Gold is Starting to Shine

Gold prices have staged an impressive run since the middle of March. Could more gains lie ahead?

The March 2023 banking episode stemmed from the failures of Silicon Valley Bank and Signature Bank and the sale of Credit Suisse. It may be the most important systematic development in global financial markets since the U.S. credit rating downgrade in 2011.

Historically, stress in a country’s financial system loops back to concerns about the stability of sovereign debt or the viability of fiat currency. That can cause investors to seek alternative stores of value, and here are some possibilities they might consider.

Is an emerging market financial system under duress? If so, its emerging market (EM) currency will likely weaken relative to developed market (DM) currencies, like the British pound or the euro. What if a developed market financial system is facing pressure? The DM currency will likely depreciate relative to the more liquid DM currencies, like the Japanese yen or U.S. dollar.

But what happens when a banking episode occurs in the financial system of a more liquid DM currency? Market participants tend to look beyond the fiat currency world. The very perception that the U.S. financial system, the financial system of the world’s reserve currency, could be facing a 2008-redux, has been a potent bullish catalyst for precious metals—a trend that may continue over the next few months.

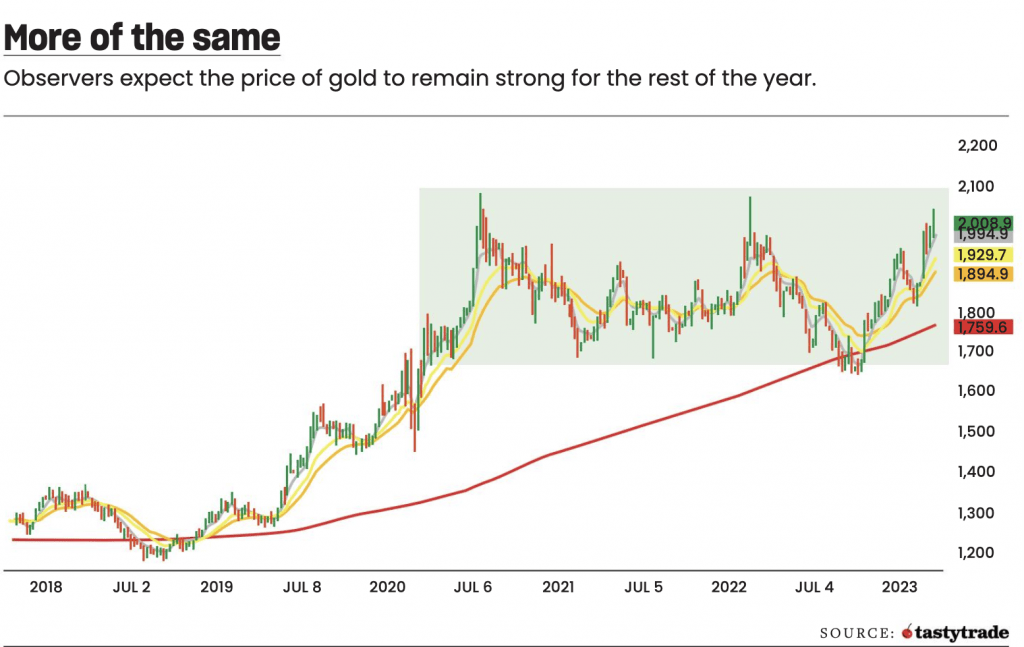

Gold prices have been strong this year, clocking a gain of approximately 11% year-to-date as of mid-May. Yet, that doesn’t tell the real story of the gains gold has accumulated since its low of $1,813.40 in early March.

The bigger technical picture suggests the rally has occurred during a sideways consolidation over the past three years. After an uptrend in late 2018 and 2019, this suggests the next significant directional move should be to the topside upon a breach of $2,089.20, the August 2020 all-time high.

Fundamental tailwinds support a bullish outlook for gold as well. In response to the March banking episode, U.S. Treasury yields have declined sharply by about 50 basis points across the curve. Lower U.S. Treasury yields have likewise eroded the U.S. dollar’s yield advantage, pushing the DXY Index (ETF: UUP) toward its yearly low.

But the kicker has yet to come: What will happen with the U.S. debt ceiling? With the X date approaching in June, a replay of summer 2011 may be around the corner. Granted, it’s possible lawmakers may find a way to prevent another summer 2011, perhaps by kicking the can down the road to 2024. That would place the next debt-ceiling confrontation just before the elections. Grab your popcorn! But no one should expect bipartisanship, even on important fiscal matters.

Stress in a country’s financial system loops back to concerns about the stability of sovereign debt or the viability of fiat currency.

Investors have two ways to try to take a bullish bias in gold prices given current market conditions. The simple method would be just to buy gold outright in the spot market. But the more advantageous trade may be heading to the options market, given how inflated volatility has been in gold. With an implied volatility ratio above 35 as of mid-May, gold was experiencing higher relative implied volatility than all bond, equity and currency futures contracts.

If you’re a bull, selling a put spread with strikes around the March 2023 lows in June gold futures contracts (/GCM3) may be one way to capitalize on high volatility.

Maybe you’re not a bull, and while you think that gold prices will stay elevated, you don’t foresee either a move to fresh all-time highs or a move to fresh yearly lows over the next few weeks. Directionally neutral strategies like an iron condor or short strangle might be the strategy you’re seeking, with strikes clustered around the August 2020 highs and March 2023 lows.

Christopher Vecchio, CFA, Head of Futures & Forex at tastylive, forecasts economic trends in a number of countries. @cvecchiofx