Options & Outcomes

A probabilistic approach—to physique sports and the markets— requires precision, accuracy and meticulous behavior

Nine Inch Nails nailed it with respect to competitive body-building, where the excitement and exhilaration of show day is preceded by weeks, months, possibly years of boring and repetitive days — every day really is exactly the same.

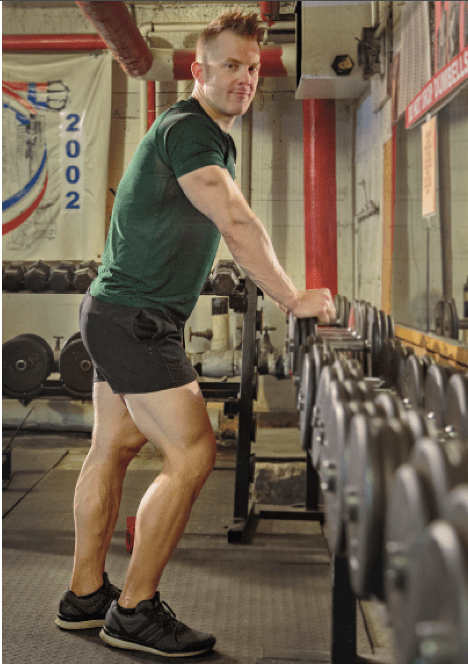

Physique sports are unique in that 100% of an athlete’s score or placing is determined by his or her body. It’s balance. It’s symmetry. It’s overall aesthetics.

Now, judges in different divisions might look for different qualities. Whereas the male bodybuilding divi- sion places a heavy emphasis on the balance between muscularity and conditioning, the male physique division (it’s not only the generic descriptor for these sports, but its own division) isn’t looking for a lat spread that blocks out the sun or a front-double bicep that resembles a small mountain range.

Instead, these athletes need to be lean, but not overly “swole,” a word that means very muscular. Similarly, female figure athletes typically need a “harder” look to do well on stage, while bikini competitors always do better if they’re still a little soft. Still, the common denominator is that everyone needs to bring the shredz. Lots and lots of shredz.

The probability of favorable output correlates directly with the dependability and reliability of input

And the only way to do any of that?

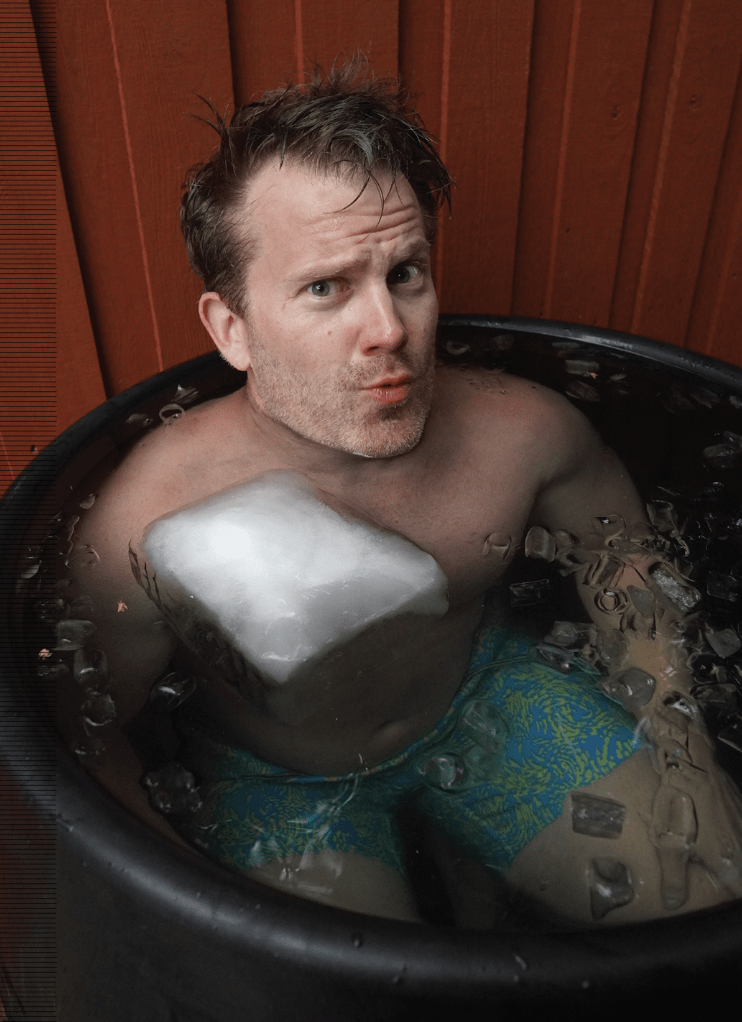

Precision. Accuracy. A meticulous approach to training that lies somewhere between highly conscientious and borderline neurotic. Meals prepped to the gram, and training sessions dialed down to the minute. People should look at you and wonder if your blood has been replaced with batteries. No serious competitive physique athletes just show up and hope for the best. Things get serious, and body compositions need to come in looking crispy (which to bodybuilders means looking super hard and super defined).

Now, take the phrase, “physique athlete,” replace it with “active trader,” and reread everything before this line. Actually, wait. Don’t do that.

The probabilities all but guarantee that at least a few traders out there are looking to bring the crispiest frame they can to their trading terminals. But in all likeli- hood, they’re the exceptions to the general rule.

Nevertheless, active traders using a probabilistic approach to the markets share the same spirit of precision, accuracy and meticulous behavior that physique athletes possess. The only way to ensure that the probabilities play out as expected is to keep feeding consis- tent data points into the models. Trades should be studied for consis- tency, and strategies should be screened for cohesiveness.

Investors should establish a governing method of uniformity and apply a stable set of mechanics every day if they expect a year-end result or a quarterly P/L that’s the equivalent of a physique competitor’s win on show day. One unique characteristic of the world of options that no other asset class can match is its relationship with probability. The variables of the Black-Scholes Option Pricing

Model, coupled with an introductory understand- ing of basic statistics, allow investors to know the probability of success on any options position ahead of time, before ever submit- ting the order.

Probability is only one piece to the four-dimensional puzzle of option trading, but it’s an important piece. And when it comes to the puzzle as a whole, consistency after-the-fact depends on consistency before-the-fact. Otherwise, there’s only one outcome — haphazard inputs leading to haphazard outputs. To succeed, embrace the monotony of routine and welcome the mundane nature of predictability.

Why else would physique sports athletes eat chicken and broccoli daily? Chicken breasts aren’t the most flavorful option and broccoli stalks don’t normally get the salivary glands popping. Still, they’re both staples on competitive kitchen tables everywhere.

Why? It’s simple—winning

Whether it’s winning on the competitive stage or winning on the trading screen, the likelihood that a favorable output correlates directly with the dependability and reliability of input.

Think of the robotic arm on an assembly line that tirelessly performs the same task 24-7. Now is not the time for spontaneity.

Jim Schultz, Ph.D., a derivatives trader, fitness expert, owner of livefcubed.com and the daily host of From Theory to Practice on the tastytrade network, was named a North American Natural Bodybuilding Federation’s 2017 Novice Bodybuilding Champion. @jschultzf3