The Tick is the Trade

… and Other Essential Trading Advice

A pro trader dissects the three pillars to successful active investing

Everyone who trades options wants to make money doing it. But how does someone reach that goal? A lot of strategies, techniques and products might work. Or not.

Yet, three ideas can tilt the odds in favor of becoming a profitable trader, and they apply to everyone—no matter the strategy or product. Let’s call them the “Three –itties:” liquidity, volatility and probability.

Liquidity

The worst advice for a new trader usually comes in the form of a question: “What do you want—the tick or the trade?”

The idea is that if a trader feels bullish on a stock and wants to short a put that has a bid price of $2.00 and an ask price of $2.02, an order to sell it for $2.01 might not get filled.

If the stock rallies, the put’s price might drop from $2.00, to $1.50, to $.75 and lower. Fighting for a $.01 advantage could cost profits. So, why not just hit the $2.00 bid and get in the trade?

In 30 years of working as a floor trader, hedge fund manager, and now retail trader, I learned that the tick is the trade.

The bid/ask spread in a stock or option is a measure of the “edge,” or advantage, that a market maker has when a customer buys something at the ask price or sells something at the bid price. The edge to a market maker is a cost to the retail trader.

So, an order to sell that put for $2.01 would keep that edge, that cost, to a minimum. For perspective, selling an option for .01 less amounts to $1.00. The same is true for 100 shares of stock.

That doesn’t sound like much, but over the course of a year, a retail trader who’s engaged with the market might make more than 1,000 opening and closing options trades.

Giving up .01 edge on each option would amount to giving the market $1,000. That’s $1,000 shaved off your account that has nothing to do with the quality of your trade decisions

Liquidity is a measure of how efficiently a trader can execute trades and keep the edge to a minimum. Narrow bid/ask spreads and high trading volume and open interest mean a trader can work an order to buy or sell an option in between the bid/ask and have a good chance of getting filled.

Trading liquid options lowers the edge a trader pays, which increases the overall chance of making money.

Volatility

Wall Street and traditional financial media try to teach people to fear volatility, but it can be one of an options trader’s most important tools. High volatility rewards traders for taking risk.

Risk is present in any trade, even when market volatility is low. But when volatility is high, options premiums can be much higher.

For example, a 95 put with 60 days to expiration on a $100 stock is theoretically worth $0.66 when its volatility is 15% but $2.64 when its volatility is 30%. Volatility doubled, but the put’s premium increased four times.

Options sellers have a statistical advantage over options buyers. And when volatility is high, that advantage is increased by the elevated option prices.

When the market is nervous or uncertain about the future, volatility tends to go up. But more often than not, the market or a stock doesn’t move as much as the increased volatility predicts.

With high volatility, the reward for taking risk becomes magnitudes higher.

When that happens, the trader selling that option captures more reward for taking risk than if they took risk when volatility is lower.

Every trade has risk, but shorting options when volatility is high means the reward for taking risk is magnitudes higher.

