Iron Ore Miners Should Benefit From Higher Prices in Q4 Earnings

Iron ore prices were up around 30% in Q4 2023, which should provide an extra boost for iron ore miners heading into the upcoming earnings season

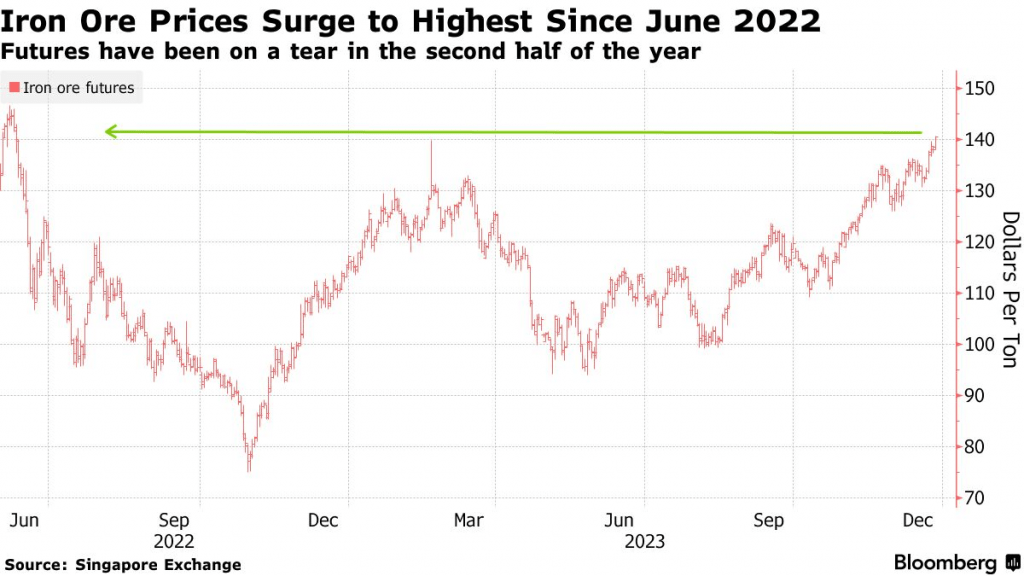

- Iron ore prices have rallied by about 30% since August and are currently trading at an 18-month high.

- Demand for iron ore has been historically tied with the relative strength of the global economy, indicating that the first “green shoots” of a potential economic rebound may be sprouting.

- Iron ore miners such as BHP (BHP), Rio Tinto (RIO) and Vale (VALE) are expected to get a Q4 earnings boost from the recent upswing in prices.

In the wake of some topsy-turvy moves amid the COVID-19 pandemic, global economic activity has been steadily slowing during the last few years.

In 2022 and 2023, global economic growth slowed to +3.5% and +3.0%, respectively. Those figures are well below the post-pandemic boom that was observed in 2021, when global gross domestic product (GDP) spiked to +6.3%.

This year, economic growth in the world economy is currently forecasted to remain in the 3.0-3.5% range, but some green shoots—signs of economic recovery—have sprouted recently, which may indicate the economy is starting to heat up again.

For example, iron ore prices have rallied by more than 30% since mid-August and are currently trading at an 18-month high, at around $140/ton. Historically, iron ore prices have been closely tied to economic growth, because iron ore is a key component used in the manufacturing of steel.

During periods of robust economic growth, demand for steel and iron ore tend to increase, driving prices higher. Conversely, economic downturns can lead to reduced demand and lower prices for these two metals.

Iron ore prices crashed during the onset of the COVID-19 pandemic, when economic activity ground to a halt due to widespread lockdowns. Back in the spring of 2020, iron ore prices bottomed around $80/ton. But during the ensuing recovery, the price of iron ore soared, climbing above $220/ton.

During the past few years, the pattern has been much the same. When the global economy faltered in 2022, iron ore prices dropped back toward $80/ton. But today, iron ore is trading closer to $140/ton. The recent rally in iron ore prices may therefore represent an early signal that the global economy is beginning to heal.

Another potential green shoot for the global economy has been stronger than expected economic data out of China. Last month, activity in the Chinese services sector expanded to its highest level in five months. China also happens to be the world’s largest consumer of iron ore, suggesting that these two green shoots may be linked.

According to global shipping data, roughly 70% of all seaborne iron ore ends up in China. That’s mostly due to China’s dominant position in the steel sector. In recent years, China’s foundries have pumped out more than 50% of the world’s total annual steel production.

