Pro Traders Know Probabilities Like Poker Pros Know Pot Odds

Many seasoned traders were not taken in by the meme stock hype

It’s not opposable thumbs, extra cranial capacity or the ability to walk on two feet that separates humanity from animals. It’s hype.

OK, maybe bees and ants let their friends know about the picnic. But humans have the unusual anti-competitive quality that spurs them to encourage others to buy something, or buy into something.

Hype has given humankind everything from printed books, light bulbs and Teslas to Pelotons and MacBooks. Hype got those products widely adopted and changed the way people live. Without hype, working as a monk scribe would be the hot gig job of 2022.

When it comes to trading and investing, though, hype is more of a mixed bag.

Hype in the markets comes in different forms, with sometimes less than productive results. One kind is the standard Wall Street analyst or CEO hype that touts all the great things a company is doing that will boost earnings and explains why everyone should buy the stock. Whether or not investors respond to this hype in the way the company hopes is debatable, and making a trading decision based on it is basically a guess.

Another more modern type of market hype is the online chat room. That’s where Redditors, for example, pile into a discussion and make a case for why a $10 stock should be $100, or a $200 stock should be $2. This type of hype seems effective if for no other reason than that traditional analysts and money managers hate it.

But chat rooms produce a type of market hype that might yield interesting trades. The reason is that at least a few of these online stock hypers have positions in the stock. They’ve bought some shares, or even long calls. Unlike most Wall Street analysts, they have skin in the game. So, their hype—if it gets more people to buy the stock—could benefit them financially.

Poker, and the concept of pot odds, is a close probability analog to chat room stock hype. Bluffing a poor poker hand is a type of hype intended to convince other players that a hand is stronger than it actually is. And because this article is all about probabilities, the strength of a poker hand is really its probability of being better than other possible hands.

Because a 52-card deck has a defined, albeit large, number of possible five-card combinations, players can quantify the probability of various hands. The probability of combining one hole card with the cards on the table in a game of Texas Hold ‘Em to get one pair (a relatively low-value hand) is higher than combining both hole cards into a full house

(a relatively high-value hand).

A deck of 52 cards has about 2.5 million possible combinations of five-card hands. A little over 50% have no value in a poker game, unless the game ends in a contest where the player with the highest card wins. And while even 1.25 million hands would be hard to evaluate, a basic knowledge of how frequently two Kings or two Hearts are dealt as the hole cards (2 in 221, or .905%), as well as the probability of the hands that can be created with the community cards, gives a player an idea that a particular hand will beat the other players’ hands. In poker, the practical application of that probability is pot odds.

Pot odds combine the probability of a hand winning with the size of the next bet (the call) and the total pot. If the pot is large, the call is low relative to the pot, and the probability of a hand is high, then the pot odds for the hand are high. It’s worth taking the risk of continuing to play a hand. High pot odds are no guarantee of winning a poker game, but as with trading, playing a high number of games in which a player has high pot odds will likely result in that player winning a majority of the games.

