

Click here to read about how SPACs work and to see the SPAC timeline.