Passage of the SAFE Act Could Trigger a Rally in Cannabis Sector

The cannabis sector has been trending lower for almost six months, but a forthcoming Senate vote on the SAFE Act could provide a much-needed boost for the industry.

The legal cannabis industry is expected to rake in more than $30 billion in sales during 2023. And by 2028, that figure could exceed $50 billion, which would put it on par with the coffee industry, which pulls in roughly $48 billion annually.

No matter how you cut it, that’s a lot of moolah. And one of the biggest complications for cannabis-focused companies has been where to stash that cash. But in the near future, that issue may finally be resolved.

Full legalization of cannabis at the federal level isn’t expected to occur anytime soon, but on May 11, 2023 the U.S. Senate is expected to vote on the Secure and Fair Enforcement Banking (SAFE) Act.

Enactment of the SAFE Act would finally open the federally-regulated banking system to any business operation that’s licensed under state law—including cannabis-orientated businesses. The legislation is necessary because traditional financial institutions aren’t currently able to facilitate cannabis-related transactions because marijuana is illegal at the federal level.

The U.S. House of Representatives has passed the SAFE Act on seven previous occasions, but each time, the legislation failed to pass the Senate. This time around, the SAFE Act is once again expected to pass a vote in the House of Representatives.

The big question, once again, is whether there’s enough support for the bill in the U.S. Senate. And that won’t be known for certain until after the votes are cast.

However, reports indicate that a bipartisan group of Senators has been working hard to find a path forward for this legislation, and as a result, it’s believed that right now the SAFE Act has its best chance of clearing the Senate. To wit, the SAFE Act is supported by the American Bankers Association, as highlighted in the tweet below.

In a somewhat counterintuitive fashion, a split Congress actually serves to help the Safe Act, because, in such an environment, the only legislation that receives meaningful consideration (i.e. a floor vote) is that which enjoys a degree of bipartisan agreement.

When one party controls all of Congress and the White House, there’s a constant barrage of legislation coming to the floor which leans in spirit toward the side that’s in control. A split Congress basically serves as a deterrent for legislation that’s heavily soaked in one philosophy or the other.

For this reason, the Marijuana Opportunity, Reinvestment and Expungement (MORE) Act, which would fully legalize cannabis at the federal level, probably won’t see a vote in 2023.

On the other hand, a split Congress has provided a window of opportunity for the SAFE Act, as well as its cousin, the Clarifying Law Around Insurance of Marijuana (CLAIM) Act, which would provide safe harbor to insurance companies that work with legal cannabis businesses.

The CLAIM Act was filed in the House and Senate at the end of April, only a day after the SAFE Act. The CLAIM Act could be voted upon in the near future, as well.

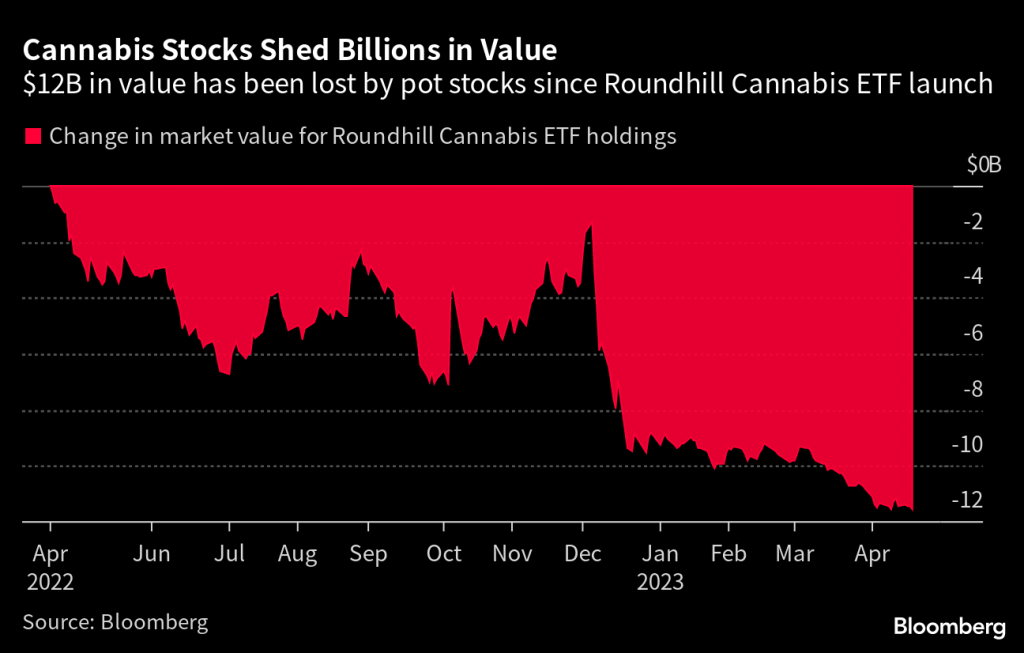

The successful passage of the aforementioned bills could give the cannabis sector a much-needed boost, because cannabis-related stocks have been trending lower for almost six months.

