SpaceX’s Tender Offer Will Make it the Most Valuable Aerospace and Defense Company in the U.S.

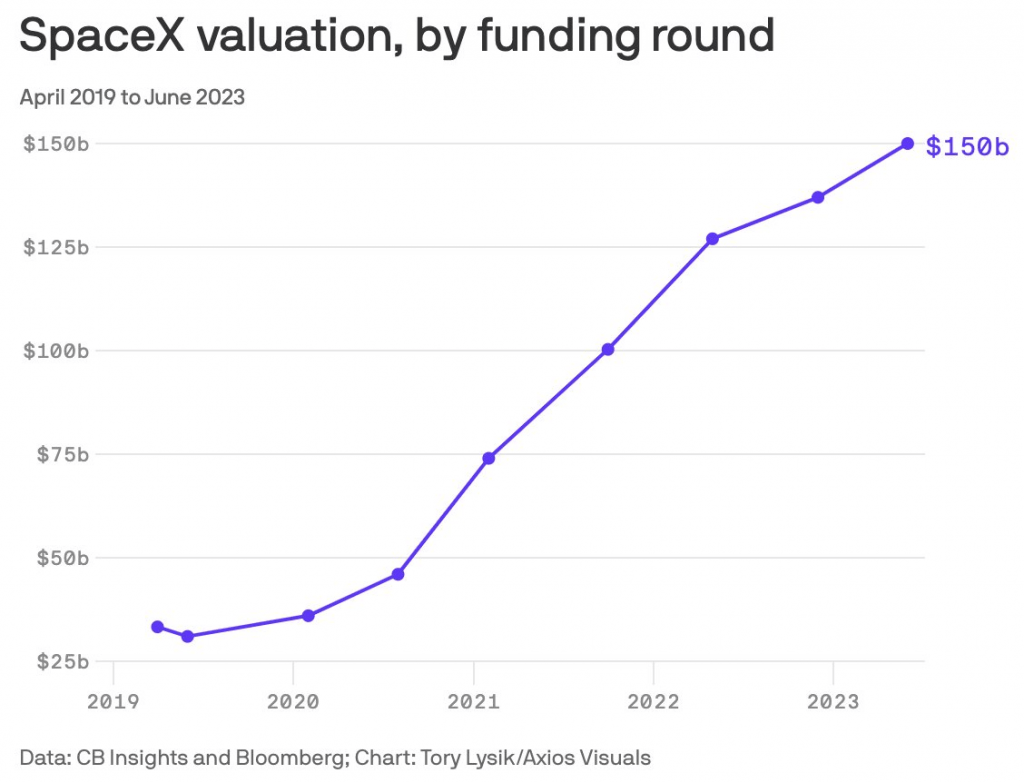

SpaceX is reportedly pursuing a tender offer, which could increase the company’s valuation to $150 billion, making it the most valuable company in the global aerospace and defense sector

Fundamentals play a key role in the financial markets, but so do psychology and sentiment.

That truth was laid bare by the “meme stock” craze, which illustrated how social media hype can play a major role in the modern financial markets. After all, hype is essentially what drives the fear of missing out, or FOMO, investing/trading philosophy.

From this perspective, one can see why SpaceX enjoys such a captivated audience in not only the mainstream news, but also in the financial markets.

The company has single-handedly revived the U.S. space industry, and in doing so has revitalized the possibilities and opportunities offered by the cosmos. Moreover, the company perfectly embodies the American pioneering spirit, and in many ways, the future potential of humanity.

SpaceX’s official slogan could easily be borrowed from the title of an original Star Trek episode (season 1, episode 3), “Where No Man Has Gone Before.”

Elon Musk, founder of SpaceX, has stated that one of the company’s goals is to colonize Mars. In the meantime, SpaceX will play a key role in the next major NASA missions, which will deliver American astronauts back to the surface of the moon.

It’s extremely difficult to not get lost in the possibilities. And if SpaceX ever conducts an initial public offering (IPO), it will undoubtedly be one of the most anticipated in history.

However, for investors and traders, the harsh reality is that one day in the near future, SpaceX will need to deliver as a profitable business enterprise, and not just as a vessel for the hopes and dreams of humanity.

In that regard, SpaceX can’t just keep selling pieces of the company to fund ongoing operations.

Lockheed Martin (LMT) serves as a good example of a company that has embraced the possibilities of space, while also ensuring that its annual revenues exceed its annual expenses. Profitability, after all, is a key driver of not only the underlying value of a company’s shares, but also its ability to reinvest in itself.

