Forget the Darknet

The markets can provide the excitement active investors want—without risk of prison time

Ah, the so-called darknet. The Wild West of the internet. Where anonymity—or as close as anyone outside DARPA (Defense Advanced Research Projects Agency) is going to get—provides a warm blanket while users surf unhindered by the blue-nosed algorithms of Google, Facebook, Apple, Amazon or Microsoft.

That’s the story, anyway. While the darknet may harbor content unavailable on the more-regulated internet, most people aren’t searching for “Tulsi Gabbard 2020” sites blocked by the DNC.

The darknet is where one searches for things with a high likelihood, if not 100% probability, of being illegal. Drugs, weaponry, other people’s credit card info. Now, Luckbox readers aren’t going to do anything illegal, but they’re curious.

When they step outside the highly vetted world of Amazon, or even eBay, what’s the likelihood they will actually receive what they paid for as opposed to their money simply disappearing into someone’s untraceable bank account?

While some sites that match buyers with sellers might track data, it’s tough to find solid info. But some darknet sites have ratings, like eBay. If buyers stick with them, the odds of a successful transaction might be somewhere between Craigslist and Facebook Marketplace. Outside the rated-vendor sites, it’s a crapshoot.

But unlike buying legal stuff on Craigslist or Facebook, where a buyer just might get scammed out of money, buying illegal stuff online has an asymmetric risk/reward. Yes, buyers might receive what they paid for. But the risks can go far beyond losing some money because the “seller” didn’t ship the product.

Law enforcement agencies can’t use an IP address to find someone making purchases on the darknet. But when something suspicious goes through the mail or another common carrier, a lot of eyeballs—both organic and electronic—can focus in on it.

If the purchase seems sufficiently threatening, a couple of black Suburbans might pull up to the house and spill out a bunch of guys with M4-shaped bulges under their jackets. Not good. In trader lingo, that’s limited upside and unlimited downside, with the downside being prison.

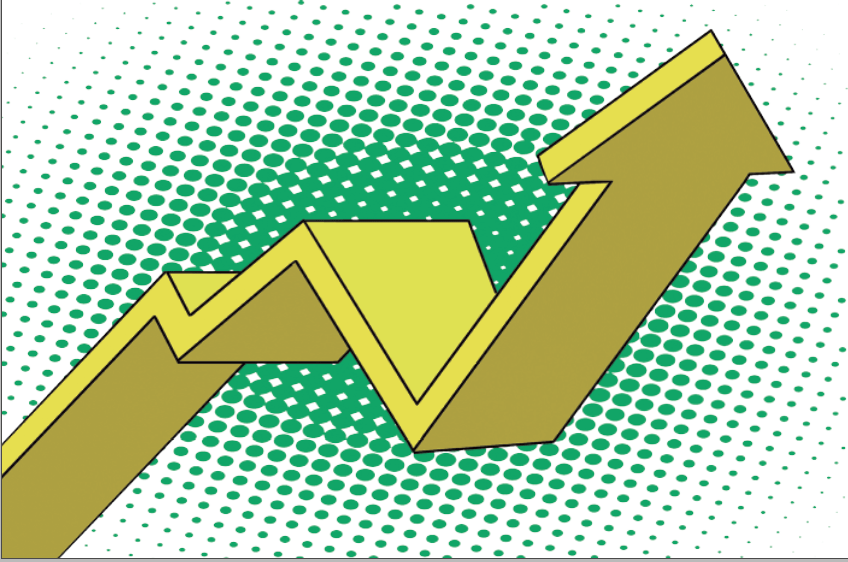

Now, that might sound like trading to the uninitiated. But it isn’t. The prices of products listed on exchanges can’t go below zero. Investors might buy a share of Google for $1,300. But if Google goes to $0, the most they can lose is the $1,300 they paid.

If a darknet purchase is sufficiently threatening, a couple of black Suburbans might pull up to the house and spill out a bunch of guys with M4-shaped bulges beneath their jackets.

Not good.

But the price is unbounded on the upside. Because of that, stock prices have asymmetric risk to the upside that’s best modeled using a lognormal distribution. On the other hand, stock price returns can and do go below zero. And stock returns are much more symmetrical, with negative returns balanced by positive returns, best modeled using a normal distribution. That works out really well because the normal (stock price returns) and lognormal (stock prices) probability distributions are simply transformations of each other.

By definition, variable has a lognormal distribution when the log of that variable has a normal distribution. Because of the convenience of the lognormal and normal distributions, they underlie option pricing formulas.

Yes, some traders want to use other statistical distributions they think are better at modeling stock price behavior. But they can require assumptions and unobservable parameters.

They can also be computationally less efficient, and not conducive to calculating probabilities in real time, with streaming stock and option prices. That’s how to quantify the risks of a trade, unlike the unquantifiable risks of the darknet.

Investors have been using the lognormal/normal distributions for decades and haven’t found a better replacement. Feel confident about the probability numbers they generate.

So, with more exchanges offering nearly non-stop trading, there’s no reason to look for entertainment on the darknet. The markets can provide as much excitement as traders want—without the risk of prison time.

Tom Preston, Luckbox features editor, is the purveyor of all things probability-based and the poster boy for a standard normal deviate.