Dollar Gains as Crumbling Russian Economy Pulls Down Ruble

Weakness in the Russian economy has spilled over into the ruble, and helped push the ruble to fresh 16-month lows against the dollar.

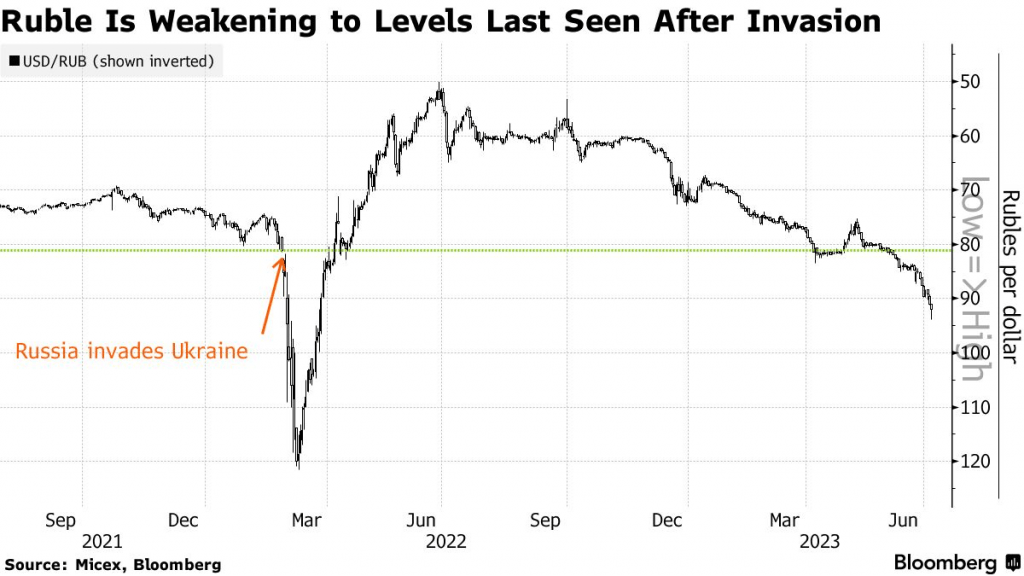

- The Russian ruble has steadily been losing value against the U.S. dollar since December 2022.

- The dollar/ruble exchange rate recently hit 96, which represents a 16-month low for the ruble.

- Since the start of 2022, the dollar/ruble exchange rate has ranged between roughly 55 and 130.

There’s no end in sight to the war raging in Ukraine, but there’s fresh evidence that the conflict is weighing more heavily on the Russian economy.

Just a few days ago, the Russian ruble dropped to a 16-month low against the U.S. dollar. The dollar/ruble exchange rate is currently trading at about 96.

Exchange rates are quoted using the format “ABC/XYZ,” and are interpreted to mean that the first currency listed is a single unit, while the exchange rate itself represents the amount of the second currency that is required to purchase a single unit of the first currency.

Leading up to Russia’s invasion of Ukraine in February of 2022, the Dollar/Ruble exchange rate was trading 65 and below. After the invasion, however, the ruble plummeted in value, with the Dollar/Ruble exchange rate sinking past 130.

The ruble recovered in June of last year, however, and maintained a relatively strong valuation through December of 2022. But since the end of last year, the ruble has been steadily losing ground against the dollar, as illustrated below.

At present, the ruble appears to be fighting two troublesome trends.

At the top of the list is a mass exodus of capital from the motherland. A recent update from the Russian government indicated that Russian citizens have been aggressively moving capital outside of Russia, and therefore, divesting of the ruble.

Since the February of 2022, the Russian central bank estimates that some $40 billion in deposits have exited the country, according to the Financial Times.

On top of the capital exodus, it appears that Russia’s income from exports has also been dwindling, which has undoubtedly weighed on the Russian currency, as well. The New York Times recently projected that Russian gas exports could drop by 50% in 2023 as compared to last year.

Moreover, Russia’s gross domestic product (GDP) has now dropped for six consecutive quarters. And the Russian economy is expected to shrink further during the last two quarters of 2023, as well.

Speaking to spiraling economic conditions in Russia, Alexandra Prokopenko—a scholar at Carnegie Russia Eurasia Center—recently told the Financial Times, “The flow of money into Russia is drying up, and the outflow of capital is increasing. All this is a direct consequence of sanctions.”

G7 Price Cap on Russian Oil Exports Weighs on Ruble

On Dec. 5, 2023 the G7 instituted a $60/barrel price cap on Russian crude oil exports, with the intent of cutting into Russia’s income from energy exports.

Based on data collected during the first half of 2023, it appears the price cap has been effective in reducing Russia’s export income.

In March, the International Energy Agency (IEA) estimated that Russia’s revenues from oil exports were running about 50% lower than they were a year prior. Interestingly, however, the volume of oil leaving Russia was virtually unchanged.

That information is important for two reasons.

First, that means that Russia’s ability to generate income from energy-related imports has been severely impaired. In turn, that theoretically suggests that it’s becoming harder for Russia to fund its so-called “special military operation” in Ukraine.

On top of that, the aforementioned data also indicates that Russia’s contribution to the available supply of global remains virtually unchanged.

