Earnings Season Starts Next Week. Here’s What You Need to Know.

With corporate earnings season set to kick-off on Jan. 12, current market valuations appear to be pinned on an expectation that earnings growth will surge in 2024

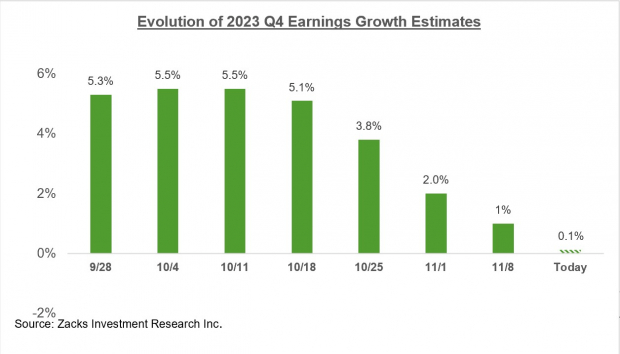

- Q4 earnings season is set to ramp up on Jan. 12, with current forecasts indicating that earnings in the S&P 500 will be a modest +0.1% higher than the same period last year.

- Earnings forecasts are more optimistic for 2024, with the S&P 500 expected to grow its earnings by nearly 12%.

- If those earnings projections aren’t realized, it’s highly likely the stock market pulls back from recent highs, bringing valuations back in line with lower earnings expectations.

The new year has just begun, but the first big test for the stock market is already right around the corner.

Quarterly earnings season—covering the last three months of 2023—is set to unofficially kick off on Friday, Jan. 12, when some of the country’s largest financial institutions are scheduled to announce their Q4 earnings figures.

The upcoming earnings season has arguably taken on extra gravity as a result of the stock market’s strong rally to close 2023. That move raised the bar for Q4 earnings, because it’s hard to imagine the stock market maintaining all-time highs if the forthcoming earnings reports aren’t as rosy as expected.

One of the key reasons the market rallied so strongly at the end of the year was due to the recent pivot by the Federal Reserve. At its most recent policy meeting, the Fed adopted a more dovish outlook, intimating there could be as many as three rate cuts in 2024.

That shift is undoubtedly positive for the corporate sector because lower rates typically translate to improved profitability. On the other hand, robust corporate earnings will likely be needed to justify current valuations. Additionally, any forward guidance pertaining to calendar year 2024 will also heavily influence where the stock market heads from here.

Mobileye (MBLY) announced on Jan. 4 that its earnings outlook for Q1 2024 had weakened significantly as a result of slowdown in customer orders (i.e. softening demand). Shares of MBLY traded 25% lower in the wake of that disappointing earnings guidance.

Looking at another example, shares of Apple (AAPL) were recently downgraded by Barclays. In an associated research note, Barclays noted that sales for the iPhone 15 line have been “uninspired” of late. Year-to-date, shares in Apple are down about 3%.

Traders should also note that shares of JP Morgan Chase (JPM) recently climbed to fresh all-time highs. And if the company’s Q4 earnings report doesn’t provide a good reason for ongoing optimism, it’s easy to see how the stock could pull back after earnings.

The current outlook for Q4 earnings

Earnings estimates for Q4 are currently rather modest. According to data compiled by Zacks, earnings for the S&P 500 are expected to clock in roughly +0.1% higher than the same period last year.

That’s well below the earnings growth observed in Q3 2023, when earnings for the S&P 500 were up 3.4% as compared to a year earlier.

Earnings estimates for Q4 have been deteriorating of late. In early October, Q4 earnings for the S&P 500 were expected to grow by more than 5%. But in the interim, analysts have been cutting back their expectations for Q4 earnings.

The current estimates for Q4 earnings growth aren’t especially attractive. However, estimates are one thing, while the actual figures are another. If earnings growth is better than expected in Q4, that would do a lot to justify the recent rally in stock prices.

On the other hand, worse-than-expected earnings aren’t guaranteed to pull the market lower. That’s because forecasts for calendar year 2024 earnings have remained relatively robust, despite the deterioration in Q4 expectations.