Probability

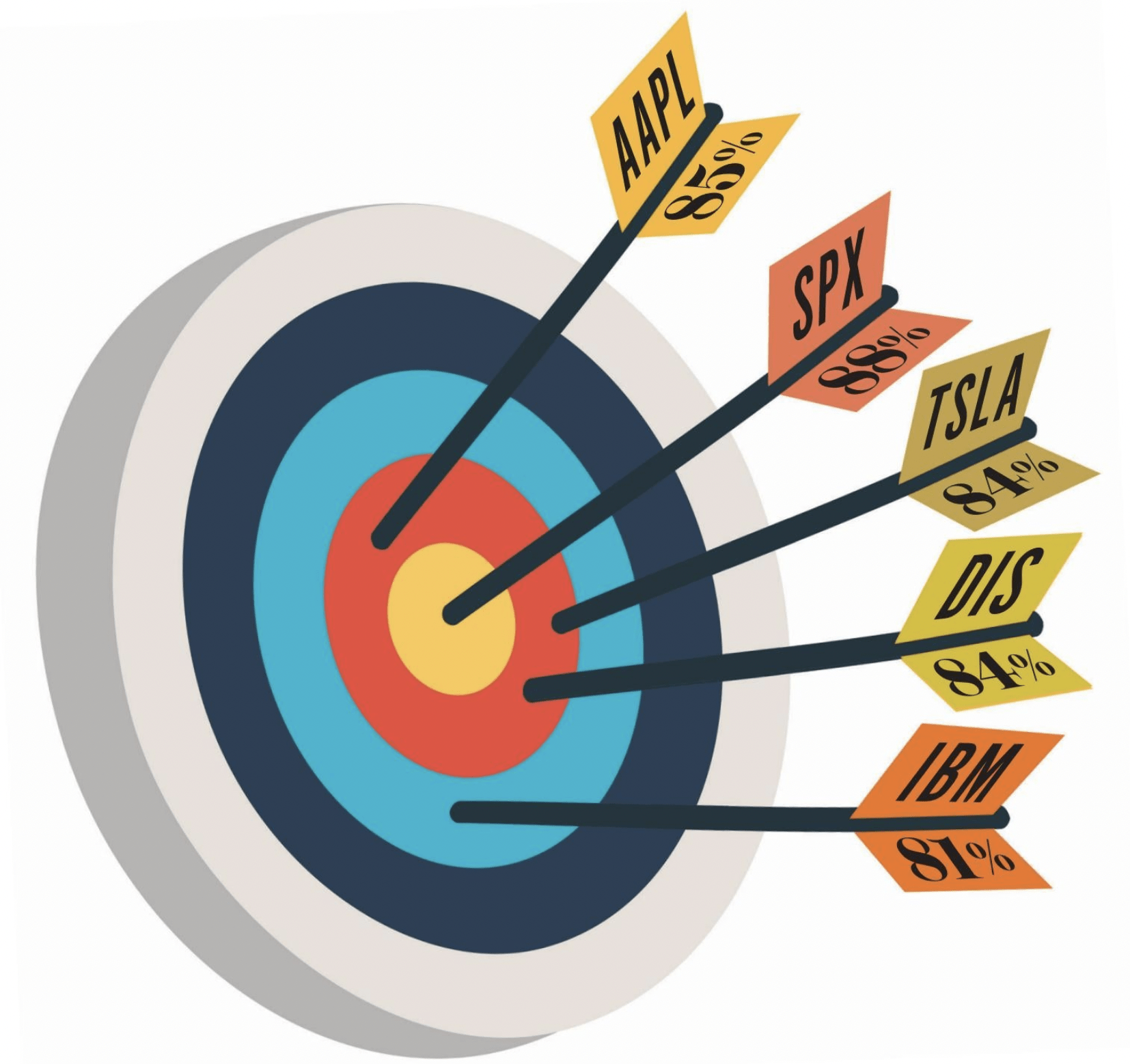

Quantifying the probability of making money is one of the most important parts of trading options. After all, a high probability of profit is better than a low probability of profit.

But if a trade with a 70% probability of profit is good, isn’t a trade with an 80% probability of profit better? Not always.

Probability and potential profit have an inverse relationship. The higher the probability of making a profit, the lower that potential profit is.

For example, with the SPX index at $4,700, the 4510 put with 50 days to expiration had a 70% probability of profit at expiration and was worth $64.20. The 4325 put in the same expiration had an 80% probability of profit at expiration and was worth $37. Further, the 4100 put had a 90% probability of profit at expiration and was worth $19.50.

As the probability of profit increases, the potential profit from shorting one of those puts decreases significantly.

Moreover, while the capital requirement to short the 4510 put is about $74,000, the requirement for the short 4325 put is $56,000, and for the short 4100 put is $41,000.

The credit from the short put drops faster than the capital requirement and gives the higher probability trades a lower potential return on capital.

And if the SPX crashes, all those short puts will lose money, and selling a put for a much smaller credit doesn’t necessarily reward a trader for taking risk.

Choose high probability options trades, but balance probability with capital requirements and potential profit for the risk a trade presents.

Tom Preston, Luckbox contributing editor, is the purveyor of all things probability-based and the poster boy for

a standard normal deviate. @fittypercent