The Weather Trade

Unlike the weather, probability-based investment strategies prove surprisingly predictable.

Not everyone wakes up thinking about proactive investing—but most contemplate the weather almost every day. In fact, the Weather Channel is piped into something like 79 million American homes. That’s about 61% of all the households in the United States. And that’s not counting all the news websites with weather pages or the mobile apps that send alerts. So, weather news has tremendous reach.

But many of the Americans keeping tabs on weather don’t really trust the forecasts. And who can blame them? When Jimmy Webb composed “MacArthur Park” and included the lyrics “someone left the cake out in the rain,” it was ostensibly about a love gone wrong. But it’s remained memorable because getting caught in unexpected precipitation has been one of the low points of human experience since caveman days. It only takes getting soaked one time when the forecast calls for sun for people to leave the cake inside for the rest of their lives.

That was the old days, though. Today, forecasts attach probabilities about how much rain or snow might fall. Meteorologists are brimming with confidence about that number. On the National Weather Service the “probability of precipitation” (or POP) is the probability that precipitation will fall somewhere in the area times the percent of the total area that might receive precipitation. So, if the meteorologist thinks there’s a 60% probability rain could fall on 70% of the area, there’s a 60% x 70% = 42% probability of precipitation. Hmmm, OK. But we live in a specific place. And the meteorologist might make a few drops of rain count as much as a downpour. So, yes, the probabilities of the forecasts are right, one supposes, but that still leaves everyone on the hook if they’re in the wrong spot at the wrong time. That’s why they leave the cakes inside.

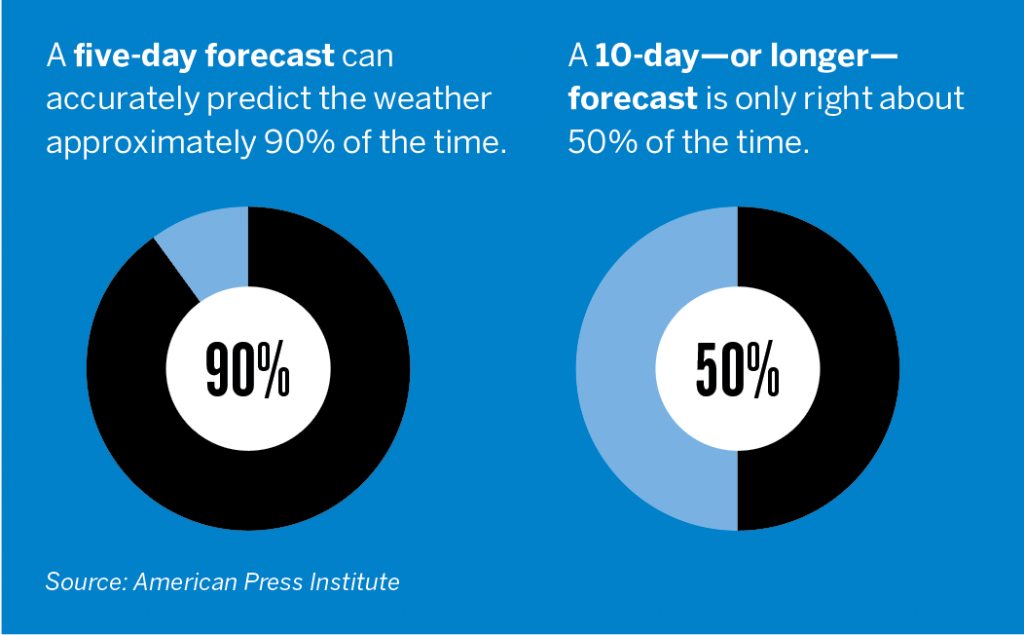

For most people who aren’t farmers, the probabilities of weather are just factoids that don’t have a huge impact if they’re wrong. But if that’s a person’s most frequent exposure to probability, he might develop some skepticism about using numbers to improve his ability to trade and invest. Don’t give in to that temptation. Dismissing probabilities in trading can have real financial consequences. Doing it is akin to tossing money around like a leaf in the proverbial wind. Part of the job at luckbox (the Trades and Tactics sections, in particular) is to show why people can trust probabilities in trading more than they can with the weather reports, and how to use them to one’s advantage.

Meteorological models remain largely opaque but the models used in trading are transparent. Trading models are based on readily observable market data, like the price of a stock, a number of days in the future and the volatility of the stock. Apply those stats to a bell curve to generate the probability that the market cap of Apple (AAPL) will one day get back more than $1 trillion or that crude oil will stay below $65 per barrel. Are trading probabilities reliable? Well, investors have been using many of the same time-tested tactics for the past 25 years or so, and choosing a smart strategy based on them, gives traders a better chance of making money than not.

If having a better chance to make money doesn’t make investors pay more attention to trading probabilities than to the weather, they could be missing out on the most delicious cake of all.

Tom Preston, luckbox features editor, is the purveyor of all things probability-based and the poster boy for a standard normal deviate.

FORECASTING HACKS

The frequency of a cricket’s chirps correlates

with the air temperature in degrees fahrenheit. Just count the number of chirps in 15 seconds and add 37.

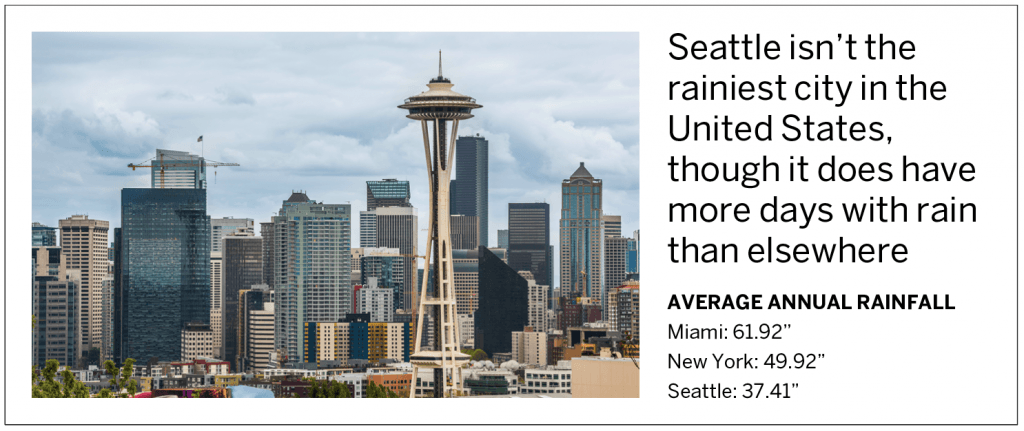

Chicago got its name as the windy city in the late 19th century because of its hot-air, blustery politicians, not because of wind speed.