Natural Gas Prices Have Nearly Doubled From 2024 Lows

The natural gas market has been one of the biggest movers in the commodities sector during early summer

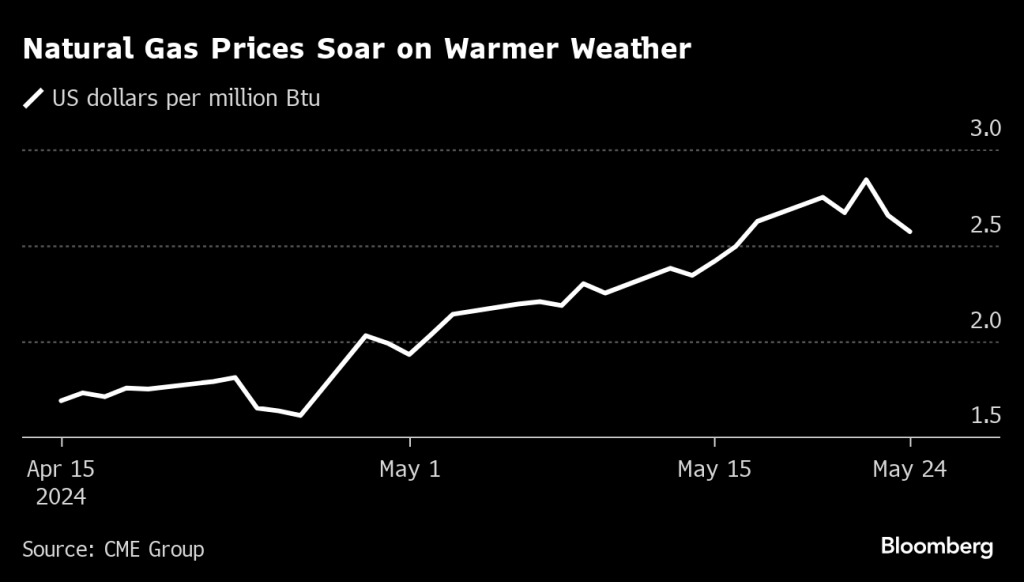

- Natural gas prices have nearly doubled since the end of March, climbing from around $1.48 mmBtu to almost $3.00 per mmBtu.

- One of the key drivers of higher prices has been the weather forecast in the continental United States, which calls for warmer-than-average temperatures in June.

- However, geopolitical factors are also driving the market, with tensions in Europe also adding to bullish sentiment.

The financial markets are always dynamic, and recently, natural gas has emerged as a standout performer in the commodities sector.

After hitting a low of approximately $1.48 per metric million British thermal units (mmBtu) in late March, natural gas prices have surged, now trading around $3.00 per mmBtu. This marks an impressive rally of nearly 100% in just over two months.

This sharp turnaround contrasts with the first quarter of 2024 when natural gas prices were under significant pressure due to warmer-than-expected weather across the continental United States. From early January to late March, prices plummeted from around $2.60 per mmBtu to $1.48 per mmBtu

As the winter heating season transitions to the summer cooling season, the demand forecast for natural gas has steadily improved. June is expected to bring warmer-than-average temperatures, leading to increased use of air conditioners across the country in the coming weeks.

Natural gas is extensively used for heating and cooling both residential and commercial properties, making it one of the most heavily traded commodities worldwide.

While it’s still too early to predict if July and August will also experience above-average temperatures, such a scenario could drive the current rally even higher in the latter half of the summer.

European market dynamics contribute to bullish sentiment

In addition to the weather forecast in the United States, natural gas prices are also benefiting from supply-demand dynamics in Europe.

A recent dispute between major energy companies in Germany and Russia has injected anxiety into the European natural gas market. Notably, Uniper, a major German energy company, recently terminated its remaining contracts with Gazprom. The two companies have been embroiled in a contentious dispute since 2022, involving legal challenges in both countries.

The termination of Uniper’s contracts with Gazprom marks a resolution of sorts to the dispute. However, the way the dispute was “settled” has raised anxieties in the European natural gas market. According to Uniper, Gazprom failed to fulfill its supply agreements, withholding $14 billion of gas since mid-2022.

As a result of the dispute and the latest contract terminations, many are left wondering how the Russian government will respond. There are concerns that Russia may further weaponize its natural gas supplies by reducing exports to express its dissatisfaction with the Uniper situation.

Due to Russia’s ongoing war with Ukraine, the European Union has worked intensively to reduce its reliance on Russian-sourced natural gas. According to Eurostat, Russian natural gas accounted for only 12% of the bloc’s total gas imports during Q3 of 2023, down from 39% in Q3 of 2021.