According to FactSet, corporate earnings for the S&P 500 are expected to grow by nearly 12% during 2024. That figure is well above the 10-year average, which is closer to 8.4%. Interestingly, the majority of that rosy outlook appears to be concentrated in Q4 of 2024, when earnings are expected to jump by an eye-popping 18.2%.

Looking at the first three quarters of 2024, FactSet is projecting earnings growth of 6.8%, 10.8% and 9%, which are also fairly robust figures.

Considering that backdrop, one can see how some investors and traders might be willing to look past a lukewarm earnings season in Q4 of 2023. At this time, it’s the promising earnings growth in 2024 that has arguably been fueling recent optimism in the stock market.

There are a few caveats to the current outlook, though. If Q4 2023 earnings season is significantly worse than expected, that could shake investor confidence in the 2024 forecasts. That negativity could be compounded if a large number of companies lower their full-year 2024 earnings projections, as observed recently with Mobileye.

Corporate profit margins and overall market valuations

A detailed analysis of the upcoming earnings season reveals that expectations for Q4 2023 are rather modest. It appears bullish investors and traders have pinned their hopes on a strong rebound in corporate earnings growth in 2024. Whether that comes to pass is still anyone’s guess.

The market does have a couple things going for it: corporate profit margins remain robust and the stock market’s overall valuation doesn’t appear overextended. As a result, investors and traders are likely to wait and see whether corporate earnings grow as expected, rather than adopting a defensive position at this time.

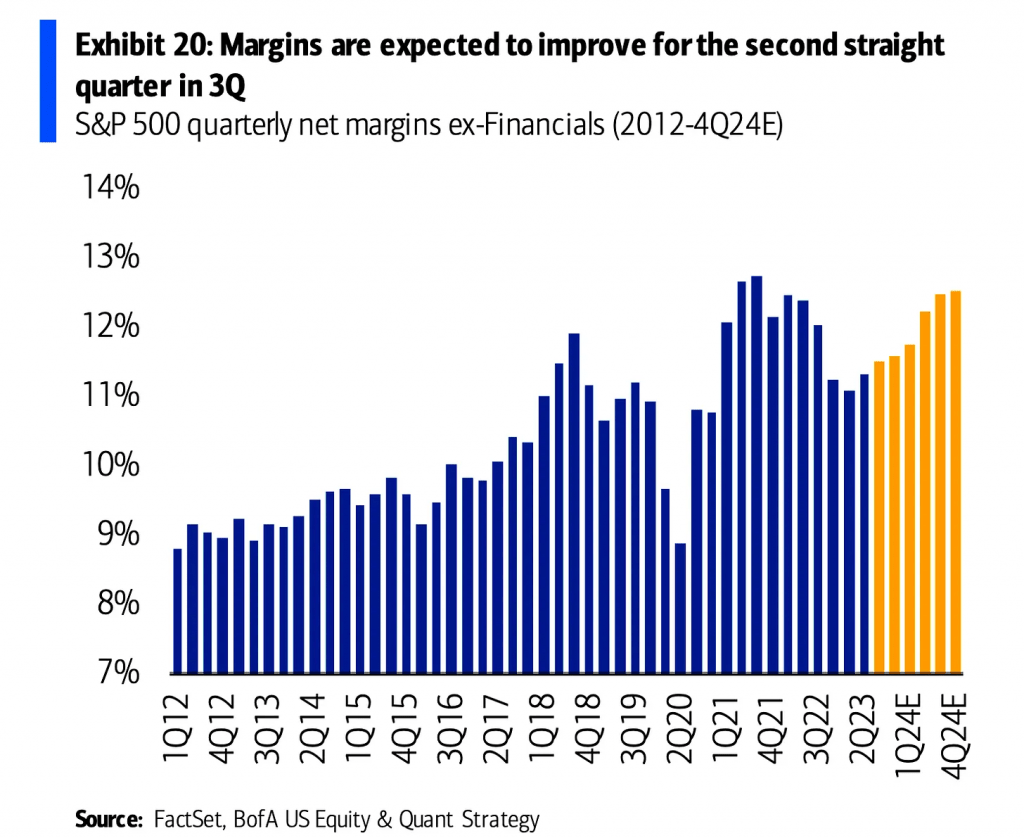

In Q3 of last year, the average corporate profit margin for companies in the S&P 500 was about 11.6%. That’s down from the recent peak, which was closer to 13%. However, it’s also above the five-year average, which is closer to 11%