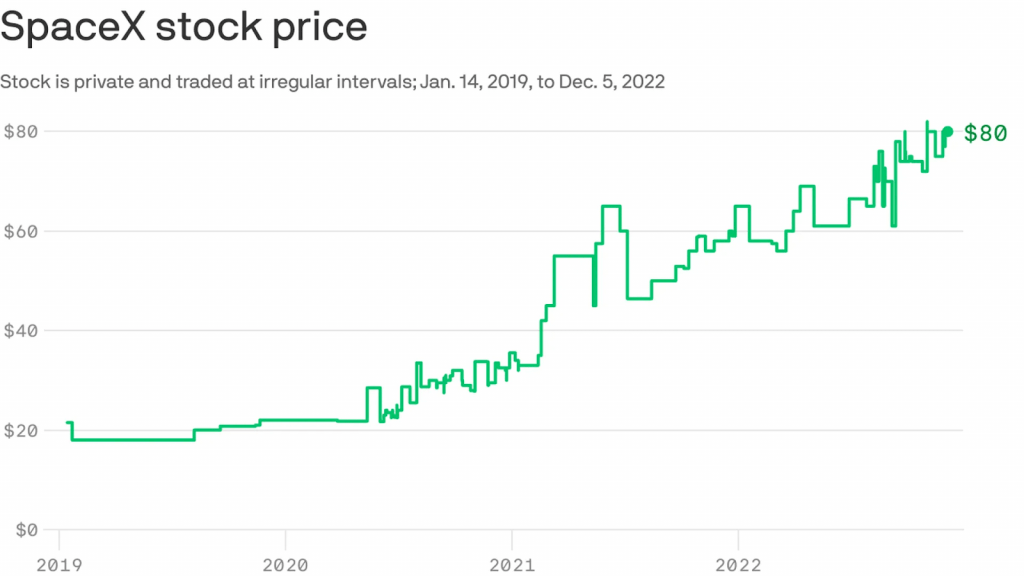

Interestingly, SpaceX is reportedly pursuing a tender offer involving the sale of employee shares that could bump its valuation from $137 billion to $150 billion. SpaceX last sold shares in January of this year for $77/share, while the upcoming tender offer is reportedly for $81/share.

But, the details of the tender aren’t yet finalized and could change based on buyer/seller (investor/insider) interest.

If successfully executed, however, the tender offer will make SpaceX the most valuable company in the global aerospace and defense industry, even though it currently produces far less revenue than many of its competitors.

Raytheon (RTX) is currently valued at $141 billion, while Boeing (BA) and Lockheed Martin (LMT) are valued at $125 billion and $115 billion, respectively.

The SpaceX value proposition

Prior to the announcement of the latest tender offer, SpaceX was valued at roughly $137 billion, with some estimates suggesting the company pulled in about $4.5 billion in revenue last year. In comparison, Raytheon is valued at $141 billion, and produced $67 billion in revenue during 2022.

That disparity in valuation suggests investors believe revenue growth at SpaceX will rapidly expand at some point in the near future. That’s the only way one can rationalize the company’s current valuation.

One of the key drivers of future revenue growth in SpaceX relates to the company’s satellite launch services. For external customers, SpaceX charges somewhere between $60 and $100 million per launch, depending on the size of the rocket used in the mission.

Because it’s a private company, SpaceX isn’t required to disclose financial data to the public. However, it does theoretically release some of that information to potential investors and other insiders.

In an article for PayloadSpace.com, writer Mo Islam estimated that 2022 launch revenues at SpaceX were in the neighborhood of $2.5 billion. That’s on top of the revenue produced by the Starlink division (aka satellite-based broadband), which is estimated to have been somewhere between $1 billion and $2 billion in 2022.

Added together, those figures represent the vast majority of SpaceX’s total revenues in 2022, which means the future potential of those two divisions will be a key driver of SpaceX’s ongoing valuation. And in 2023, Islam projects that total revenue at SpaceX could rise above $10 billion, representing an increase of more than 100% from the 2022 level.

That said, the hard numbers aren’t necessarily the only consideration when it comes to SpaceX’s valuation. The company’s ability to deliver on the NASA missions, and its other ambitions, will also dictate the future market capitalization of SpaceX.

That’s where hype and sentiment come into play.

Source: Axios.com

Trading in SpaceX’s privately-held shares

In recent years, the privately-held stock of SpaceX has been a relatively hot commodity.

Since the company was founded in 2002 through the end of 2022, SpaceX raised a total of $9.8 billion over the course of 32 different rounds of financing. And at the beginning of this year, SpaceX raised another $750 million, which yielded the company’s current valuation of $137 billion.

But the capital raising activity hasn’t come without a cost. According to a recent report by the Wall Street Journal, Elon Musk’s stake in SpaceX recently dropped to just 42%, as compared to 54% in 2016. Musk still maintains 80% of total shareholder voting rights, though.

Importantly, much of the company’s valuation growth also occurred in the last several years. In May 2019, SpaceX’s valuation was estimated at around $33 billion.

At current levels, there’s an argument to be made that SpaceX’s valuation has been stretched.

Along those lines, recent trading activity in the market for privately-held SpaceX stock reveals that investor interest in the company appears to have slowed since SpaceX last raised capital in January. At least that’s the view of Glen Anderson, who runs Rainmaker Securities, one of the many platforms used for trading privately-held securities (the shares of private companies that are held by insiders).

Commenting on the broader market environment for SpaceX’s non-public stock, Anderson recently told Barrons, “We have a decent-sized book on both sides of the trade right now.” However, in Anderson’s opinion, buyers aren’t currently willing to pay up, and sellers aren’t currently willing to come down.

Anderson added that for the first time in recent memory, large blocks of SpaceX stock had been sitting untouched for an unusually long period of time.

The upcoming tender offer will therefore serve as a referendum on the company’s current valuation. And the next Starship test launch may dictate whether interest in SpaceX’s privately-held shares remains strong.

In the wake of the first test launch, Musk suggested it would only be a few months until the next Starship launch occurred. But more than two months have passed, and Musk is now hedging on a firm date for the next launch—the CEO of SpaceX recently indicated it could be another 6-8 weeks away.

Unfortunately, these delays will likely create a domino effect, and push back NASA’s lunar mission schedule, as well. Any additional setbacks, especially those of a material nature, could also throttle back interest in SpaceX’s privately-held stock.

To date, SpaceX has been able to grow its valuation based on investor excitement over the company’s future potential. But if the company’s path to consistent profitability doesn’t crystalize soon, then SpaceX’s lofty valuation could come back down to earth.

To follow everything moving the markets in 2023, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.