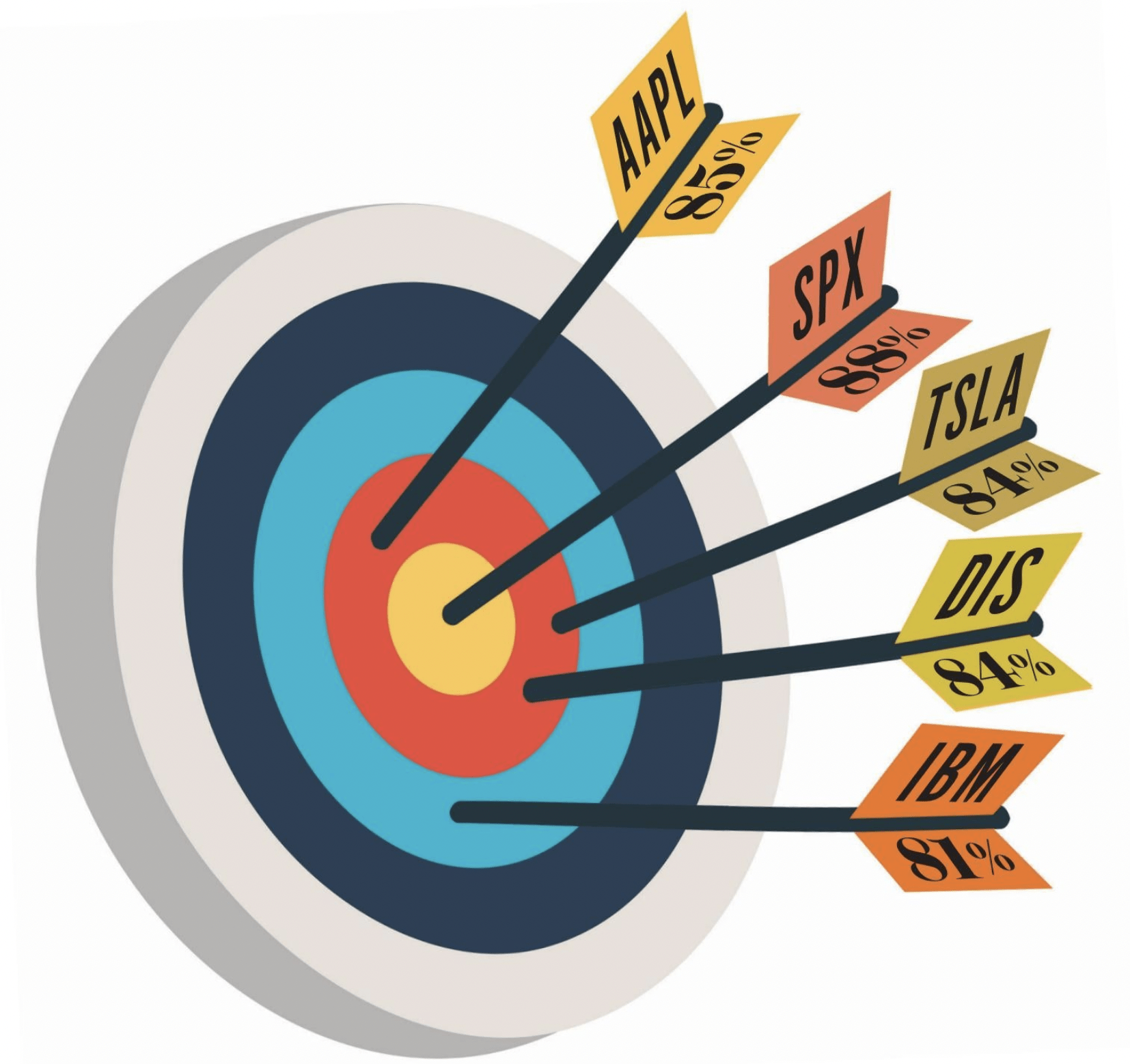

In trading, stock prices theoretically have more than 2.5 million potential outcomes, but the probability of moving higher or lower at any time is 50%. Yet with a Reddit-driven stock, where an online community is hyping a low-priced stock to buy or a high-priced stock to short, sometimes the pot odds can favor an up move or a down move.

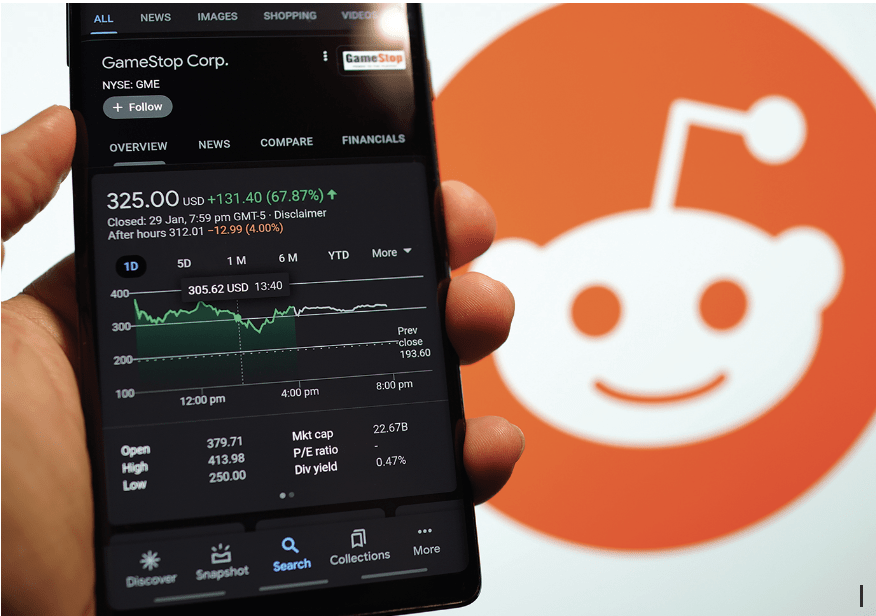

For a stock to keep moving higher, investors and traders need to step in and buy it at those levels. At some point, they’ll stop stepping in, and that may cause the stock to fall. Consider GameStop (GME), hyped on the Reddit boards in early 2021. When GameStop was still $16 and was being hyped online as “too cheap,” there was a theoretical 50/50 chance it would go higher or lower. But its relatively low price and the magnitude of the potential upside if the hype “worked,” meant the “pot odds” favored the upside.

GameStop went from about $16 to $500 in about five days. At $500, there was still a 50/50 chance it would go higher or lower. But with the online hypers getting paid and likely selling their positions, the pot odds favored the downside. The stock then fell and gave most of its rally back over the following five days.

This is a case of “buy the rumor—sell the news,” and it doesn’t work for every low-priced stock or for every stock on the Reddit boards. But as with poker, making small low-risk, high-potential-reward trades in stocks that have had a big move up or down can put the odds in a trader’s favor.

Tom Preston, Luckbox contributing editor, is the purveyor of all things probability-based and the poster boy for a standard normal deviate.