From this perspective, it appears the G7 has notched a significant victory, because the group has cut into Moscow’s income without creating a critical shortage in the global market for crude oil.

A quick review of oil prices in Russia helps reinforce the effectiveness of the G7 price cap.

In November 2022, a barrel of crude oil from the Urals region of Russia was trading for about $82/barrel. However, only a month later, the price for that same barrel plummeted as low as $40/barrel, as illustrated below.

The above chart also shows crude oil from the Urals region of Russia consistently traded below $60/barrel in H1 2023. However, during early July 2023, Russian crude oil prices started rallying, and recently reached a peak of $70/barrel.

That move may be attributable to the fact that the broader market for crude oil also rallied over the same period. Since the start of July, the primary American benchmark for crude oil—known as West Texas Intermediate (WTI)—is up roughly 15%.

Interestingly, the recent rally in Russian oil prices hasn’t boosted the ruble, which indicates that the ruble’s woes may run deep. And if the ruble’s decline intensifies, that could stir up concerns over a broader Russian financial crisis.

The last Russian financial crisis played out in 1998 when the Russian government intentionally devalued the ruble and then defaulted on domestic debt, while declaring a moratorium on the repayment of foreign debt.

As many investors and traders are aware, Russia came close to defaulting on its foreign currency-denominated debt last summer.

However, a technical default never arguably materialized because the delay in the repayment of that debt was associated with cross-border payment difficulties as opposed to insufficient funds. Moreover, the amount in question purportedly fell below the minimum threshold of $75 million, which is the minimum hurdle to qualify for a technical default.

Going forward, the Russian government could theoretically borrow from domestic Russian banks, or from its foreign allies (i.e. China), or even tap its $100+ billion sovereign wealth fund.

But some of those options become significantly less attractive if the ruble continues to slide, or even worse, falls off a cliff.

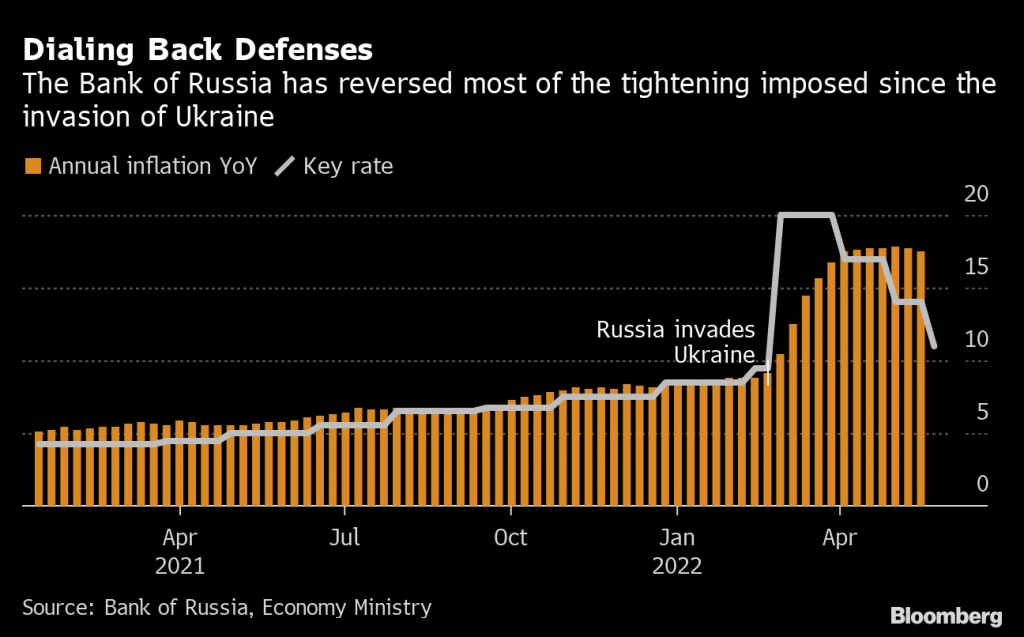

The Russian central bank—known as the Bank of Russia—is clearly aware that a weakening ruble represents a serious problem for the economy. On July 21, the Bank of Russia raised benchmark interest rates in Russia by 100 basis points, from 7.5% to 8.5%, in hopes of shoring up the ruble.

But so far, that effort has proved too little, and too late.

When Russia invaded Ukraine in the spring of 2022, the Bank of Russia doubled benchmark rates to a jaw-dropping 20%, in order to defend the ruble and prevent capital flight. However, the Russian central bank steadily normalized rates in the following months, as illustrated below.

If the ruble weakens further in the coming weeks, Russia will undoubtedly be forced to raise rates again—and likely in a more aggressive fashion.

Unfortunately, that type of strategic approach can lead to other potential pitfalls.

If Russia continues to increase interest rates, that could further impede the Russian economy, because higher rates are generally a deterrent for borrowing, and therefore economic growth.

And with Russia’s economy already reeling, that means any significant increase in rates could push it over the precipice—even if higher rates do temporarily bolster the ruble.

All told, that means leaders in the Russian government are facing some extremely difficult decisions. Many of which could impact not only the geopolitical landscape, but also the global financial markets.

To learn more about trading foreign currencies, readers can check out this episode of In This Economyon the tastylive financial network. To follow everything moving the markets, readers can also tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.