AI Boom Electrifies the Utilities Sector

Utility stocks have emerged as one of the top-performing niches in the stock market in early 2024, with the sector ranking just behind technology and communications

- Utility stocks have been red hot in early 2024, with the Utilities Select Sector SPDR Fund (XLU) already up about 10% year-to-date.

- Rising demand from AI-focused data centers has been a major driver of bullish sentiment, and a potential rate cut could provide an additional boost for the sector.

- Utility companies generating power from nuclear plants have posted some of the best gains in the sector.

Fear of missing out swept through an unexpected corner of the market this year—the utility sector.

Traditionally seen as a quieter segment, the utility sector has been thrust into the spotlight in 2024, emerging as one of the top performers in the S&P 500, just behind the ever-dominant technology and communications sectors.

Several bullish factors are driving this unusual trend, not least of all the AI craze. The world’s leading generative AI platforms are heavily reliant on electricity, which means rapid adoption of AI is driving increased demand for power. This could create a significant uptick in revenue and profits for utility companies.

An expectation that the Federal Reserve will soon pivot and start cutting interest rates also helps utility stocks. If that happens, it could make it easier for utility to invest in infrastructure and grow their capacity.

Lastly, utility companies are benefiting from the looming possibility of a recession in the U.S. Like consumer staples, electricity and heat are necessities. Families typically cut back on discretionary expenditures like shopping, travel and dining out when finances are stretched. Necessities are among the last to be slashed from the budget, making the utility sector traditionally more attractive during economic downturns.

Collectively, these narratives raised the profile of the utility industry in 2024. Year-to-date, the Utilities Select Sector SPDR Fund (XLU) has appreciated by about 10%.

AI optimism spills over into the utility sector

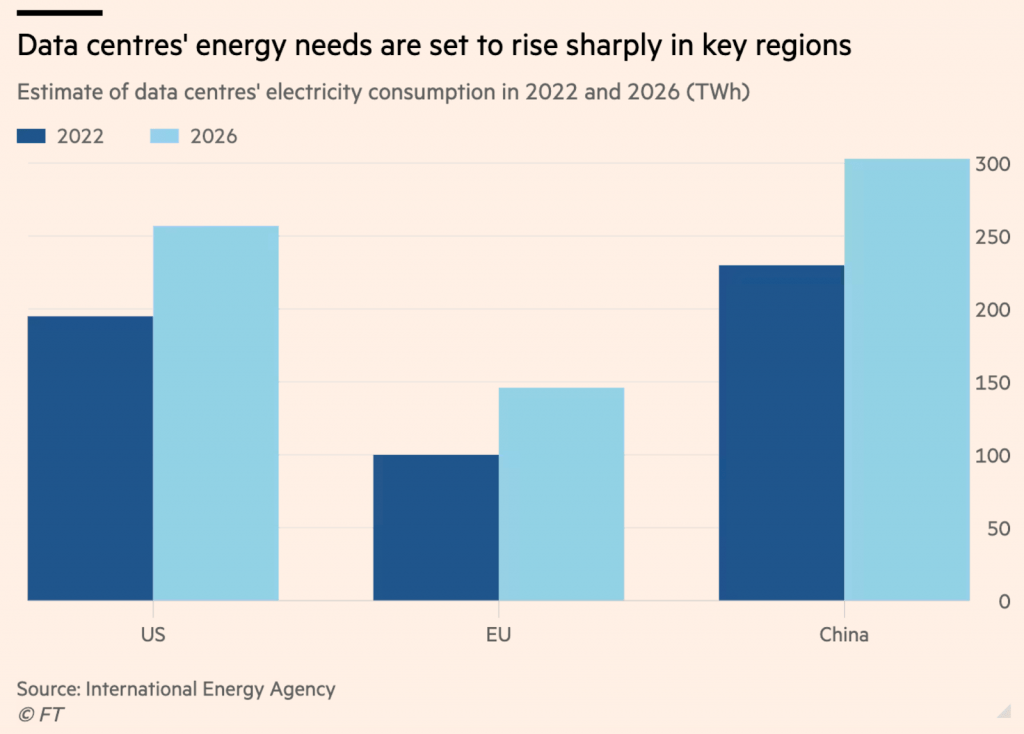

Most investors and traders understand the latest AI advancements, particularly in large language models like OpenAI’s ChatGPT, are driving significant changes in the tech landscape. Training these models requires massive data centers, which consume vast amounts of electricity.