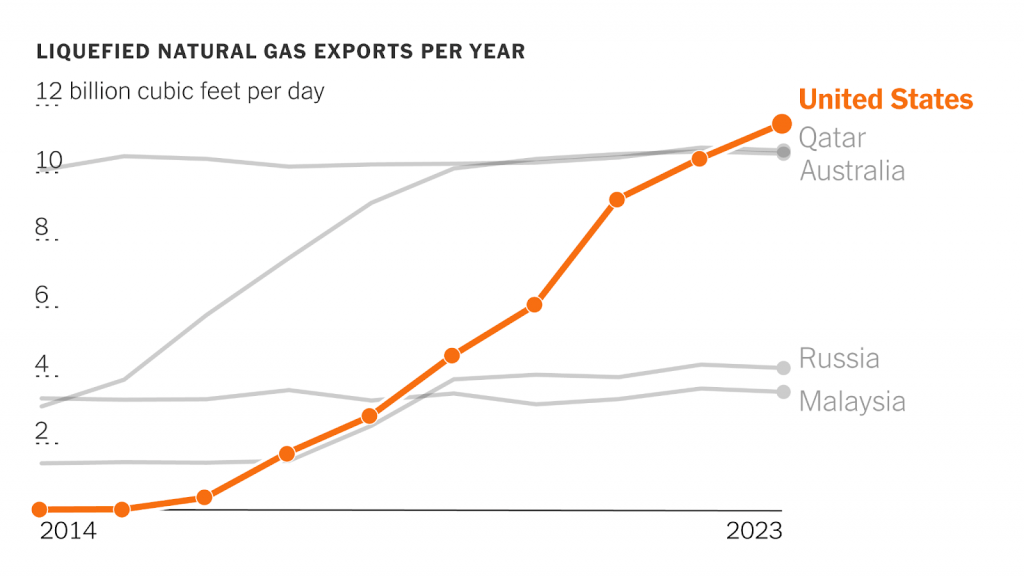

A key factor enabling Europe to reduce its dependence on Russian natural gas has been a significant increase in imports from the United States. Last year, about 48% of Europe’s total natural gas imports came from the U.S., a substantial rise from 27% in 2021. The U.S. exported approximately 7.1 billion cubic feet per day (Bcf/d) of liquefied natural gas (LNG) to Europe last year, compared to 2.4 Bcf/d in 2021

But in the event of an emergency, Russia remains the supplier of last resort. For this reason, prices in the European natural gas market can still swing based on supply-demand developments related to Russia.

Domestic inventories of natural gas remain at historically elevated levels

Even with the increase in natural gas exports to Europe, supplies of this vital commodity remain robust in the U.S. market. The historically elevated levels undoubtedly contributed to the recent price slump during the winter season.

According to The Wall Street Journal, natural gas inventories in the U.S. were about 40% above the 5-year average during early 2024. However, that surplus has now declined to about 25%. And with temperatures set to soar in the continental U.S., that surplus should fall further in the coming weeks.

The United States is currently the world’s top producer of natural gas, just as it is one of the top crude oil producers. During the last two months of 2023, natural gas producers in the United States were pumping at a rate of 106-107 billion cubic feet per day (bcf/d), representing a new record. In recent months, that output level slipped slightly to 103 to 104 bcf/d.

At the end of March, the total natural gas inventory in the U.S. was about 2,300 billion cubic feet, well above the five-year average of around 1,600 billion cubic feet. Fast-forwarding to today, that surplus above the five-year average remains, as illustrated below.

Final takeaways

After a significant downturn in early 2024, the natural gas market has perked up during early summer. And if hotter-than-average temperatures persist, that could extend the current rally.

However, investors and traders should be aware that the supply side of the natural gas narrative remains a potential headwind. That means a cooldown in the summer forecast could weigh negatively on prices.

Additionally, geopolitical developments—particularly involving Russia and its extensive natural gas supply—will continue to affect the market. This is like the market for crude oil, which has seen increased volatility in recent weeks.

To track and trade the natural gas market, investors and traders can use futures (/NG), ETFs and single stocks. Some of the most-followed natural gas ETFs include the United States Natural Gas Fund LP (UNG) and United States 12 Month Natural Gas Fund LP (UNL).

In addition, the following single stocks are heavily connected to the natural gas market:

- Antero Resources (AR)

- Cabot (CBT)

- Cheniere Energy (LNG)

- Chesapeake Energy (CHK)

- Chevron (CVX)

- Enbridge (ENB)

- EQT (EQT)

- Kinder Morgan (KMI)

- Range Resources (RRC)

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.