Key 2023 Cannabis Advancements at the State Level

Looking beyond cannabis reforms at the federal level, the legalization effort of cannabis at the state level continues to steadily chug forward.

In 2023, three new states have already legalized recreational marijuana, including Delaware, Missouri and Maryland.

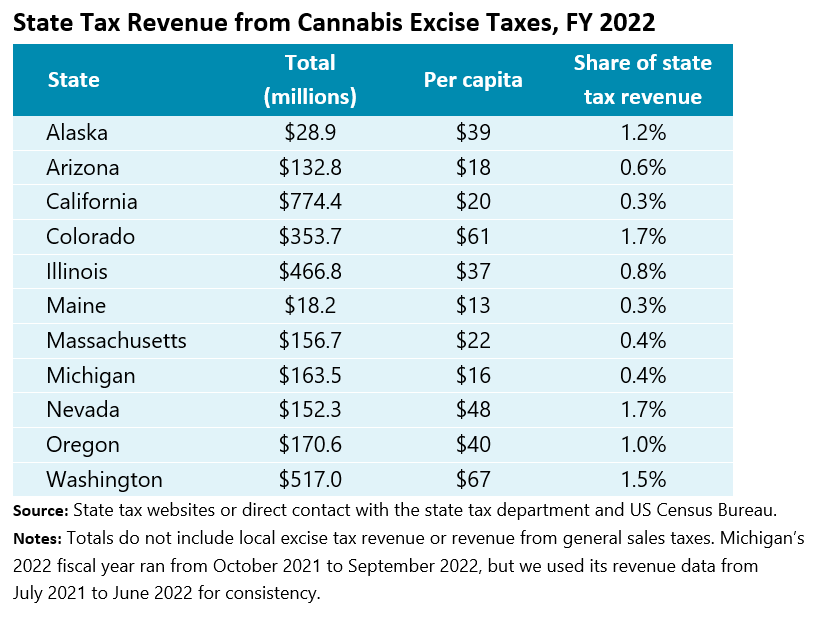

Last year, legalization states generated roughly $3.77 billion in cannabis-related tax revenue. That figure was down slightly from 2021, but is expected to rebound again in 2023.

According to a report compiled by the Urban Institute, California, Washington, Illinois and Colorado brought in the most revenue from cannabis-related taxes in 2022. California collected roughly $775 million last year, while Washington, Illinois and Colorado all brought in $517 million, $466 million and $353 million, respectively, as highlighted in the graphic below.

Missouri started selling legalized recreational cannabis products in early February, and sales have already exceeded expectations. During Missouri’s first full month of sales activity, the state recorded $72 million in revenue, which was about $33 million more than Illinois collected during its first month.

Missouri appears to be benefiting from “cannabis tourism,” which occurs when residents of states that haven’t legalized marijuana travel to a nearby state that has legalized the drug for recreational purposes. Missouri also appears to be benefiting from a lower-than-average price point.

In February 2023, a report compiled by Cantor Fitzgerald indicated that the median price for one-eighth of an ounce of marijuana in Missouri was $36, as compared to $50 in Illinois.

Pablo Zuanic, who helped author the report, said the Missouri market could produce $1.6 billion in total sales during the next three years, and that “Missouri will have lower prices (and lower taxes) and more stores than Illinois.”

Currently, Illinois sells about 30% of its cannabis to out-of-state shoppers, but that figure is expected to decline going forward. Residents of Iowa and Tennessee are viewed as especially tenuous in the Illinois market going forward, considering the proximity and price of cannabis in Missouri.

Looking ahead, the states viewed as most likely to legalize recreational marijuana next are Florida, Minnesota, Ohio and Pennsylvania. Florida is expected to add a proposed constitutional amendment to the 2024 ballot that would allow residents to decide whether recreational marijuana should be legal in the state.

Considering recent positive momentum at the state level, as well as the upcoming Senate vote on the SAFE Act, the cannabis industry could be in focus on Wall Street in the coming days and weeks.

To track and trade ongoing developments in the cannabis sector, investors and traders can add the following symbols to their watchlists:

- Acreage Holdings (ACRHF)

- AdvisorShares Pure US Cannabis ETF (MSOS)

- Alternative Harvest ETF (MJ)

- Amplify Seymour Cannabis ETF (CNBS)

- Aurora Cannabis (ACB)

- Ayr Wellness (AYRWF)

- Canopy Growth (CGC)

- Cronos (CRON)

- Global X Cannabis ETF (POTX)

- Green Thumb Industries (GTBIF)

- Innovative Industrial Properties (IIPR)

- OrganiGram Holdings (OGI)

- Sundial Growers (SNDL)

- Tilray Brands (TLRY)

- Trulieve Cannabis (TCNNF)

- Verano Holdings (VRNOF)

- AdvisorShares Pure Cannabis ETF (YOLO)

For more background on the cannabis trade, readers can review this installment of Market Measures on the tastytrade financial network. To follow everything moving the markets, readers can also tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastylive or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.