So, with the AI sector poised for explosive growth, electricity demand is expected to benefit. According to The Wall Street Journal, data centers currently account for around 4.5% of the total electricity demand in the United States, but that figure could jump to over 10% by 2030.

As a result of this developing situation, experts expect the utility sector to ramp up capacity faster than they previously expected. And in turn, it is likely utility companies will see higher-than-anticipated revenues and profits. With that in mind, it’s easier to imagine how a reduction in benchmark interest rates could provide an additional benefit, with lower financing costs providing even more juice to the bottom lines of these companies.

This confluence of factors underscores why utility stocks are becoming increasingly attractive in the stock market.

These utility companies appear especially well-positioned to benefit

Observers expect increased demand to boost the entire utility sector, but some companies will undoubtedly benefit more than others. And that’s partly because some utility companies were already re-positioning their operations, making them especially well-suited to capitalize on the forthcoming opportunity.

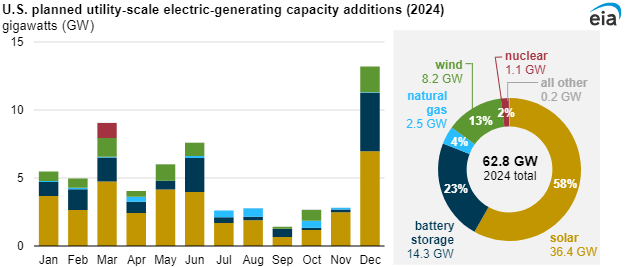

On top of that, the U.S. government’s climate goals add another layer to this dynamic. To reduce CO2 emissions, the United States aims to decrease its reliance on fossil fuels. This shift significantly affects utilities because they use coal, natural gas and oil to generate much of the country’s electricity.

Due to shifting priorities, the U.S. government has incentivized energy companies to expand their capacity to generate “green energy,” using technologies like solar and wind generation. The government also has voiced an intent to boost nuclear fission capacity, at least until fusion energy becomes commercially viable. This is reflected in the forecasted additions to the country’s electricity-generating capacity in 2024, as highlighted below.

With these considerations in mind, researchers at Morningstar recently analyzed the utility sector to identify which companies might be best positioned to benefit in the near term. According to their findings, Entergy (ETR), Pinnacle West (PNW), Southern Company (SO) and WEC Energy (WEC) are the top contenders.

In their report, Morningstar analysts Andrew Bischof and Travis Miller noted that three of the companies—Entergy, Pinnacle West and WEC Energy—are “undervalued,” while Southern Co. is “fairly valued,” in their opinion.

Speaking to the growth potential of Entergy and WEC, the analysts indicated that both companies are slated to invest billions of dollars in electricity generation and transmission capacity in the coming years.

At Entergy, Bischof and Miller noted, the investments should drive the company’s earnings growth towards the upper boundary of recent guidance, aiming for an 8% increase through the end of the decade. Similarly, they project WEC’s earnings to grow by 6.5% to 7% over the next several years.

Regarding Pinnacle West, the Morningstar analysts are bullish due to a recent shift in government regulations, marking a significant reversal. In 2022, Arizona state regulators had limited Pinnacle West’s return on equity to 8.7% to 10%, which was expected to negatively impact earnings until at least 2025. However, following a successful appeal by Pinnacle West, the regulations were adjusted, allowing for an improved outlook.