That means rising iron ore prices have to be at least partially tied to strengthening demand from China, suggesting the Chinese economic dragon might finally be reawakening. Intriguingly, 2024 is also the year of the dragon, according to the Chinese zodiac.

Rising prices should boost earnings in the iron ore sector

In the commodities sector, rising prices are typically a good thing when it comes to corporate earnings. That’s because rising prices typically translate to increased revenues, and some of those extra revenues are bound to trickle down to the bottom line.

Many of the major iron ore miners reported better than expected earnings in Q3 of 2023. With iron ore prices spiking by 30% in the interim, Q4 earnings should be even better.

For example, Vale SA (VALE) reported adjusted earnings per share (EPS) of $0.66 in Q3 of 2023, comfortably beating the consensus estimate of $0.61. Moreover, Vale’s net operating revenues rose 7% in Q3 as compared to the same quarter a year ago, rising to $10.6 billion.

Since the end of Q3, iron ore prices have risen from roughly $107/ton all the way to $140/ton.

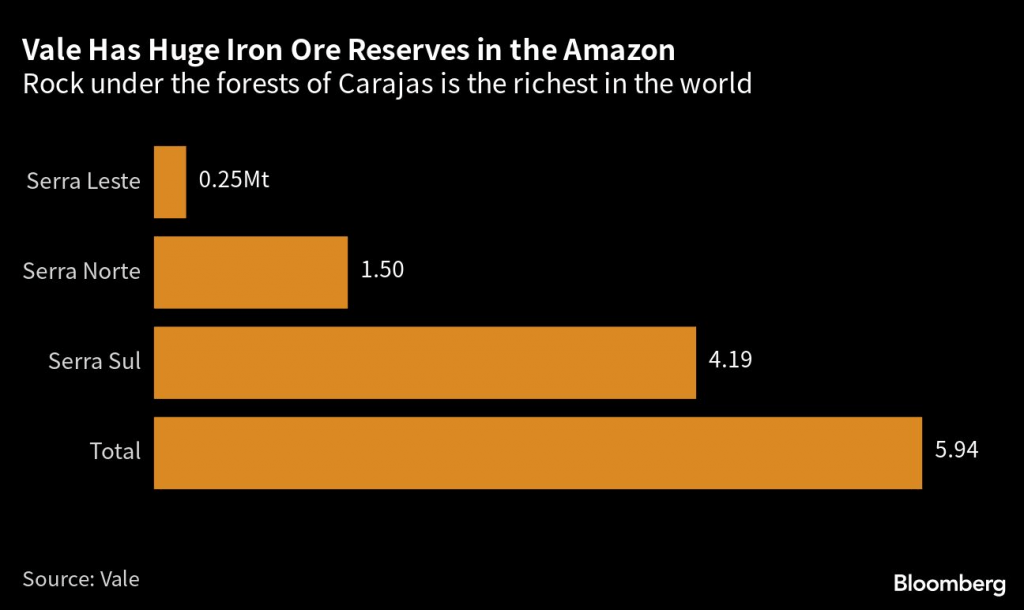

As a result, it’s virtually assured that Vale’s operating revenues will be higher in Q4 than they were in Q3. As highlighted below, Vale has plenty of available capacity to continue ramping up production to meet a potential strengthening in demand.

Vale’s earnings

Vale is scheduled to announce its Q4 earnings report in mid-February. Consensus estimates indicate that Vale’s earnings will rise to roughly $0.86/share in Q4 2023, as compared to $0.82/share in Q4 of 2022. Those robust earnings projections likely help explain why shares of Vale are currently rated a “strong buy.”

That said, investors and traders seeking to play the rebound in iron ore prices aren’t limited to Vale. As highlighted below, there are a couple of other well-known iron ore miners that may also be considered ahead of the Q4 earnings season, including:

- BHP Group (BHP)

- Rio Tinto (RIO)

- Vale (VALE)

When it comes to global iron ore production, Australia and Brazil are the world’s top two producers. As one might expect, most of the world’s largest miners of iron ore are headquartered in these countries.

For example, the aforementioned Vale is headquartered in Brazil, while BHP Group and Rio Tinto are both headquartered in Australia. Last year, both Vale and Rio Tinto produced over 300 million tons of iron ore, while BHP produced roughly 260 million tons.

According to TipRanks, shares of VALE are currently rated a “strong buy,” while shares of BHP and RIO are rated a “moderate buy.”

Stronger than expected economic growth in 2024 should help sustain, or even intensify, the current rally in the iron ore market. As such, investors and traders bullish on a forthcoming economic rebound may want to consider a long position in one of these three miners.

To follow everything moving the markets in 2024, including the commodities markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.