Moreover, the current profit margins in the S&P 500 are well ahead of the average levels observed prior to the pandemic.

Corporate profit margins are currently projected to surge back toward record highs during the second half of 2024. That outlook dovetails with the aforementioned projections on favorable earnings growth.

Analysts are currently expecting corporate earnings to grow by over 18% in Q4 of this year. If that type of growth does materialize, one could see how associated profit margins would likely skyrocket, as well.

Either way, 11.6% profit margins—as observed last quarter—are robust in their own right, which has undoubtedly served to help justify current valuations in the stock market. At this time, valuations in the stock market are far from inflated, despite the surge in prices at the end of 2023.

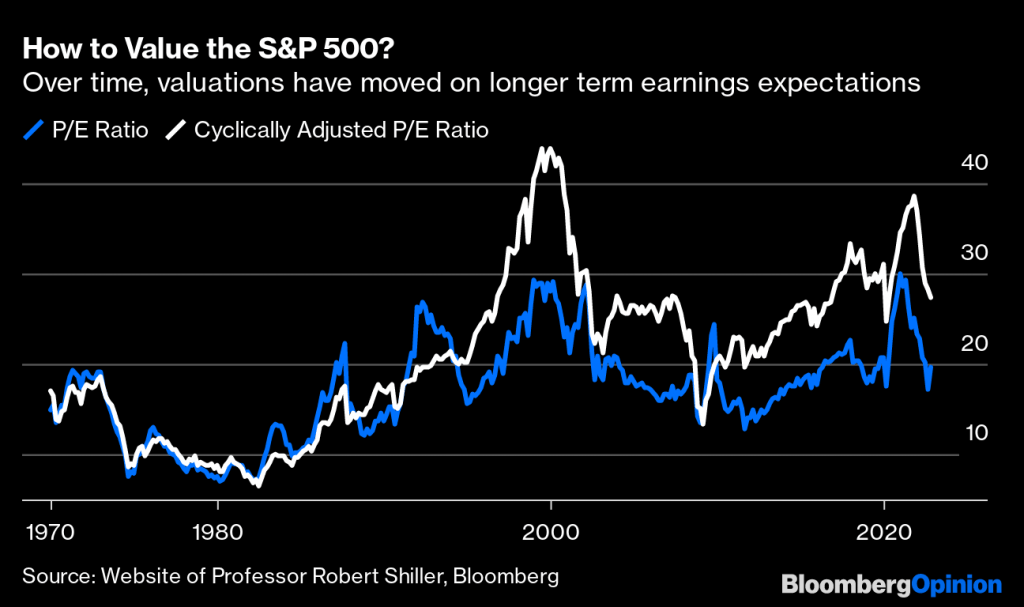

The forward price/earnings (P/E) for the S&P 500 is currently hovering around 21. That’s down from the recent peak of 23, and only slightly higher than the longer-term average of roughly 18.

During the last 10 years, the P/E for the S&P 500 has ranged between roughly 18 and 40, which suggests that the current reading of 21 is far from extended. The only caveat is that the forward P/E relies heavily on aforementioned 2024 earnings projections, which may be overly optimistic.

At the end of the day, it appears if corporate earnings keep up with expectations in 2024, the market could continue to rally, or at worst, trade sideways. But if 2024 earnings guidance starts to waver, and the P/E ratio for the S&P 500 starts to climb, that could trigger a correction in the stock market, bringing valuations in line with the revised expectations.

To follow everything moving the markets in 2024, including the options markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.