While the Morningstar analysts view Southern Company as valued fairly, they noted the company has undergone an impressive transformation. Previously reliant on coal for electricity production, Southern Company has reduced its coal-generated electricity to less than 20% of its total output, thanks to substantial investments in new energy sources. As a result, Bischof and Miller expect Southern to achieve earnings growth close to 6%, nearly matching the growth rates of Entergy and WEC.

In a separate report, Morningstar previously identified 10 companies as the “best utility stocks to buy,” based on their dividend yields and relative valuations. This analysis took a more holistic approach, considering various factors beyond just the companies’ exposure to the growing demand from AI-focused data centers. Those ten stocks are listed below, along with their respective year-to-date performance:

- NextEra Energy (NEE), +24%

- Evergy (EVRG), +0%

- NiSource (NI), +4%

- WEC Energy Group (WEC), -7%

- Duke Energy (DUK), +5%

- Portland General Electric (POR), -1%

- Entergy (ETR), +6%

- Alliant Energy (LNT), -4%

- Essential Utilities (WTRG), -2%

- American Water Works (AWK), -4%

Top-performing utility stocks in 2024 and final takeaways

When searching for potential opportunities in the financial markets, it’s often useful to consider the opinions of professional analysts, such as those offered by Morningstar.

However, it is equally important to review year-to-date performance to identify which stocks the market believes are best positioned to benefit from recent trends. Performance is an especially important consideration for investors and traders who focus on momentum and trend-following strategies.

The top-performing stocks from the American utility sector are listed below, filtered to include companies focused on the American utilities with market capitalizations of at least $2 billion.

- Vistra (VST), +166%

- Constellation Energy (CEG), +100%

- NRG Energy (NRG), +68%

- Targa Resources (TRGP), +32%

- MDU Resources (MDU), +28%

- NextEra Energy (NEE), +24%

- Public Service Enterprise (PEG), +22%

- Southern Company (SO), +10%

- Dominion Energy (D), +9%

- American Electric Power (AEP), +7%

NextEra Energy sticks out in the above list and was highlighted by Morningstar as a top pick in 2024. The fact that NextEra is flying high with some other top performers in the sector indicates that many market participants agree with Morningstar.

And while its year-to-date performance isn’t as mouth-watering as some of the others, the 10% year-to-date return in Southern Company is also notable. Especially considering how the company has successfully transformed from a traditional coal utility to more of a green energy play.

The astonishing returns of Vistra and Constellation Energy are also hard to ignore. For its part, Vistra shifted its operational focus away from traditional fossil fuels and replaced it with additional nuclear capacity. Nuclear offers a similar degree of reliability, with a much smaller carbon footprint.

And with Constellation Energy also producing outsized returns, it seems fairly clear that nuclear exposure has been a key differentiator in the sector. Most estimates indicate that about 85% of the power generated by Constellation comes from nuclear sources. For this reason, the company now counts among a select group of “carbon-free baseload electricity generators.”

Interest in nuclear power

A nuclear start-up backed by Sam Altman—Oklo (OKLO)—recently went public via a SPAC merger. Oklo intends to generate traditional nuclear energy (e.g. fission) using small modular reactors (SMRs), which are viewed as more economical and scalable when compared to traditional reactors. Oklo doesn’t yet generate revenues, but it has already signed several customers, which intend to buy power from the start-up at some point down the road.

Nuclear is of particular interest in the utility and energy sectors because the United States intends to aggressively grow its nuclear capacity during the foreseeable future. Specifically, the U.S. hopes to triple its nuclear capacity by 2050. As part of that strategy, the Inflation Reduction Act carves out special incentives nuclear energy producers, primarily in the form of fresh tax credits.

In addition to the aforementioned single stocks, investors and traders can track and trade the utility sector using ETFs such as the Utilities Select Sector SPDR Fund (XLU), the Vanguard Utilities ETF (VPU) and the iShares U.S. Utilities ETF (IDU). To learn more about trading utility stocks, readers can also check out this post on tastylive.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.