Trading Digital Currency’s Volatility

Trading Digital Currency’s Volatility

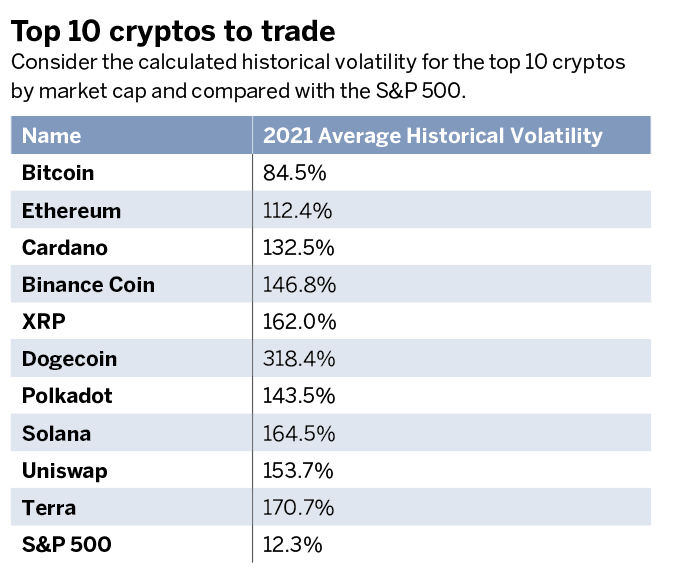

Volatility. Without it, the world would be pretty dull. It’s what makes cryptocurrencies so appealing to traders and so frightening to regulators. Dramatic price swings—both up and down—make cryptos some of the most volatile assets around.

But volatility breeds risk as well as rewards.

Traders look at the big rallies and crashes in bitcoin or ethereum, for example, and see large potential profits that could reward taking risk. Regulators sees risk in cryptos upending traditional government-controlled currencies versus a mountain of potential tax revenues. They’re both right.

But “risk” is a meaningless term if it can’t be quantified, and volatility is what quantifies risk. In the trading world, implied volatility—derived from options prices and in conjunction with the normal distribution—indicates the probability that the price of a stock, bond, future or even a cryptocurrency will be above or below some level in the future. That’s powerful and potentially profitable knowledge.

Most cryptos, though, don’t have options. Bitcoin futures on the Chicago Mercantile Exchange have options, but they’re not very actively traded. A few crypto options exist on other exchanges, but there isn’t broad participation by retail or institutional traders. The more people trading a product’s options, the better. Specifically, bid/ask spreads tighten, and that generates a more accurate implied vol. Feeding an accurate implied volatility into the probability model, in turn, generates more accurate estimates of future

price changes.

The absence of options on, or active trading in, a particular asset is why proxies are used. For example, if a new index was created for big cap stocks but it didn’t have options on it yet, the volatility of the SPX (it being an index of big cap stocks) might be used to quantify the probabilities around how high or low that new index might go in the future. Applying that to cryptocurrencies, traders can use bitcoin’s options to estimate potential price moves. Sure, bitcoin options aren’t very actively traded, but their bid/ask spreads are tight enough to make the implied volatility of their options useful.

Also, many of the cryptocurrencies like bitcoin, ethereum, litecoin, polkadot and OmiseGo are correlated to each other. When one goes up they all tend to go up, and vice versa. That’s why bitcoin options could be used as an implied volatility proxy. Bitcoin options have an overall implied volatility of about 99%. It’s safe to assume that the other cryptos might have implied vols—if they had options—around 99%. The implied vols wouldn’t be 20% or 300%, for example. Even if the implied volatility of the other cryptos was higher or lower, the probabilities would not be dramatically different. For example, with bitcoin at $45,000, the probability that it’s above $35,000 in 45 days is 72% with implied volatility at 99%. If the implied volatility were 79%, the probability would be 79%, and if the implied volatility were 119%, the probability would be 66%. Different, yes, but close enough that using bitcoin as a proxy is much better than guessing. Sure, cryptos are volatile, but they still obey the laws of the probability gods.

Cryptos had significant rallies this past summer. Bitcoin, ethereum, titan coin, litecoin, polkadot and gemini all had jumps of 50% or more from late July to the middle of August. In three weeks this past summer, from July 20 to Aug. 10, bitcoin rallied up over 50%. Even with a 92% implied volatility in July, which means large moves are statistically more likely, that 50% was the equivalent of 2.43 standard deviations. The probability of bitcoin doing that was less than 1%—only 0.75% to be precise. Ethereum was up 70%. Using bitcoin’s 92% implied volatility as a proxy, ethereum’s rally was the equivalent of 3.17 standard deviations. That’s big.

Everyone recognizes the big potential risks and rewards of trading cryptos. But more volatility often begets more trading activity. And trading activity is the lifeblood of exchanges. So, instead of waiting to trade cryptocurrency options, try trading a proxy like crypto exchange COIN, which has moved along with those cryptocurrencies. COIN has its own options—which are actively traded—and has implied vol. Between July 20 and Aug. 10, COIN rallied 20%, the equivalent of 1.28 standard deviations based on its 65% implied vol.

If cryptocurrencies themselves aren’t to traders’ liking and they still want to play in that arena, COIN options provide a way to do that. What’s interesting about COIN options is that out-of-the-money calls are often trading well above equidistant out-of-the-money puts. For example, with COIN trading at $260, the 270 calls with 49 days to expiration were trading for $16.80, while the 250 puts in the same expiration were trading for $14.70. That extra premium in the calls is an indication the market anticipates a rally in COIN.

If a trader agreed with the market and thought COIN might rally, buying an at-the-money call with a 260 strike and selling the 270 call is a bullish long call vertical. Selling that 270 strike call at a relatively high price reduces the cost of buying the 260 call and reduces the debit and risk of that long call vertically. That’s just one way to think about while trading crypto.

Tom Preston, Luckbox contributing editor, is the purveyor of all things probability-based and the poster boy for a standard normal deviate. @fittypercent