The Wall of ‘What, Me Worry?’

The repeated highs of recent years don’t guarantee stock prices will never again dip, crash or go sideways

In old Wall Street adage says that the stock market “climbs a wall of worry” into bullish territory, and that “bear markets slide down a slope of hope.” Mad Magazine’s Alfred E. Neuman is known for having said, “What, me worry?”

Perhaps the mixture of the Federal Reserve and monetary controls has taken the worry out of the market. Maybe S&P 500 Volatility Index readings of 30, 40 and 50 have become a thing of the past. Put options on stocks may soon be free.

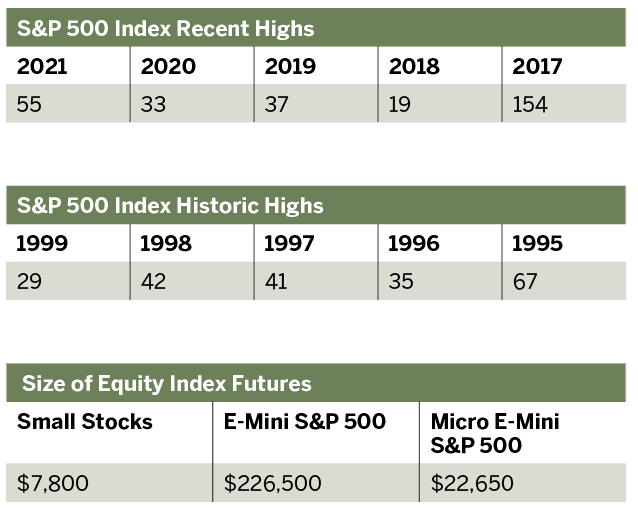

Well, none of that’s actually happening, but that isn’t to say fear of the end of prudence in the stock market is unwarranted. By mid-September, the S&P 500 made its 55th all-time high of the year.

That said, a slew of peaks stacked on top of each other isn’t a novel idea in 2021. In fact, savvy traders have come to expect a lot of new highs every year. (See “S&P 500 Index Recent Highs, below.”)

While selling all-time highs has been a rough strategy for the last half-decade, the cycle of stock movement that’s held for more than a century—simply put: up, sideways, down, repeat—would predict that a plateau and fall is coming. Take, for example, one of the last multi-year runs of many all-time highs: 1995-99.

That five-year span saw more highs in the S&P 500 Index than in the current stretch. Are equities on the precipice of a crash? (See “S&P 500 Index Historical Highs, below.”)

Staying small by selling stocks and futures can offer a low-cost (and, low-worry) outlet for either hedging a long stock portfolio or speculating on a crash, yet those low costs can reflect large size. Sprinkling in one or two small stock futures might be more appropriate than a Micro E-mini or E-mini future after a dozen new highs. (See “Size of Equity Index Futures, below.”)

There’s something enticing about selling a market that looks too expensive, and futures can help traders go down that road with relative ease. Just make sure to be able to see the end of it.

Pete Mulmat, tastytrade chief futures strategist, hosts Splash Into Futures on the tastytrade network.

@traderpetem